Financial markets around the world are deeply interconnected, and at the center of this system stands the US Federal Reserve. Regardless of the asset class—stocks, foreign exchange, commodities, or cryptocurrencies—investors closely monitor Federal Reserve interest rate decisions and policy statements. These decisions influence global liquidity conditions, capital flows, and risk sentiment, making them a primary driver of market direction.

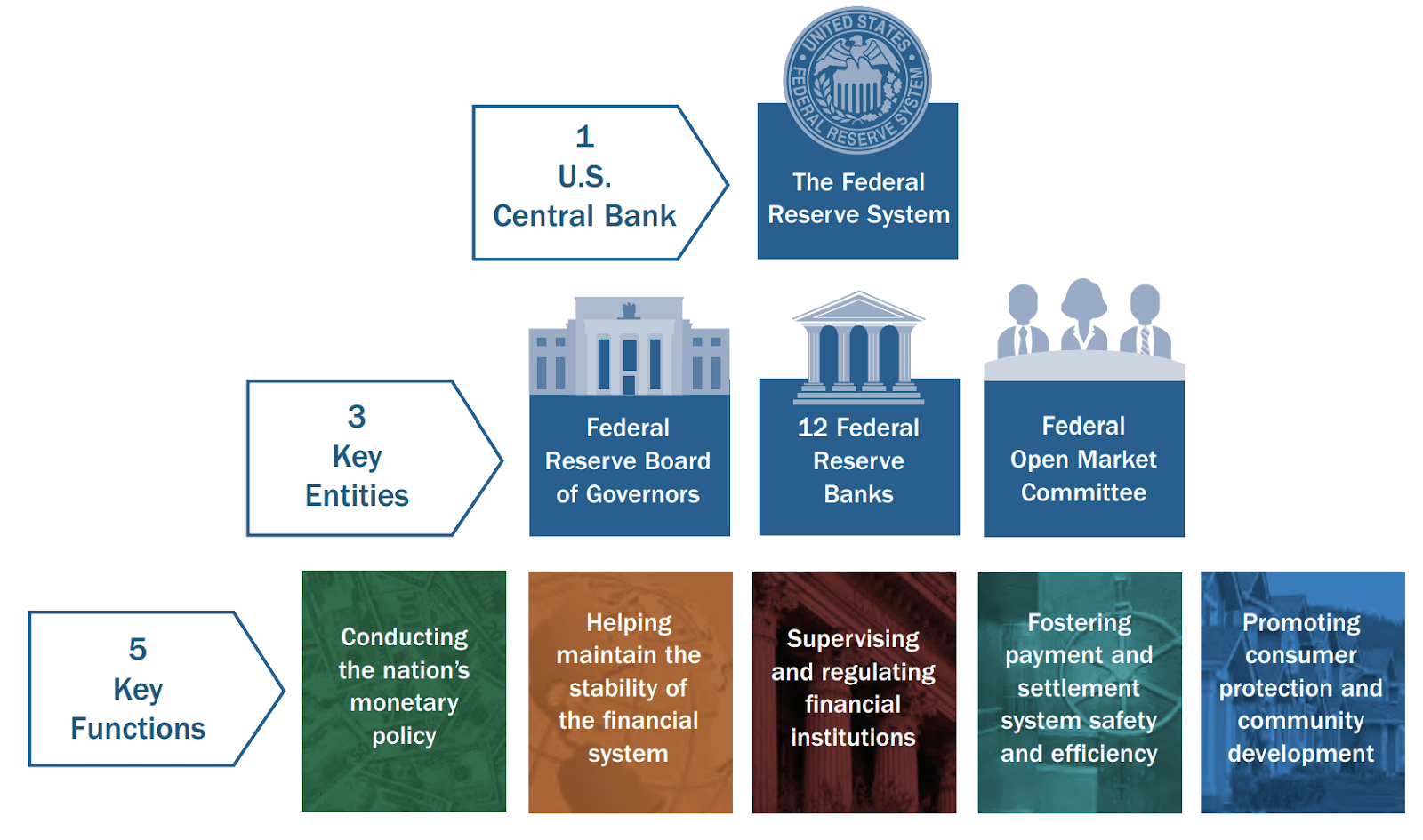

The Role of the US Federal Reserve and FOMC

The US Federal Reserve serves as the central bank of the United States, while the Federal Open Market Committee (FOMC) is responsible for setting monetary policy, including interest rates. Through its decisions and forward guidance, the Fed determines whether financial conditions will tighten or ease. Because the US dollar functions as the world’s reserve currency, Fed policy has consequences far beyond the US economy, affecting global markets at scale.

