Market downturns strip away comfort and expose reality. During bullish phases, almost every blockchain appears functional. Liquidity flows easily, congestion is tolerated, and weaknesses stay hidden. But when prices fall sharply and fear dominates, infrastructure is no longer theoretical — it is tested live.

In these moments, performance is not measured by hype, but by survival.

Capital Behavior Changes Under Pressure

As volatility increases, user priorities shift rapidly:

Leverage is reduced

Risk exposure is cut

Speculation slows

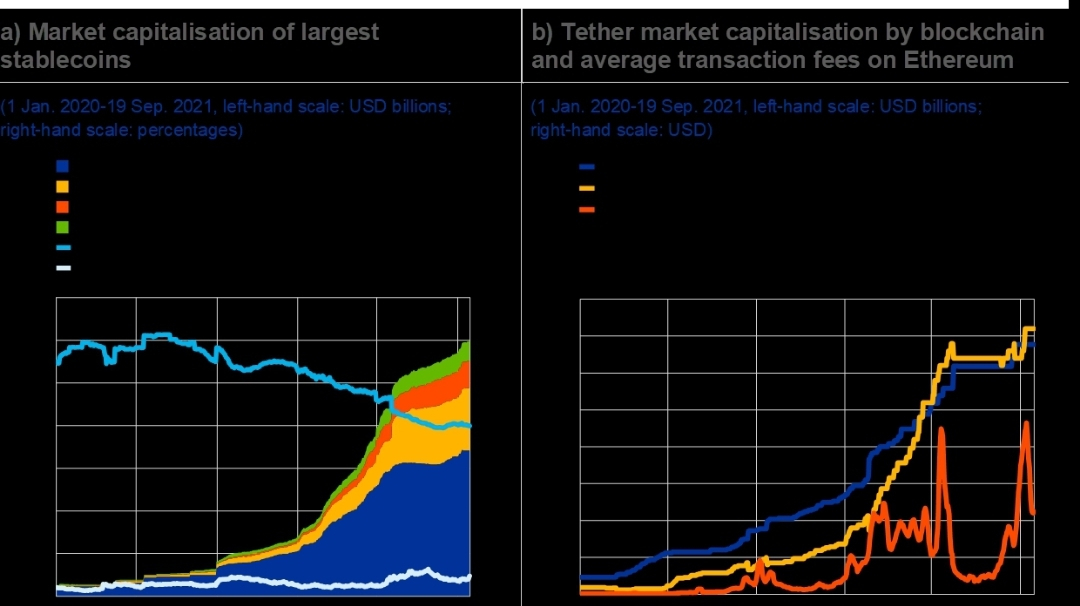

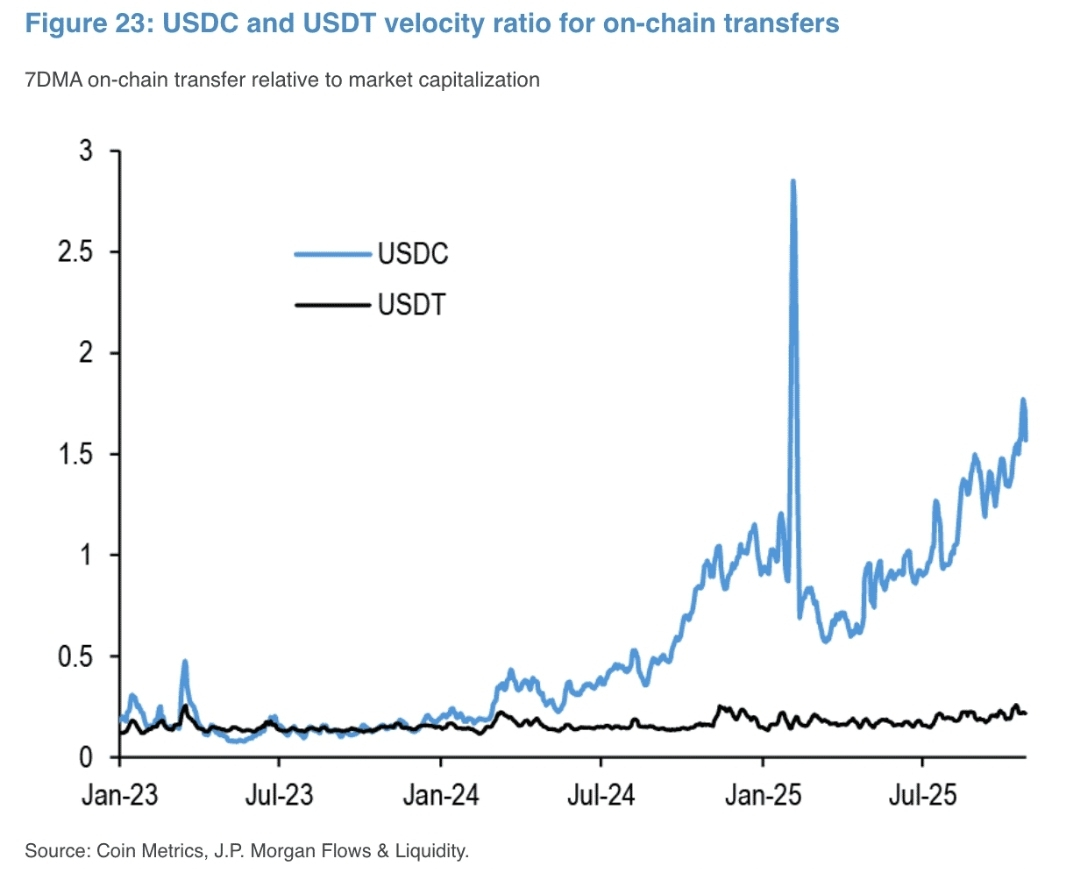

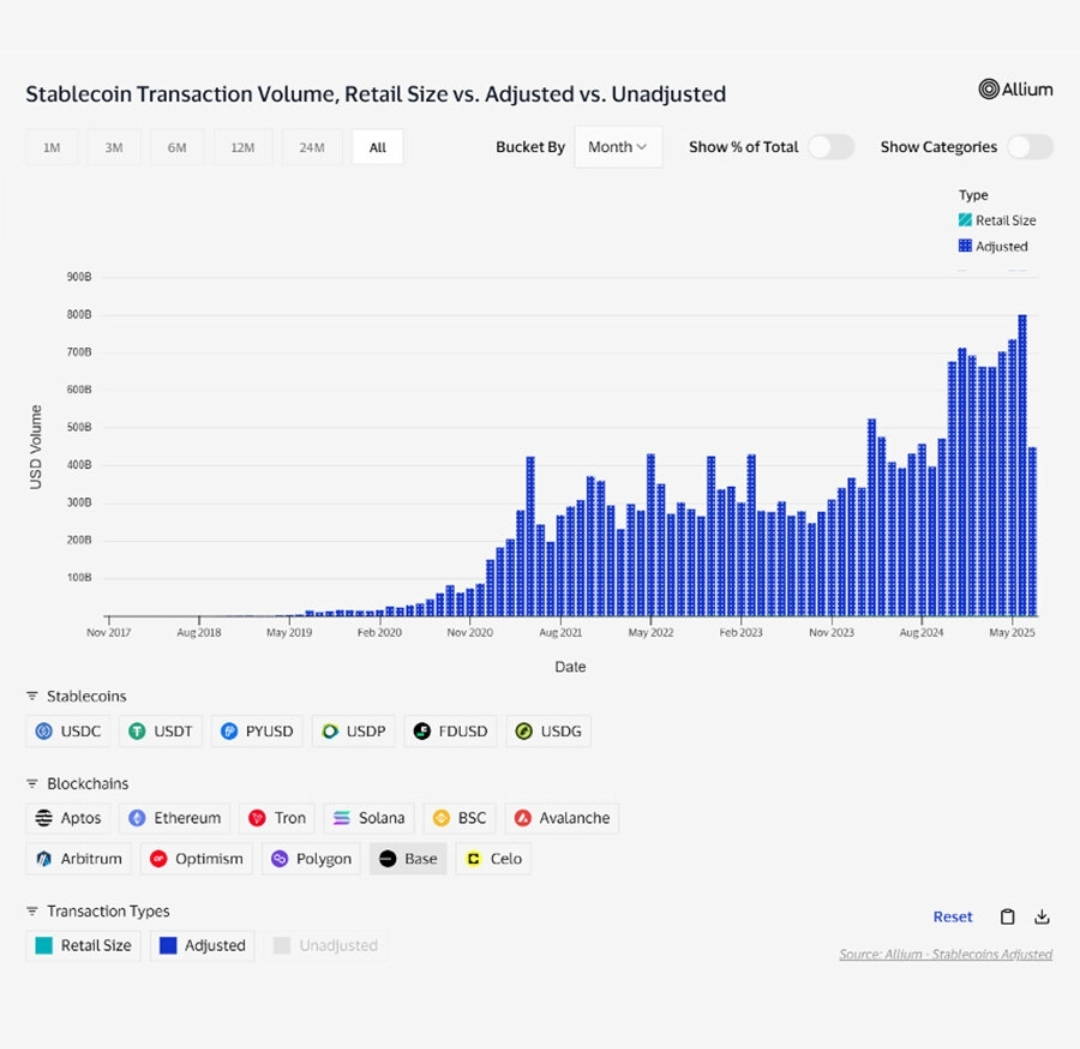

Capital moves into stablecoins

Stablecoins become the primary tool for protection, treasury management, and liquidity movement. This places intense pressure on settlement infrastructure. What once handled optional activity now supports critical financial operations.

