I don’t say this lightly.

I’ve spent 13 years inside crypto markets—through Mt. Gox, China bans, QE cycles, COVID crashes, euphoric blow-off tops, and long, soul-testing bear markets.

I’ve learned one thing the hard way:

Price tells the truth long before headlines do.

And right now,$BTC Bitcoin is telling a very different story than it was just days ago.

What Changed — And Why It Matters

As recently as five days ago, Bitcoin was mechanically trapped in a tight band between $87,000 and $90,000.

Not because of sentiment.

Not because of fundamentals.

But because of derivatives structure.

Volatility wasn’t missing—it was being suppressed.

The Gamma Trap Most People Missed

Throughout December, a large concentration of options gamma forced dealers into defensive positioning:

Above ~$88K

Dealers were short calls, hedging by selling spot, which capped every rally attempt.

Below ~$85K

Dealers were long puts, hedging by buying spot, absorbing every dip.

This is why price kept snapping back to the midpoint.

Not organically—but mechanically.

Bitcoin wasn’t trading freely.

It was being pinned.

The Moment the Pressure Released

That entire structure depended on December gamma.

And when that gamma expired, something critical happened:

👉 Forced hedging stopped.

No more artificial bids below.

No more forced supply above.

No more invisible hands compressing volatility.

The range didn’t “break.”

It ceased to exist.

Why This Looks Familiar

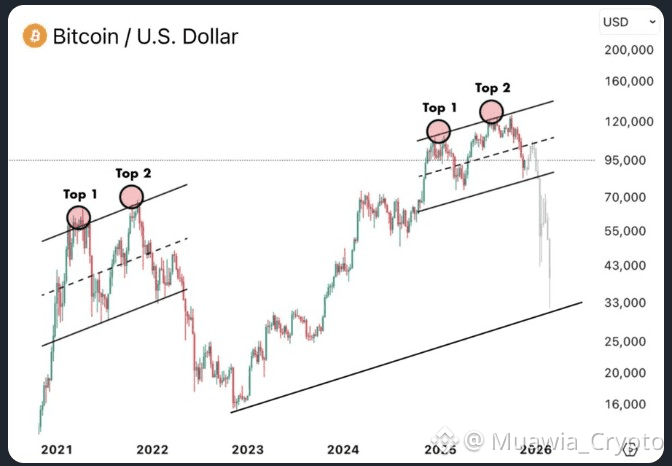

What we’re seeing now mirrors the early structural phase of the 2021 bull run:

Suppressed volatility resolves

Dealer influence fades

Price begins to move on real order flow

When markets are compressed this tightly, they don’t drift once the pin is removed.

They reprice.

This Is the Part Most Traders Get Wrong

People think breakouts are about news.

They’re not.

They’re about structure unwinding.

$BTC Bitcoin may finally be trading again on:

Genuine demand

Natural supply

Unforced participation

Not dealer mechanics.

Not gamma constraints.

Final Thought

I’ve called major tops and bottoms for over a decade—not by predicting headlines, but by reading structure when others are distracted by noise.

This setup is not random.

This is exactly how suppressed volatility resolves.

When I make my next move, I’ll post it publicly—no hindsight, no edits.

If you’re not paying attention now,

you’ll understand later.

Just watch.

#BTC90kChristmas #StrategyBTCPurchase #CPIWatch #sniper007 #USCryptoStakingTaxReview