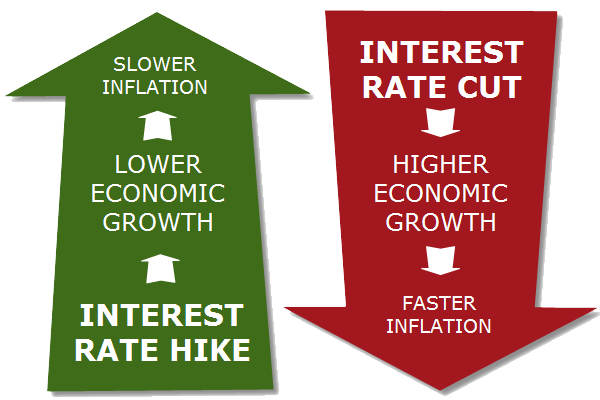

Why Interest Rates Matter to Financial Markets

Interest rates represent the cost of money. When rates are low, borrowing is cheaper, liquidity expands, and investors are more willing to allocate capital toward growth and risk-oriented assets. Conversely, higher interest rates increase financing costs, restrict liquidity, and encourage capital preservation. This dynamic explains why changes in Fed policy often trigger broad market movements across multiple asset classes.

Impact on Equity Markets

Stock market valuations are highly sensitive to interest rate changes. Rising rates increase corporate borrowing costs and reduce the present value of future earnings, which often leads to downward pressure on equity prices. Sectors reliant on growth and leverage tend to be the most affected. When the Fed signals a pause or a shift toward rate cuts, equity markets typically respond positively, reflecting improved financial conditions and renewed risk appetite.

Influence on Forex Markets

Foreign exchange markets respond directly and immediately to Fed policy. Interest rate differentials between economies drive currency valuations. A rate hike by the Fed often strengthens the US dollar as global capital seeks higher yields, while rate cuts typically weaken the dollar and shift flows toward other currencies. Fed remarks and guidance are therefore critical for forex traders, as even subtle changes in tone can alter currency trends.

Effect on Bitcoin and the Crypto Market

Although cryptocurrencies operate outside traditional financial systems, they remain strongly influenced by macroeconomic conditions. Bitcoin and the broader crypto market are highly sensitive to liquidity cycles. Periods of monetary tightening usually result in reduced speculative activity and capital outflows from crypto assets. In contrast, rate pauses or cuts often support stronger performance as liquidity returns and investors seek alternative stores of value and higher-risk opportunities.

Relationship Between Fed Policy and Gold

Gold has historically served as a hedge against inflation and currency debasement. Fed policy plays a key role in shaping gold’s performance, particularly through its impact on real interest rates and the US dollar. Dovish policy signals and rate cuts generally support gold prices, while aggressive rate hikes can create short-term pressure. However, during periods of economic uncertainty, gold often remains resilient despite tighter policy conditions.

The Importance of Fed Communication and Market Expectations

Markets are forward-looking and frequently react more to expectations than to actual rate decisions. Fed statements, press conferences, and economic projections provide guidance on future policy direction. Investors analyze this communication closely, as shifts in tone or outlook can significantly influence market sentiment and pricing.

Conclusion

US Federal Reserve rate decisions and remarks are among the most influential factors shaping global financial markets. By determining the cost of capital and the availability of liquidity, the Fed impacts stocks, forex, cryptocurrencies, and gold simultaneously. For professional traders and investors, understanding Fed policy is essential for interpreting market behavior, managing risk, and positioning effectively across asset classes.