Over ten years, blockchain efforts aimed at broad utility. Yet reaching that goal stayed out of reach

Everything runs on smart contracts. Through tokens, value moves differently. Stories shape each system now.

Money just isn’t built like that.

A single purpose shapes real money machines - nothing more. Value moves through payment rails. Orders meet on trading floors. Balances snap into place via clearing engines. Messy overlaps invite waste.

What drives Plasma isn’t theory - it’s how money actually moves. Built on its own chain, it takes real-world finance as the starting point.

Here’s the core idea - clear, yet strong

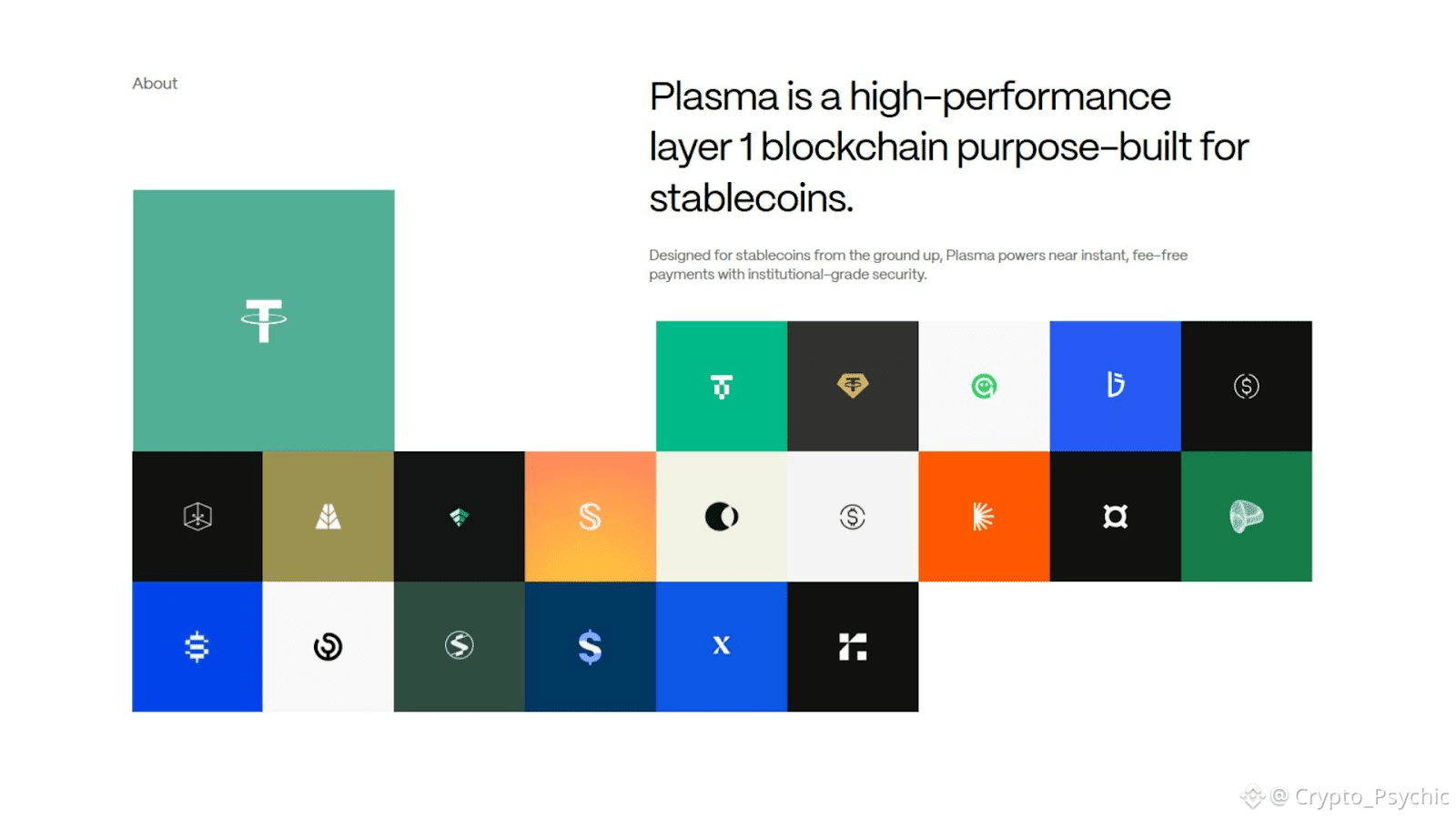

Far from it being a place where stablecoins sit like any ordinary coin

Money built right into the system’s bones. Not added later. Held steady by tokens made to stay flat. The whole thing runs because they do.

