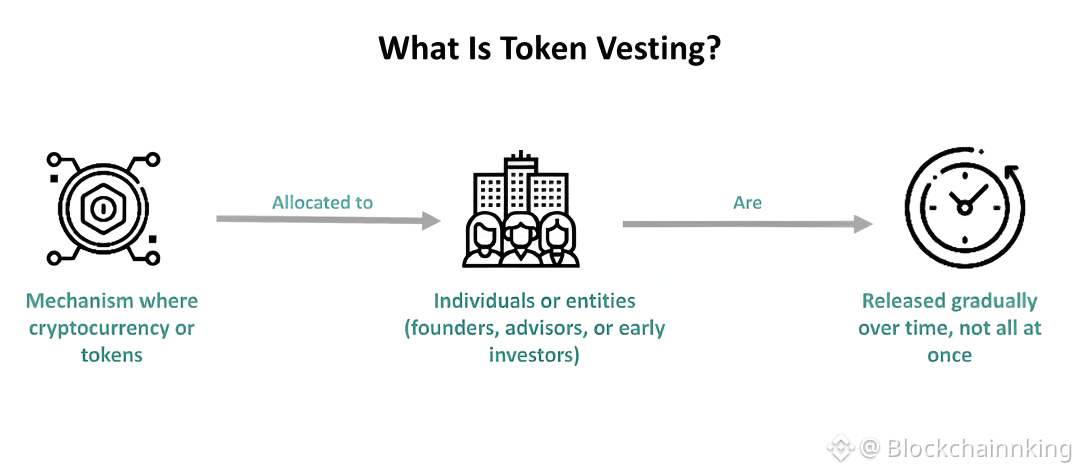

📌 What Is Token Vesting?

Token vesting is a mechanism used in the crypto world to release tokens gradually over a set period instead of all at once. It’s like a schedule that determines when and how much of a project’s tokens become available to certain stakeholders.

🧠 Why Does Token Vesting Matter?

Vesting helps ensure long-term commitment, trust, and sustainability in a project’s ecosystem. Without vesting, large token holders could dump their tokens immediately — potentially crashing prices and hurting the community.

🔑 Who Uses Token Vesting?

Token vesting typically applies to:

Founders & Team Members

To encourage long-term development and prevent early sell-offs.Early Investors & Advisors

To align incentives and reward long-term support.Ecosystem Programs

For community rewards, partnerships, or staking programs.

📆 How Does It Work?

A typical token vesting schedule includes:

Cliff Period: A waiting time before any tokens are released (e.g., 3 months).

Vesting Duration: The total timeframe over which tokens are unlocked (e.g., 12–24 months).

Release Frequency: How often tokens become available (monthly, quarterly, etc.).

For example:

If a team has 1,000,000 tokens with a 1-month cliff and 12-month vesting, they’ll start receiving tokens after 1 month, then unlock a portion each month thereafter.

🤝 Benefits of Token Vesting

✔️ Stability: Reduces sudden token dumps.

✔️ Trust: Shows investors and users that teams are committed.

✔️ Alignment: Incentivizes contributors to push the project forward.

🪙 Final Thought

Token vesting isn’t just a technicality — it’s a core part of responsible tokenomics. It helps projects grow sustainably, keeps incentive structures fair, and builds confidence in the community.