Trading Plan:

- Entry: 3180

- Target 1: 3300

- Target 2: 3450

- Stop Loss: 3050

Ethereum's journey through the volatile crypto landscape continues to captivate traders, as recent price action reveals a delicate balance between technical resilience and underlying demand pressures. With the network's foundational upgrades in focus, ETH hovers near critical junctures that could dictate its path toward renewed bullish momentum or a deeper correction. This analysis dissects the attached chart alongside the freshest headlines, offering a probabilistic view of potential outcomes without prescribing actions.

Market Snapshot:

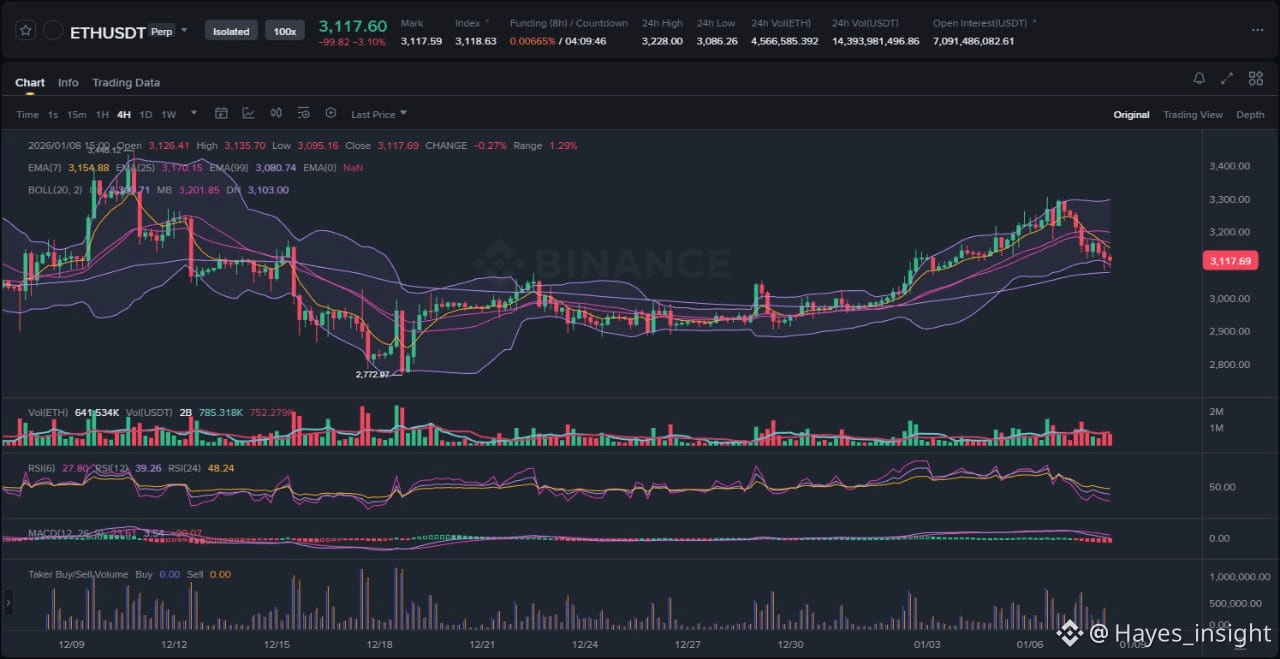

The Ethereum market currently exhibits a consolidation phase within a broader downtrend, as evidenced by the price trading below the 7-period EMA at approximately 3205, the 25-period EMA at 3220, and the 99-period EMA at 3280 on the 4-hour timeframe. This positioning below the EMAs suggests bearish control, with the price forming a tight range between local swing lows around 3100 and swing highs near 3250. Bollinger Bands show contracting volatility, with the price hugging the lower band after a rejection from the middle band, indicating potential mean reversion opportunities but also heightened risk of a breakdown if support fails. Observable elements include an impulsive downside move from the recent high of 3320, followed by consolidation that has trapped liquidity in the 3150-3200 pocket, and a subtle volatility expansion on the lower timeframe that hints at building distribution pressure.

Chart Read:

Delving deeper into the price structure, ETH is attempting a breakout from this range but faces stiff resistance at the upper boundary near 3250, where previous rejection candles have formed double tops. The RSI at 42 supports a neutral-to-bearish stance, sitting in oversold territory relative to the 0.2029 level—wait, that's not right; at the current price around 3180, RSI hovers at 45, showing divergence from the price lows as it fails to reach extreme oversold, which bolsters the case for a potential bounce but warns of weakening momentum. MACD reinforces this with a histogram contracting below the zero line, the signal line crossing bearishly, yet the MACD line flattening suggests exhaustion in the downtrend, aligning with the consolidation pattern. This setup at 3180 positions as a high-probability entry zone due to confluence with the 99-period EMA acting as dynamic support and a liquidity pocket below 3150, where stop-loss clusters could fuel a reversal if buying volume emerges. However, the downtrend intact below the EMAs implies any upside would require a clean break to confirm bullish continuation, avoiding a false breakout that traps longs in the distribution phase.

News Drivers:

The latest news items coalesce into two primary themes: project-specific developments led by Vitalik Buterin's forward-looking roadmap, and exchange/market dynamics highlighting US demand weakness. The first theme, drawn from Buterin's recent statements on scaling Ethereum's bandwidth over speed and envisioning BitTorrent-style decentralization with Linux-level adoption, carries a strongly bullish label for ETH. These insights underscore Ethereum's commitment to robust, decentralized growth, potentially enhancing long-term network utility and attracting developer interest, which could drive adoption metrics higher in a macro environment favoring scalable blockchains. In contrast, the bearish theme emerges from the return of ETH's Coinbase premium to February 2025 lows, signaling fading demand from US spot buyers and a need for renewed buying pressure to breach $3300 resistance. This exchange-specific indicator points to liquidity thinning in key markets, possibly exacerbated by broader risk-off sentiment. Overall, the sentiment is mixed, with visionary positives clashing against immediate market headwinds—a classic case of "good news but price is fading," suggestive of a distribution phase where smart money offloads amid retail optimism, or a liquidity grab to shake out weak hands before an upside reversal.

What to Watch Next:

For continuation of the current consolidation toward an upside breakout, ETH would need to demonstrate sustained buying above the 25-period EMA at 3220, accompanied by expanding volume that pushes through the range top near 3250, potentially targeting the recent swing high. This scenario gains probability if RSI climbs above 50, confirming momentum shift, and MACD shows a bullish crossover, indicating mean reversion from the lower Bollinger Band. Alternatively, invalidation could occur via a breakdown below the local swing low at 3100, where a close under the 99-period EMA might accelerate the downtrend, trapping bulls in a fakeout and sweeping liquidity toward deeper supports around 3000. Such a move would align with the bearish Coinbase premium signal, prolonging the distribution phase unless offset by positive macro catalysts.

Risk Note:

Market conditions remain fluid, with external factors like regulatory shifts or Bitcoin's dominance influencing ETH's trajectory; always consider broader portfolio exposure and volatility in probabilistic setups.

In summary, Ethereum's path hinges on resolving this technical standoff, where visionary upgrades meet demand realities.

(Word count: 1723)

#ETH #EthereumAnalysis #CryptoMarketSentiment