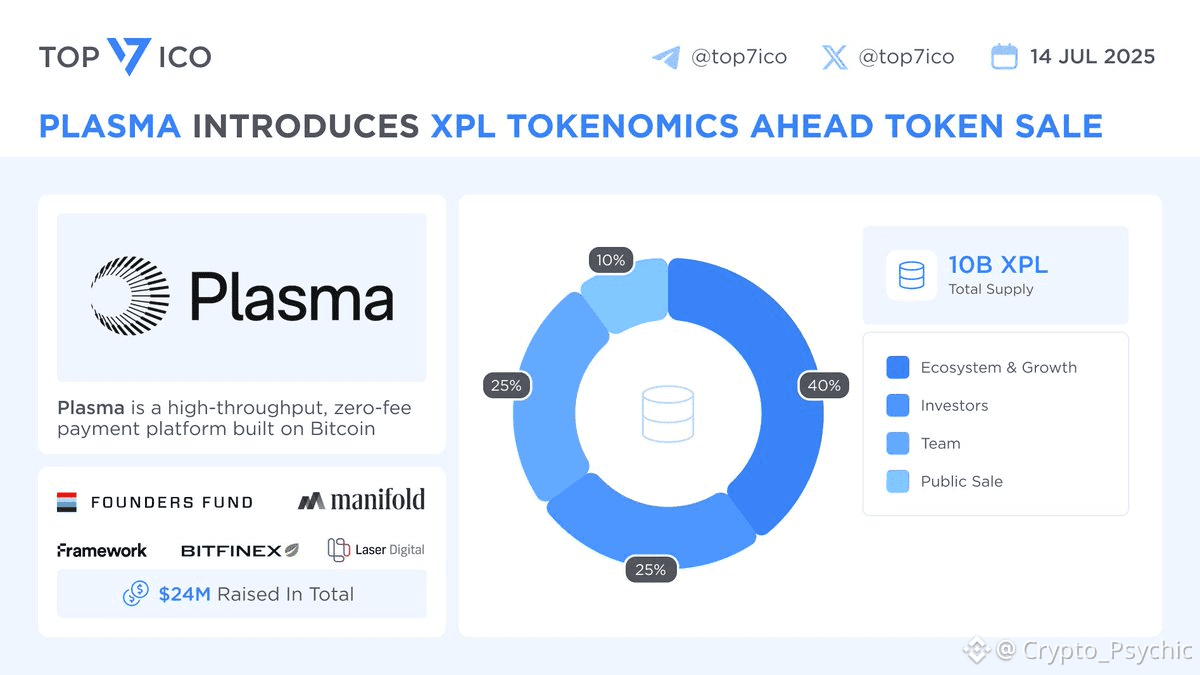

Stablecoins Need a Dedicated Blockchain

Fresh off the back of wider adoption, stablecoins have moved beyond their early days. These digital tokens now sit firmly in the mainstream spotlight. Not just for enthusiasts anymore, they’re part of everyday financial flows. Driven by real-world use, their role keeps expanding quietly but steadily

On top of everything, digital tokens move across blockchains more than anything else

Payments across borders, powered by digital currency. Built on networks that never sleep. Moving value where it needs to go - fast, open, always running

the default trading pair in DeFi

A separate currency setup running nonstop through the week

In Many Regions Stablecoins Used As Everyday Money

savings instruments

remittance rails

business settlement currency

Protect savings when prices rise at home by shifting money elsewhere

Now though, stablecoins have to operate on networks built for something else entirely.

This creates friction:

People pay gas costs using unstable digital currencies

unpredictable confirmation times

Heavy traffic shows up when markets get shaky

UX designed for traders, not payers

Meaning shaped by places where guesses pass for truth

Stuck inside old limits, stablecoins pushed beyond what they could do before. That shift? It made plasma possible.

