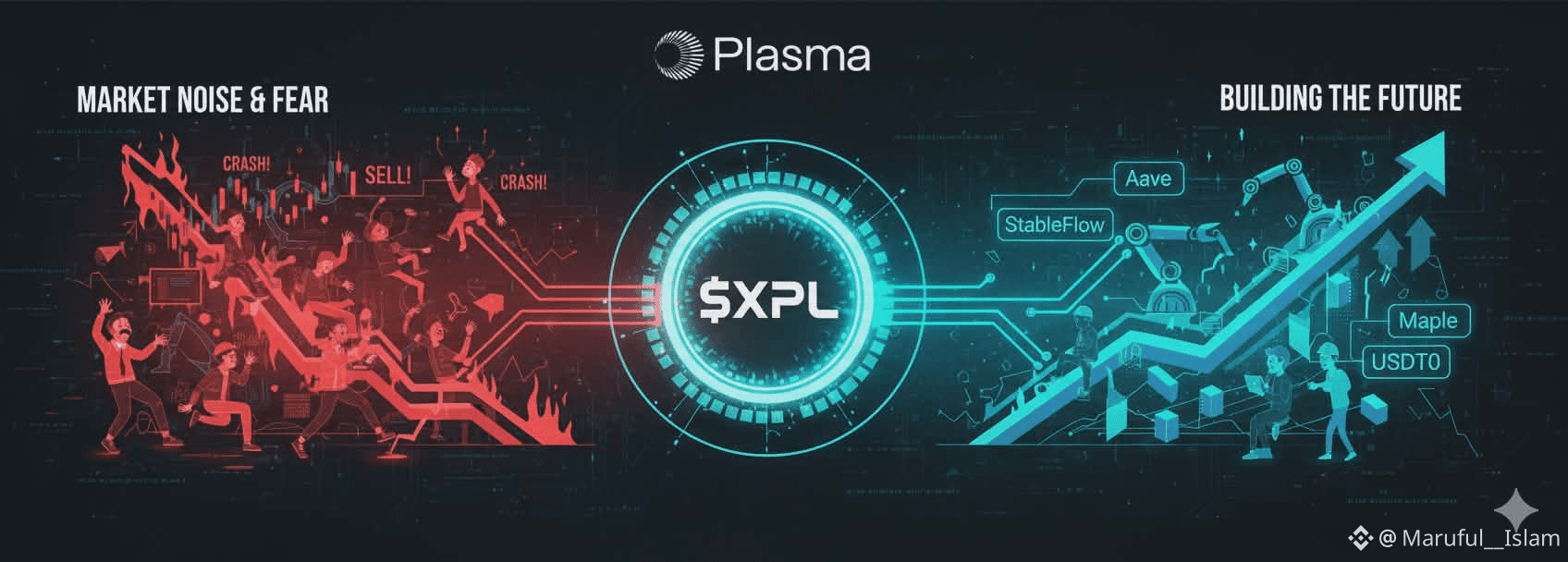

$XPL is trading in the middle of a fearful market cycle. Risk is off, emotions are high, and most people are reacting instead of thinking. I get it. When the Fear & Greed Index hits “Extreme Fear,” the first instinct is to run.

But this is where I personally shift my focus — from price to product.

Because Plasma isn’t standing still.

While the market is bleeding, Plasma is integrating:

• Aave → bringing deep DeFi liquidity

• StableFlow → enabling near-free, high-volume cross-chain stablecoin movement

• Maple → institutional-grade yield infrastructure

• USDT0 → faster settlement between Plasma and Ethereum

This isn’t hype. This is infrastructure.

And infrastructure is what creates *real* demand for a token.

Here’s how I think about it:

Short term:

Yes, XPL can go down when the whole market is scared. That’s normal. Smaller-cap assets always feel fear more than Bitcoin.

Long term:

Plasma is quietly becoming a settlement layer for stablecoins, yield, and DeFi rails. That means:

• More transactions

• More fees

• More builders

• More locked value

And that’s what ultimately supports token value.

Another thing I watch closely is behavior. When incentives were cut, Plasma didn’t collapse. Stablecoin supply stayed high. TVL stayed strong. That tells me users aren’t just here for rewards — they’re here because the network actually works.

Fear shakes out weak hands.

Utility attracts strong ones.

I don’t see Plasma as a “pump token.”

I see it as a financial layer being built for real usage — payments, settlement, lending, yield.

So when the market panics, I zoom out.

If builders keep building, users keep using, and integrations keep coming — the fundamentals keep getting stronger, no matter what the chart looks like today.

That’s why I’m watching Plasma, not the noise.