A Trade Is Not Just Numbers on a Screen — It’s a Test of Discipline

When people look at a profitable trade, they usually focus on one thing only: the profit. The green numbers. The ROI percentage. The excitement of being right. But what most traders fail to understand is that the real story of any trade is not written in profit or loss — it’s written in decision-making.

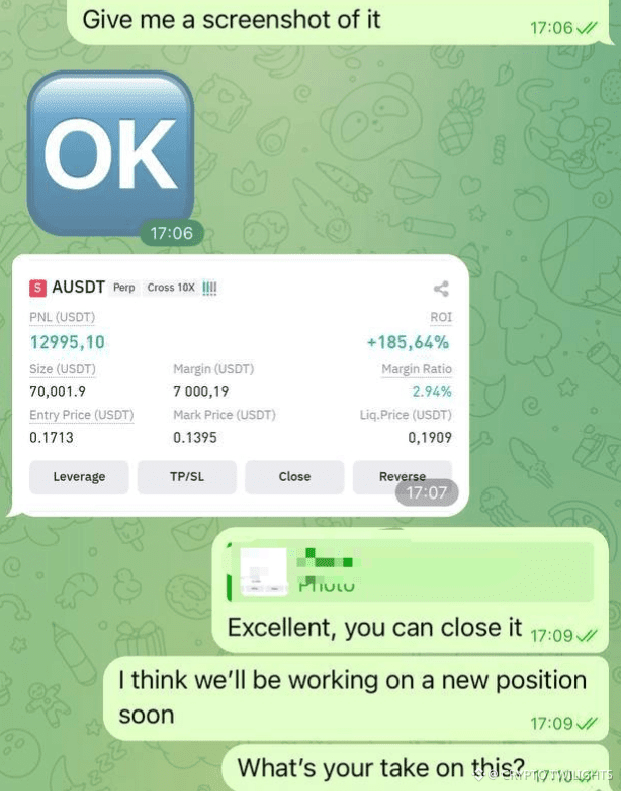

This screenshot shows a position that moved strongly in the trader’s favor. On the surface, it looks like a “perfect trade.” Good entry, strong move, high ROI, and a clean execution. But if you think this trade was successful only because of market movement, you’re missing the most important lesson.

Let’s break down what truly matters here — not technically, but mentally.

---

1. The Entry Is Only the Beginning

Every trade starts with an idea. That idea might come from price action, structure, trend continuation, or simple market momentum. But no matter how good the setup looks, the market owes you nothing.

The moment you enter a trade, uncertainty begins.

Many traders believe the hard part is finding entries. In reality, entries are easy. You can find hundreds of “good setups” every week. The real challenge starts after the entry — when price starts moving, emotions wake up, and your plan is tested.

A good entry without discipline is useless.

---

2. Profit Magnifies Emotions Just Like Losses

Most traders think emotions only show up during losses. That’s false.

Profit is just as dangerous.

When price moves in your favor:

Greed whispers: “Hold a bit longer.”

Ego speaks: “I was right, the market is easy.”

Hope appears: “This could go much further.”

This is exactly where many winning trades turn into regrets.

Not because the market reversed — but because the trader stopped following the plan.

---

3. Knowing When to Close Is a Skill

Anyone can open a trade. Very few know how to close one properly.

Closing a trade in profit requires:

Emotional control

Respect for the plan

Acceptance that no trade captures the entire move

A disciplined trader understands one simple truth:

> You don’t need the top or bottom. You need consistency.

When you see strong profit on the screen, the correct question is not: “Can this go more?”

The correct question is: “Is my reason for staying still valid?”

If your plan says close — you close. No debate. No delay.

---

4. Trust Between Traders Is Built on Execution, Not Words

In collaborative trading environments, screenshots are not about showing off. They are about confirmation and clarity.

A screenshot says:

This is the real position

This is the real PnL

This is the real execution

When someone responds with calm guidance like “You can close it”, it reflects confidence, not excitement.

Professional traders don’t chase dopamine. They protect capital and results.

---

5. One Trade Does Not Define You

Another common mistake traders make is emotional attachment to a single trade.

A big win can make you reckless. A small loss can make you desperate.

Both are dangerous.

This trade is one data point, not your identity.

Strong traders think in series:

A series of trades

A series of executions

A series of disciplined decisions

They don’t try to prove anything to the market.

---

6. The Market Will Always Offer Another Opportunity

Notice something important: After closing, the focus immediately shifts to the future — “We’ll be working on a new position soon.”

This mindset separates professionals from gamblers.

There is no fear of missing out. No emotional attachment. No rush.

The market is infinite. Opportunities never end.

If you miss one move, another will come. If you close early, another setup will form.

Patience is power.

---

7. High ROI Means Nothing Without Risk Control

A high percentage gain looks impressive, but smart traders always ask:

How much margin was used?

What was the liquidation distance?

Was risk calculated or accidental?

Risk management is silent. It doesn’t show off. But it keeps you in the game.

Many traders hit big ROIs once and disappear forever. Others grow slowly and survive for years.

Choose which trader you want to be.

---

8. Calm Is a Competitive Advantage

Look at the tone of the conversation: No hype. No celebration. No panic.

Just calm execution.

This is not accidental. This is trained behavior.

The market rewards calm minds because:

Calm traders don’t overtrade

Calm traders don’t revenge trade

Calm traders don’t break rules

Emotional traders donate liquidity. Disciplined traders extract it.

---

9. Discipline Is Boring — And That’s Why It Works

If trading feels exciting all the time, something is wrong.

Real trading is:

Repetitive

Methodical

Sometimes boring

And that’s exactly why it works.

The moment trading feels like entertainment, risk is already rising.

---

10. The Real Win Is Control

Yes, profit matters. Yes, ROI matters. Yes, results matter.

But the real victory is control:

Control over emotions

Control over execution

Control over decisions

A trader who can close a winning trade without hesitation is already ahead of most of the market.

---

Final Thought

The market doesn’t reward intelligence. It rewards discipline.

It doesn’t care about your confidence. It respects your consistency.

Every trade is a mirror. It reflects who you are as a trader.

Ask yourself:

Did I follow my plan?

Did I respect risk?

Did I stay emotionally neutral?

If the answer is yes — the trade was successful, no matter the number.

Stay patient. Stay disciplined. Let the process compound.

Because in the long run, discipline always outperforms emotion.