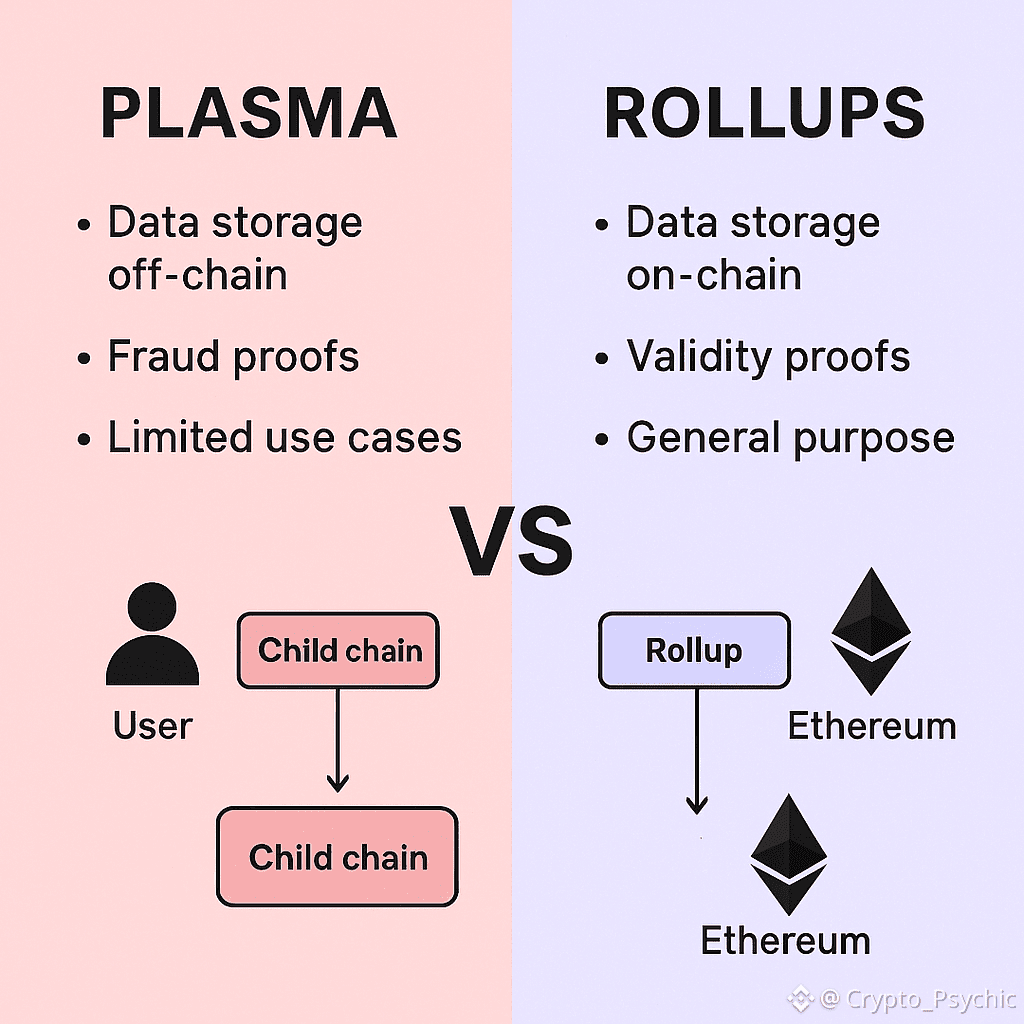

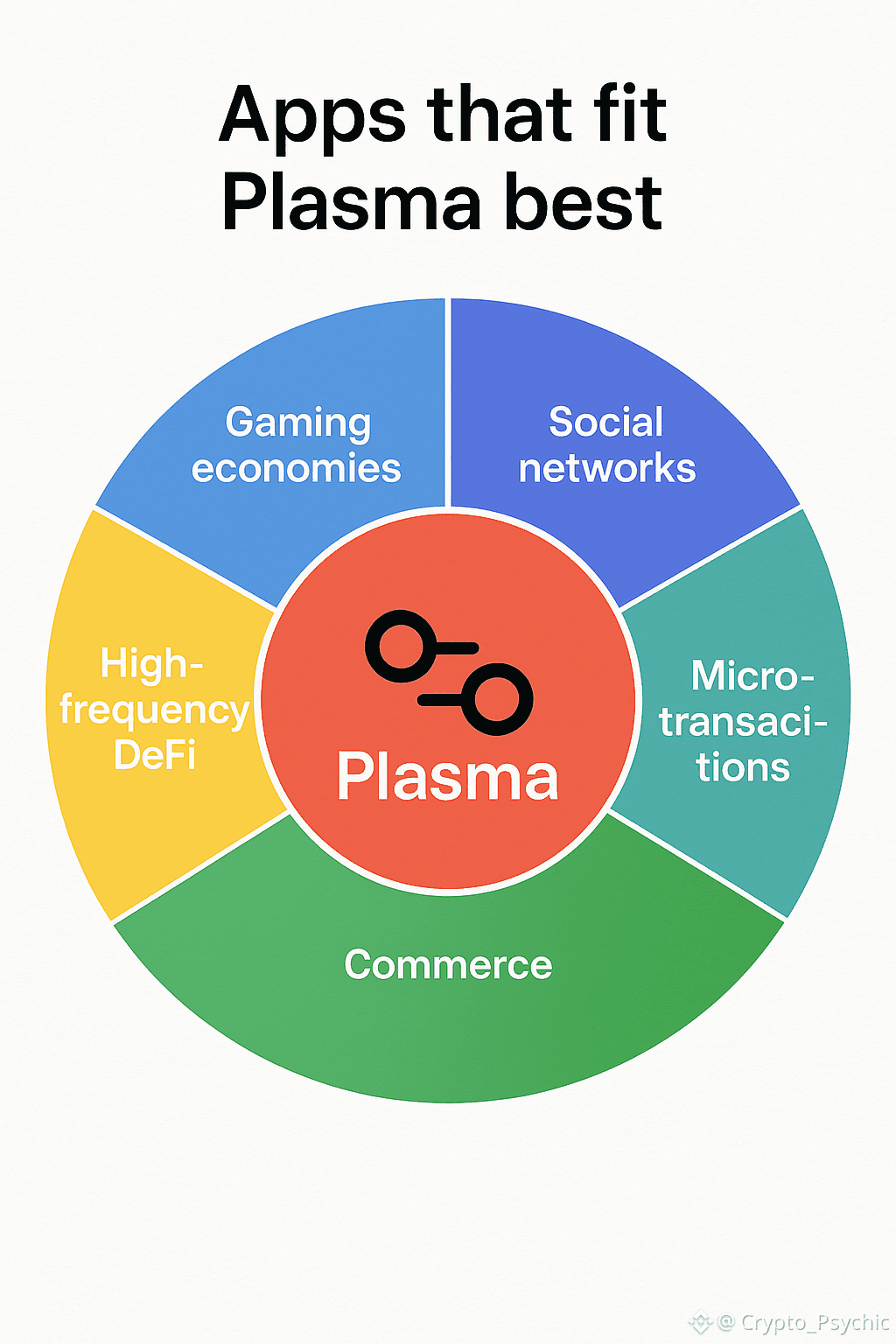

A Layer One Built for Settlements Instead of Bets

A fresh spin on blockchains, Plasma focuses only on moving stablecoins, nothing more. Built like financial rails meant for real-life cash flow patterns. Each design piece follows how payments naturally happen out there. Not chasing every feature - just solving one job well.

Breadth isn’t its goal when measured against broad smart-contract systems.

Built for speed, clear outcomes, fairness, and steady costs - what really counts when moving money or running financial systems behind the scenes. Still.

Right there, deep inside each part of the setup, that priority takes hold. It threads through everything, quiet but clear.

