Macro volatility in 2025 reignited the debate over “safe havens.”

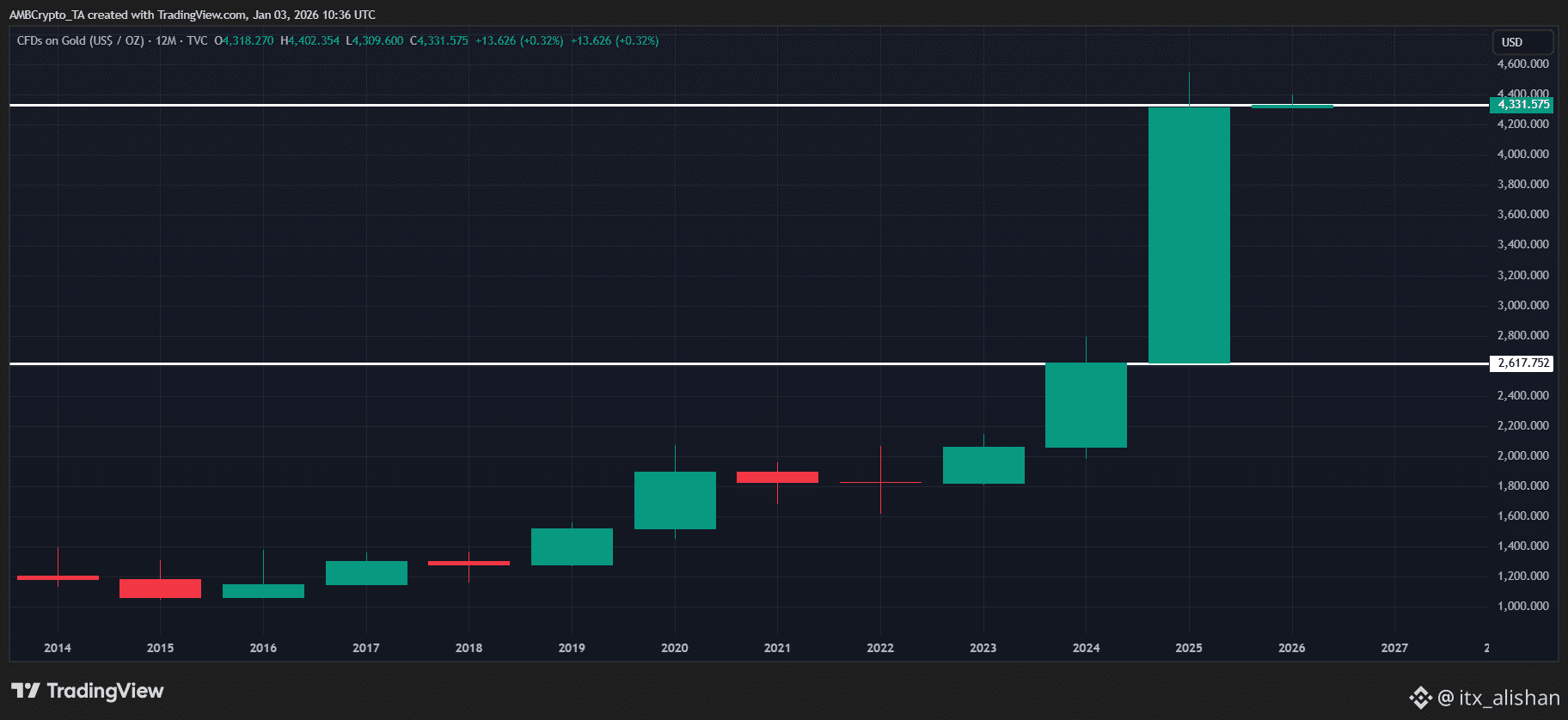

But looking at year-end closes, the verdict seems clear: Gold (XAU) dominated the narrative, surging nearly 65% to a record $4,500, reminding investors why it has long been the “go-to” asset during turbulent times.

That said, this wasn’t just a lucky streak. The U.S. economy faced multiple shocks, from inflation to the federal shutdown, putting Bitcoin’s [BTC] safe-haven story under pressure, ultimately finishing the year down 6.30%.

Source: Trading $ETH

View (GOLD/USD)

In essence, capital favored safety over risk as macro pressures built up.

However, 2025 closed with a noticeable shift. November inflation, for instance, dropped to 2.7%, marking a 0.3% MoM decline, while recent readings like core CPI and PCE have dipped below the Fed’s 2% target.

On paper, this sets the stage for capital to rotate back into Bitcoin. Yet, looking at Q4 performance versus tokenized gold [XAUT], the preference for XAUT remains evident. XAUT rallied 13% in Q4, while BTC slid 24%.

Naturally, the question arises: Is this divergence no longer about volatility, but about seeking safe returns? If so, could the growing positioning in XAUT be an early signal of a repeat divergence heading into 2026?