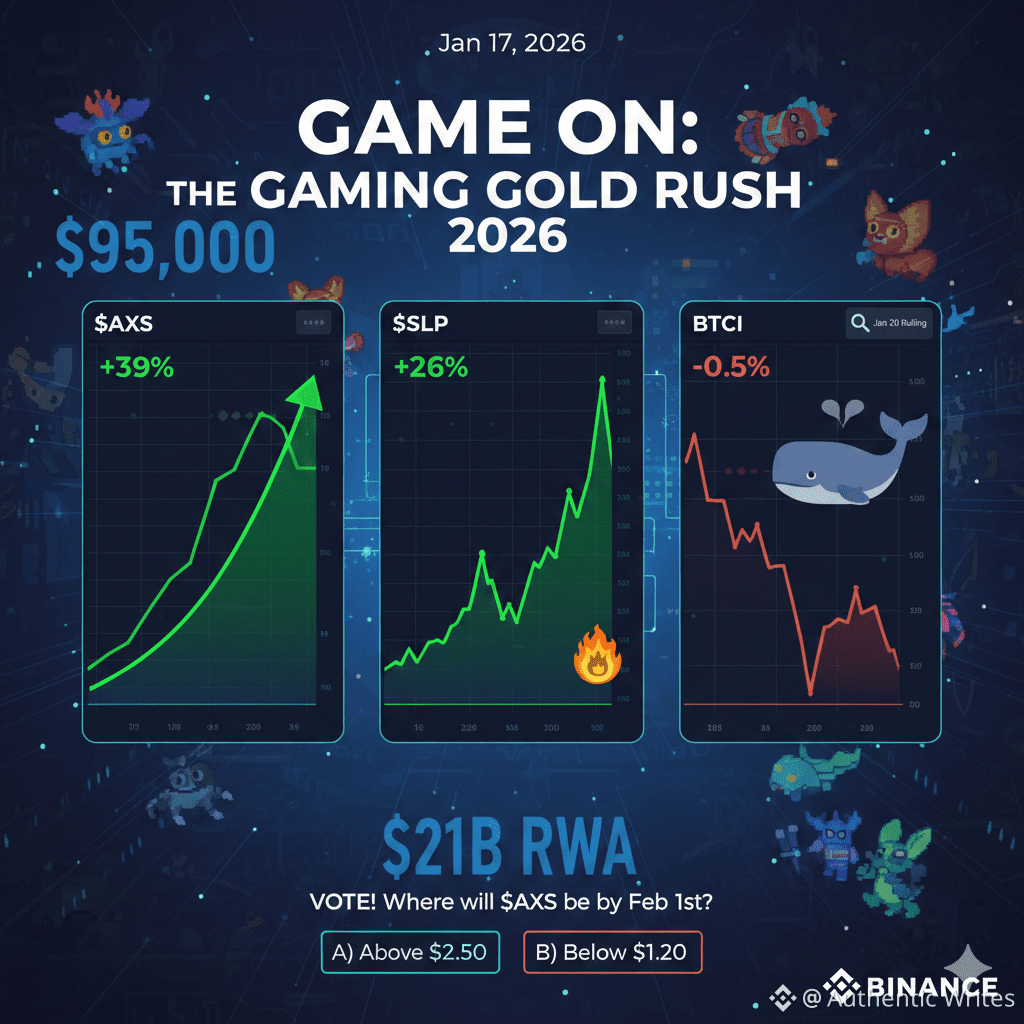

While Bitcoin $BTC stays locked in a consolidation phase near $95,000, the "dead sector" of 2024 is suddenly the loudest room in the house. Today, Axie Infinity $AXS and Smooth Love Potion SLP are leading a massive GameFi rally.

Is this a short-term pump, or have the "Grandfathers of Play-to-Earn" finally solved their inflation problem? Let’s dive into the data.

📉 The Catalyst: "The Death of Infinite Printing"

The biggest reason for today’s price action isn’t just hype—it’s a fundamental shift in tokenomics. On January 7, 2026, Axie Infinity officially halted SLP emissions in its Origins mode.

The Result: By cutting off bot farmers, the team effectively removed massive daily sell pressure.

The Reaction: For the first time in years, SLP is being burned faster than it is being created, turning it into a deflationary asset during peak gaming hours.

🚀 Roadmap Alpha: "Atia’s Legacy" MMO

The market is also pricing in the upcoming Atia’s Legacy Open Beta. This isn't just another card game update; it’s an ambitious MMO expansion aimed at competing with titles like Illuvium.

Whale Activity: Open Interest (OI) for AXS skyrocketed by 182% this week. This signals that big players aren't just scalp trading—they are positioning for a trend continuation.

Final Verdict: Is it a Buy?

We are seeing a clear rotation. Capital is moving out of stagnant "Dino-L1s" and into sectors with real utility and updated tokenomics. GameFi is no longer about "printing money"; in 2026, it’s about sustainable ecosystems.

What’s your move? Are you riding the $AXS wave to $2.00, or is this just a relief rally before another dip?

👇 Drop a "🎮" in the comments if you're still holding your 2021 bags, or "🔥" if you just entered!