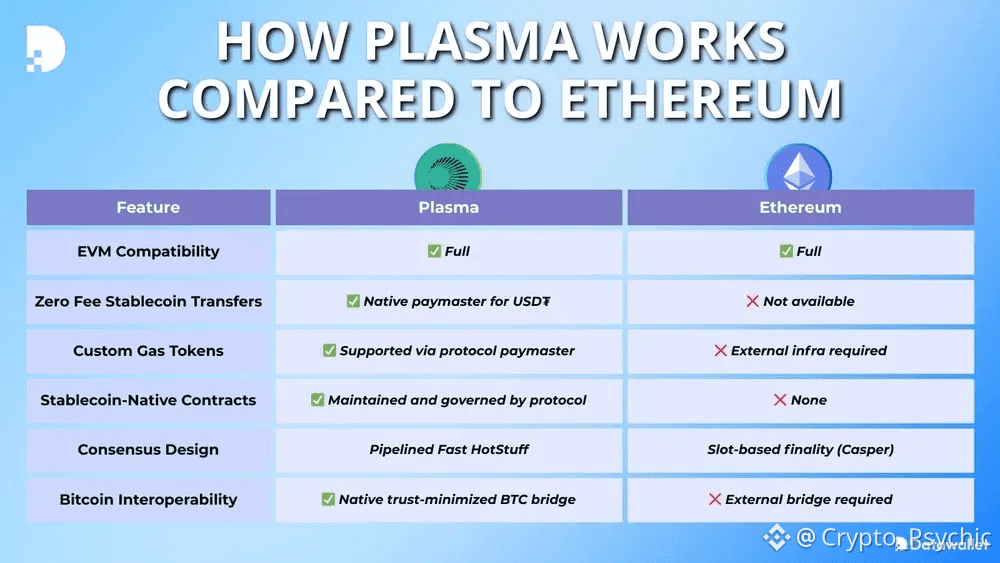

Full EVM Compatibility Without Typical Compromises

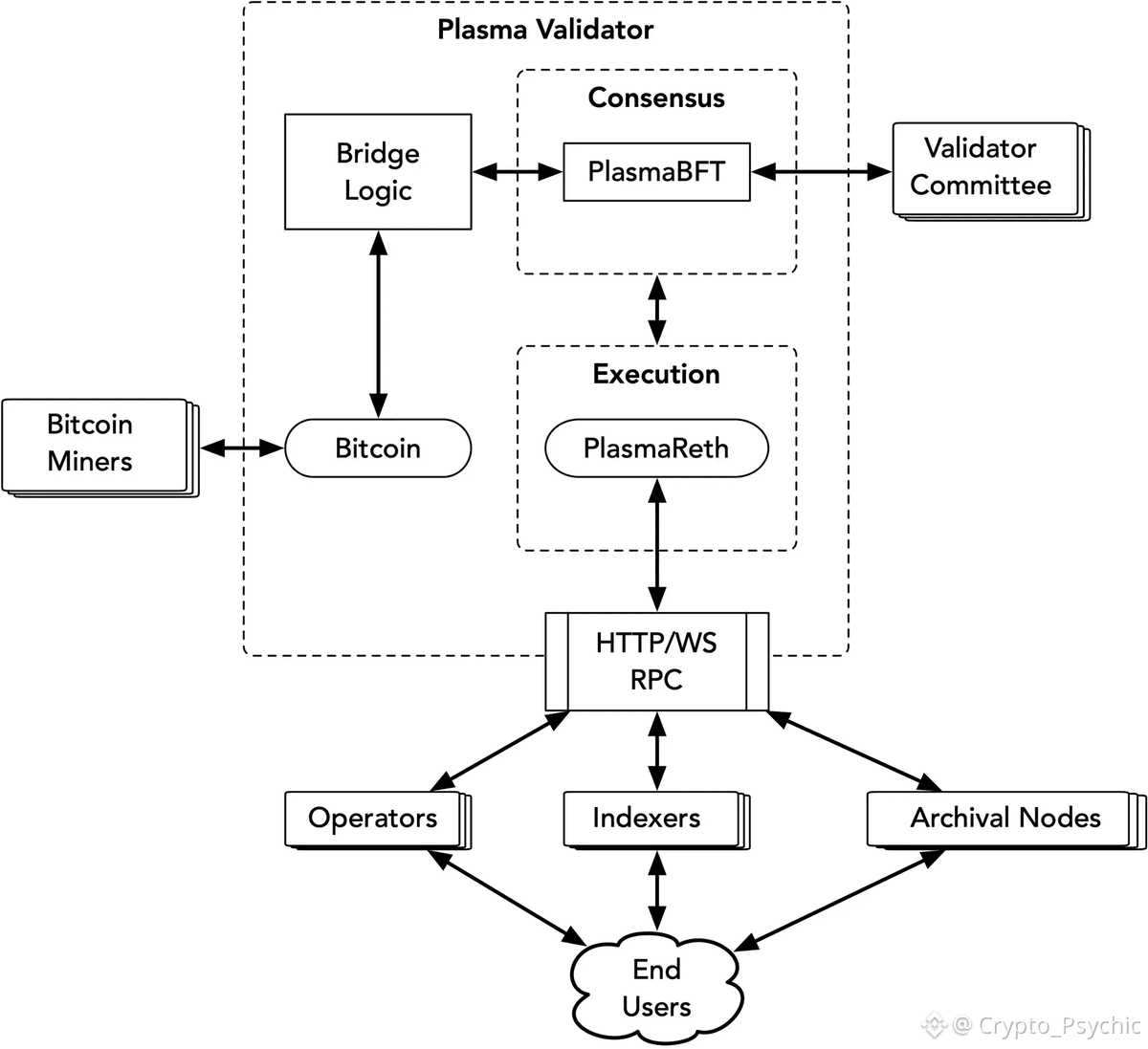

Picture four shows how EVM works with Reth alongside Plasma handling execution

Plasma works with Ethereum Virtual Machine using Reth

Most old Ethereum agreements work fine with just small tweaks

Out of the box, you get wallets alongside tooling plus solid infrastructure setup ready to go

Folks building software can skip picking up another way to run code

Yet Plasma avoids carrying over Ethereum's limitations.

