Terra Ecosystem: Short-Term Momentum vs. Sustainable Trend

Recent price action across LUNA, USTC, and LUNC has attracted renewed market attention, driven by sharp intraday rallies and elevated trading volumes. While the moves appear strong on the surface, a closer examination suggests the current momentum is speculative rather than structural.

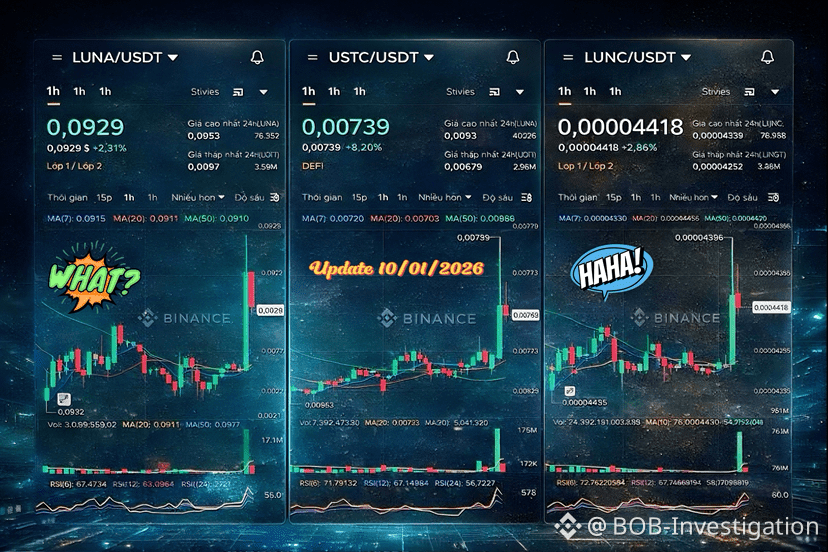

Price Behavior

Across short timeframes, all three assets experienced rapid upside expansion followed by immediate pullbacks. This pattern indicates aggressive liquidity engagement but limited follow-through from directional buyers. Price has not yet established higher highs and higher lows on higher timeframes, suggesting the broader trend remains range-bound.

Volume Dynamics

Volume spikes were concentrated at the peak of each rally, with no sustained volume expansion in subsequent candles. Historically, durable trend reversals require consistent volume support over multiple sessions. The current profile aligns more closely with liquidity testing and short-term distribution.

Momentum Indicators

RSI readings on lower timeframes reached elevated levels quickly, reflecting short-term overheating. However, momentum has not consolidated above key resistance levels, increasing the probability of mean reversion or sideways consolidation rather than trend continuation.

Market Structure Context

From a higher-timeframe perspective, Terra-related assets remain below major supply zones on the 4H and daily charts. Without a confirmed breakout and acceptance above these levels, recent rallies should be viewed as tactical moves within a broader consolidation range, not a confirmed trend shift.

Systemic Implications

Historically, Terra-driven volatility tends to coincide with periods of capital rotation and elevated risk appetite, often occurring while Bitcoin remains stable or slightly corrective. At present, this behavior signals speculative positioning rather than the early phase of a sustained altcoin cycle.

Conclusion

The Terra ecosystem is currently functioning as a short-term volatility and sentiment catalyst, not yet as a structural leader of a broader altseason. Confirmation of sustainable growth would require:

Holding above key higher-timeframe resistance levels

Continued volume expansion during consolidation

Relative stability in Bitcoin

Until these conditions are met, recent strength should be interpreted as liquidity engagement rather than trend confirmation.