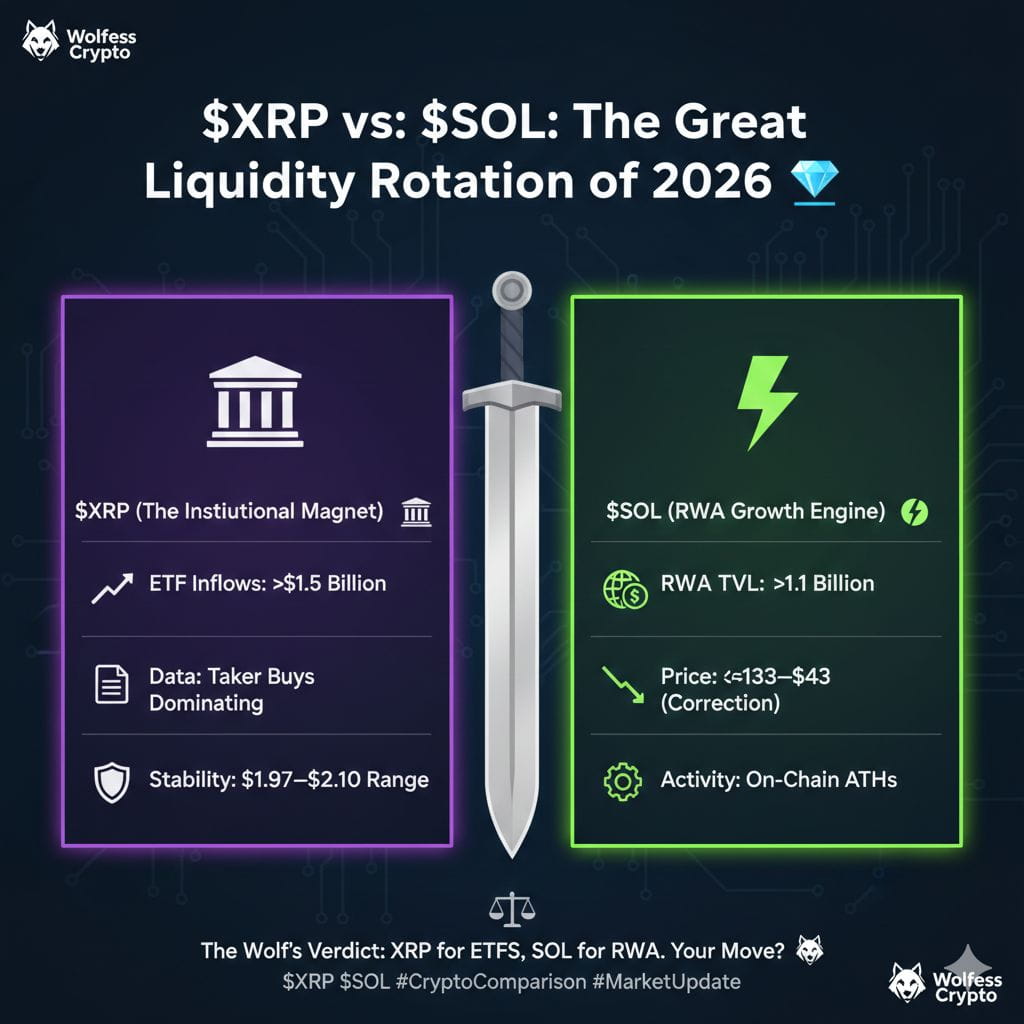

Wczesne tygodnie 2026 roku ujawniły fascynującą dywergencję na rynku altcoinów. Podczas gdy szerszy rynek pozostaje "chropowaty", dwaj giganci walczą o dominację, każdy wspierany przez zupełnie inną narrację: Użyteczność Instytucjonalna (XRP) vs. Skalowalność On-Chain (SOL).

XRP: Magnes Instytucjonalny 🏛️

XRP obecnie pokazuje jedno z najsilniejszych ustawień strukturalnych od lat.

Dominacja ETF: Skumulowane netto wpływy do ETF-ów XRP spot oficjalnie osiągnęły 1,52 miliarda dolarów. To, co imponuje, to fakt, że te fundusze nie zarejestrowały ani jednego dnia netto wypływów od swojego debiutu—rekord, który nie ma sobie równych w ETF-ach BTC ani ETH.

Cena minimalna: $XRP utrzymuje się mocno w przedziale $1.97–$2.10. Zakupy z rynku dominują, co sugeruje, że instytucje traktują tę strefę jako długoterminowe "zabezpieczenie strukturalne".

Napęd: Przesunięcie przechodzi od "spekulacji" do "użyteczności rozliczeniowej", a duże firmy korzystają z XRP Ledger do płatności RWA transgranicznych.

SOL: Silnik wzrostu RWA ⚡

Solana jest obecnie w "Fazie Korekty", ale dane bazowe opowiadają historię ogromnego wzrostu.

Akcja cenowa: $SOL testuje wsparcie na poziomie ~$133–$143. Analitycy uważnie obserwują poziom Fibonacciego $132; utrzymanie tego poziomu jest kluczowe dla zachowania trendu odwrócenia byka.

Kamień milowy RWA: Ekosystem aktywów rzeczywistych (RWA) Solany właśnie osiągnął historyczne 1.1 miliarda dolarów TVL. Z funduszem BUIDL BlackRock i nowymi tokenizowanymi produktami skarbowymi, Solana zdobywa udział w rynku DeFi instytucjonalnego.

Zdrowie sieci: Codzienna liczba aktywnych adresów wzrosła do 3.7 miliona, co sygnalizuje, że spadek cen to okazja do "kupowania na spadkach" dla użytkowników on-chain.

Werdykt: 🐺

Płynność nie porusza się już losowo. Dzieli się między bezpieczeństwo regulacyjne/ETF XRP a szybką działalność gospodarczą Solany.

Czy twoje portfolio skłania się ku "Uregulowaniu Instytucjonalnemu" czy "Gospodarce On-Chain"? ⚖️

#XRPvsSOL #MarketSentiment #InstitutionalCrypto #xrp #sol