Plasma sidesteps the usual slowdowns seen when systems match Ethereum’s format. Instead of sacrificing speed for fit, it builds its own agreement method underneath. That means running familiar code without dragging down efficiency. Most setups stumble here - either they work smoothly but feel foreign, or run slow while pretending to be compatible. This one moves fast and still feels right at home.

This changes how construction teams work

familiar development workflows

predictable execution

payment-grade performance

Sub Second Finality Using PlasmaBFT

Firm closure decides survival in settlement networks.

A payment sitting on the edge of happening isn’t real - just words hanging in the air.

Plasma introduces PlasmaBFT, a consensus mechanism engineered for:

sub-second finality

deterministic transaction ordering

high throughput under load

predictable confirmation guarantees

This matters most when dealing with situations that demand immediate attention

retail payments

merchant settlement

payroll flows

remittances

institutional payment rails

Firm closure matters right away in Plasma - built in, not bolted on later.

Stablecoin First Built In From The Start

Many blockchains start with tokens. Only after do they add stablecoins.

Plasma inverts this.

Gasless Stablecoin Transfers

With Plasma, moving USDT doesn’t need gas fees at all. That wipes out a major roadblock holding back wider use.

Most folks can skip it. Not required at any point. Skip if you like. Unnecessary entirely. Leave behind without worry

native tokens

gas management

fee estimation

prior blockchain knowledge

Stablecoin-First Gas Model

When gas is present, fees shift to stablecoins instead - tying expenses directly to what people count their money in. Costs make more sense that way.

This eliminates:

fee volatility

confusing UX

hidden exposure to asset price swings

Bitcoin Anchored Security Built on Neutrality

Built on Bitcoin's foundation, Plasma sidesteps reliance on one isolated system. Instead of trusting a single network’s rules, it draws strength from Bitcoin’s anchor. This shift spreads risk across broader ground. Security flows not from internal controls but external roots. Neutrality grows stronger when power isn’t centralized. Censorship becomes harder when control dissolves into deeper layers.

This matters for:

cross-border payments

Much money moves where power watches closely

institutional trust

long-term settlement guarantees

Firmly tied to Bitcoin's strength, Plasma stands out as a worldwide system for finalizing transactions - unbound by geography or limited networks. Instead of chasing trends, it builds on proven resilience.

Who Benefits From Plasma

A snapshot sits where people buy things plus big companies work. This space fits both everyday shoppers and larger groups making moves. Picture shows who uses it most clearly

It's clear that plasma has specific goals, not a universal reach

People moving actual assets across blockchains are the ones it focuses on.

Retail in high-adoption markets

Payment companies & fintechs

Institutions & financial infrastructure providers

Each group benefits from:

predictable settlement

stablecoin-native UX

low operational friction

neutral security assumptions

Plasma Works Because It Does Less

Stillness holds more weight than motion ever could

NFTs

meme cycles

social graphs

speculative narratives

It takes pride in being dull machinery - the sort that runs beneath working economies without fanfare.

When we look back, what sticks isn’t scattered trial and error - it’s clear purpose built to last. Strength comes from direction, not guessing. What remains stands because it was meant to.

The Bigger Picture Stablecoins as Global Settlement Currency

Fresh off the press each day, stablecoins shift massive sums - billions quietly changing hands without fanfare.

Far beyond one nation's reach, they work when banks sleep, cutting out middlemen entirely.

Missing is a proper system to handle settlements.

Built for that world, Plasma isn’t a test. It’s what comes first.

Attention isn’t something plasma goes after.

This time aims at gaining stronger footing in resolution outcomes.

By combining:

EVM compatibility

sub-second finality

stablecoin-first economics

Bitcoin-anchored security

Beyond the usual chains, plasma builds something different. Not every network sees this space as worth entering. What sets it apart? A focus few bother with. While others rush ahead, it moves quietly. Most overlook what it does entirely

A foundation built for balance, running strong where digital cash flows. Its design stays fair while handling serious work in dollar-linked deals.

This is precisely what makes it count.