I’ve adapted traditional stock market investing rules to the crypto market.

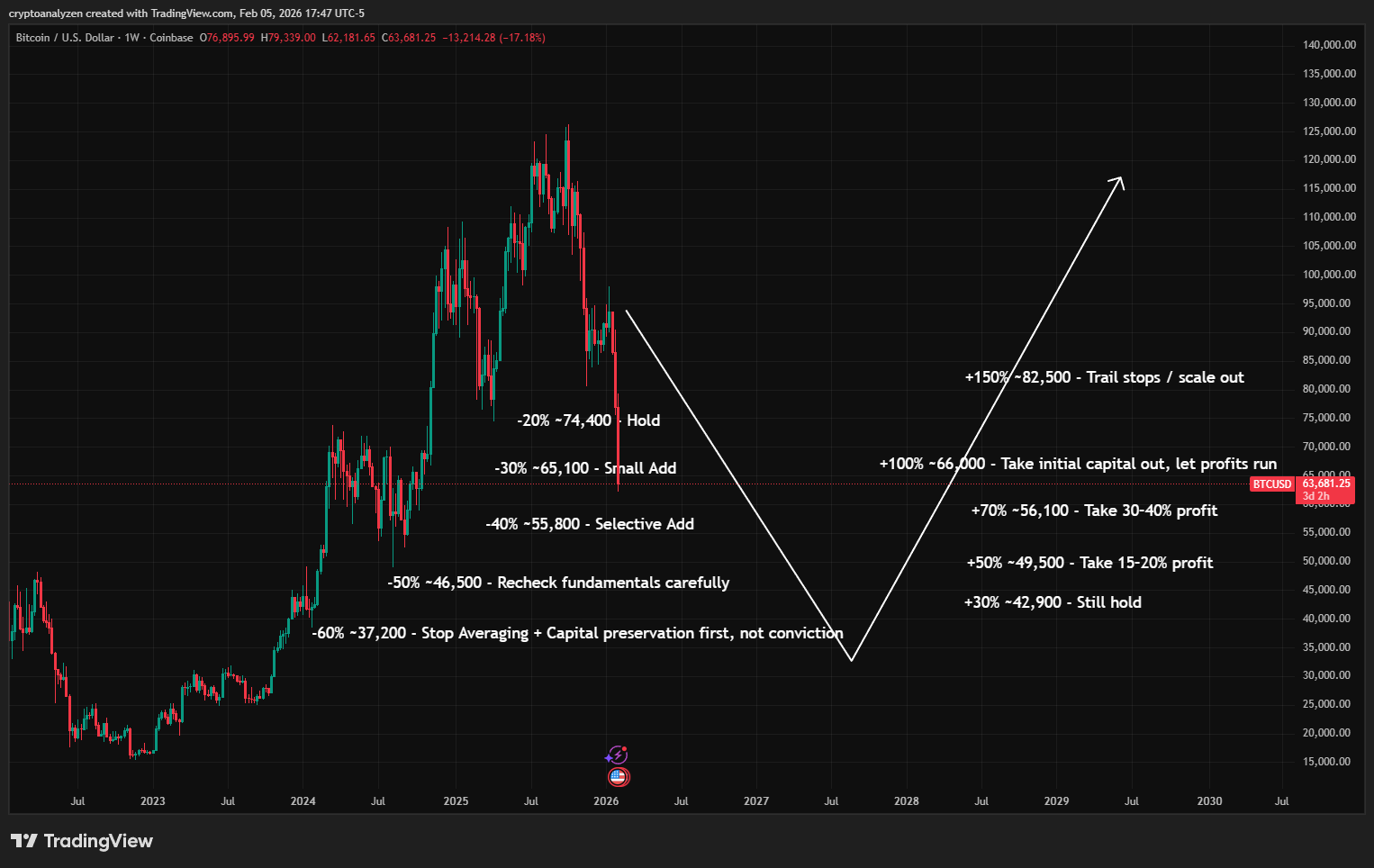

The example scenario shown on the Bitcoin chart is for educational and illustrative purposes only and does not constitute investment advice.

🟢 Spot Crypto (No Leverage)

🔻 When price drops:

If price drops 20% → Just hold

If price drops 30% → Add small size (if thesis is intact)

If price drops 40% → Add selectively

If price drops 50% → Recheck fundamentals carefully

If price drops 60% → Stop averaging unless something materially improved

Example :

BTC: 93K → 63K = ~%32 Drop

🔹 20% drop (≈ around 74K) → Just hold

Don't panic, this is a normal correction for Bitcoin.

🔹 30% drop (≈ around 65K) → Add small size (if thesis is intact)

The 63-65K range falls exactly into this category. In other words:

📊 Let's Clarify the Levels (From the 93K )

Drop % Price Level What to Do

-20% ~74,400 Hold

-30% ~65,100 Small Add (if thesis is intact)

-40% ~55,800 Selective Add

-50% ~46,500 Recheck fundamentals carefully

-60% ~37,200 Stop Averaging + Capital preservation first

🔺 When price goes up:

If price goes up 30% → Still hold

If price goes up 50% → Take 15–20% profit

If price goes up 70% → Take 30–40% profit

If price goes up 100% → Take out initial capital, let profits run

If price goes up 150%+ → Trail stops / scale out

📈 BTC Rebound Scenario (Measurement from 33K Bottom)

Increase % Price Level What to Do

+30% ~42,900 Still hold

+50% ~49,500 Take 15–20% profit

+70% ~56,100 Take 30–40% profit

+100% ~66,000 Take initial capital out, let profits run

+150% ~82,500 Trail stops / scale out

PS: All levels and % of falls and rises, as well as instructions on "what to do" are provided solely as an example to give an idea of how to build a long-term position on the spot