Bitcoin (BTCUSDT Perpetual) recently faced a sharp pullback amid high volatility in the crypto market. While price fluctuations are common, this move stood out due to the scale and speed of the decline.

Bitcoin (BTCUSDT Perpetual) recently faced a sharp pullback amid high volatility in the crypto market. While price fluctuations are common, this move stood out due to the scale and speed of the decline.

Let’s break down what happened and why this move matters, based on verified market data — not speculation.

🔍 What Happened in the Market?

Bitcoin experienced a sudden downward move after failing to hold key technical support zones

More than $2.5 billion worth of leveraged positions were liquidated across the crypto market

Once BTC broke structure, automated selling accelerated the downside

Altcoins reacted even more aggressively, showing higher percentage losses

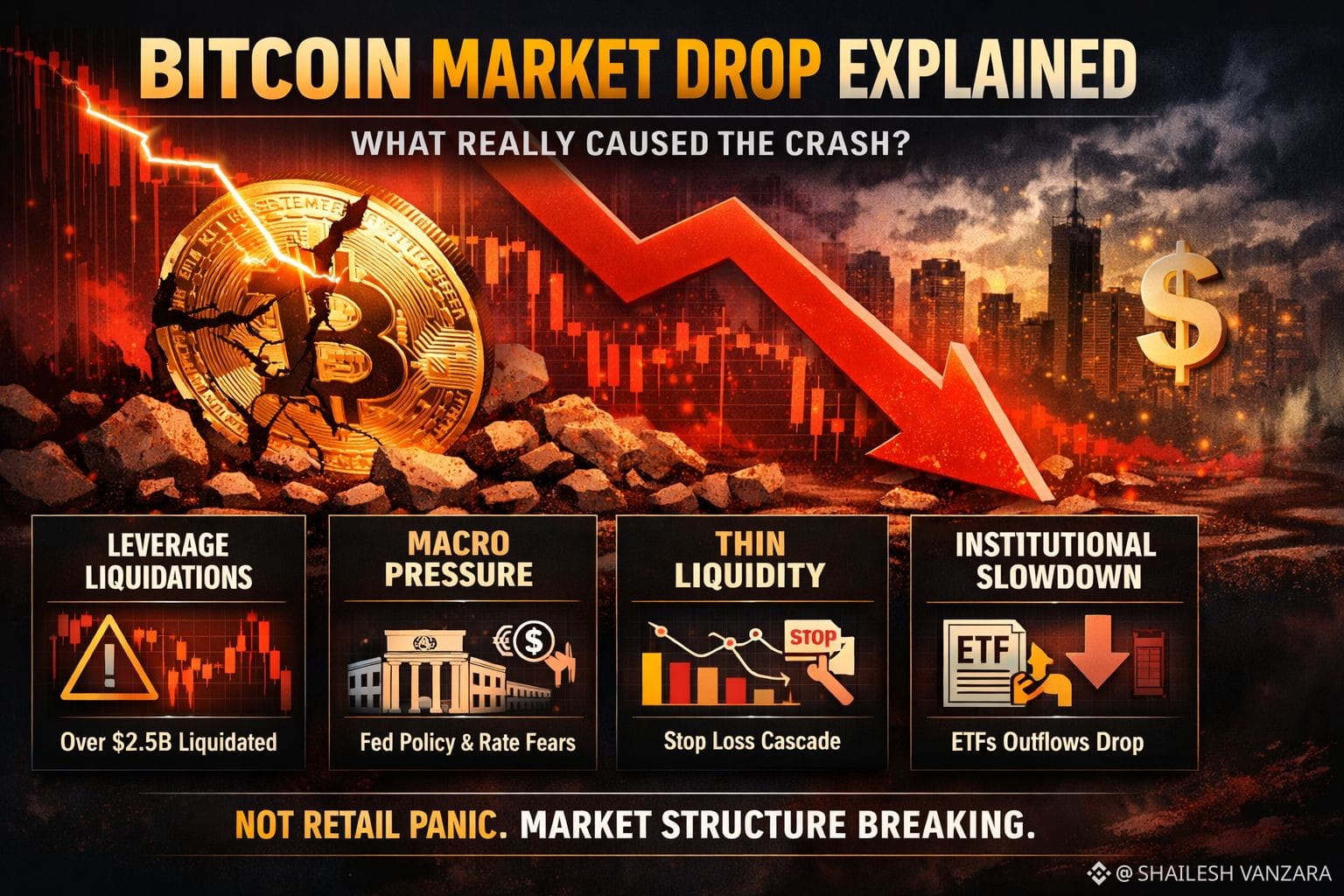

This move was not driven by retail panic, but by market mechanics.

🧨 Key Reasons Behind the Bitcoin Dump

1️⃣ Leverage Flush-Out

The market was heavily over-leveraged on the long side.

As Bitcoin slipped below important levels, forced liquidations kicked in, creating a domino effect that pushed prices lower.

👉 This type of move is common in overheated markets.

2️⃣ Macro-Economic Pressure

Global markets are currently sensitive to:

U.S. Federal Reserve policy expectations

Interest rate uncertainty

Strengthening U.S. dollar

Risk assets like crypto often react first during such macro stress, and Bitcoin was no exception.

3️⃣ Low Liquidity Amplified the Move

During thin liquidity periods:

Even relatively small sell orders can move the market

Stop-losses get triggered rapidly

Price structure breaks faster than usual

This caused a cascade effect, rather than a slow sell-off.

4️⃣ Institutional Caution

Recent data showed reduced momentum in Bitcoin ETF inflows, limiting buy-side strength during the drop.

When institutional participation slows, volatility tends to increase.

🧠 What This Means Going Forward

Bitcoin has now retraced to price levels seen before recent macro and political developments.

Such corrections often:

Reset market positioning

Remove excess leverage

Prepare the market for a healthier next move

Historically, strong volatility phases punish emotional traders, but they often create opportunities for disciplined and prepared participants.

📌 Final Thoughts

This market drop was primarily driven by: ✔ Liquidations

✔ Macro pressure

✔ Market structure breakdown

❌ Not by fear around Bitcoin’s fundamentals.

Bitcoin’s long-term narrative remains unchanged — this move was about market mechanics, not the end of the trend.