The Real Enemy Is Uncertainty, Not Speed

In stressed markets, users are less concerned with shaving milliseconds and far more focused on clarity. Uncertainty creates risk.

Problems emerge when:

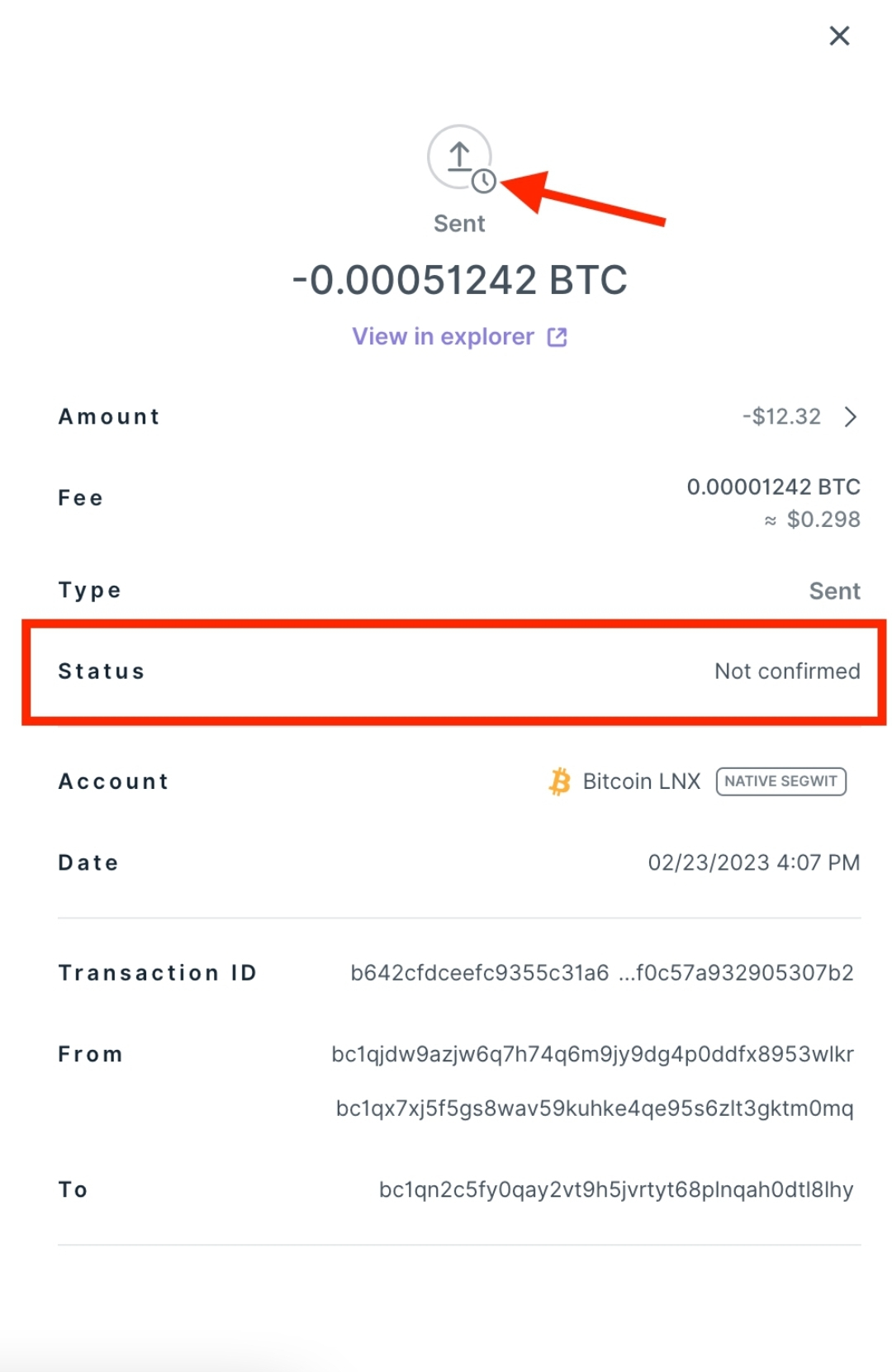

Confirmation times are unclear

Execution order becomes unpredictable

Fees spike without warning

Transactions remain stuck in limbo

Capital locked in uncertainty cannot be hedged, rebalanced, or protected. During downturns, this uncertainty is often more damaging than outright losses.

Why Settlement-Focused Design Matters Most

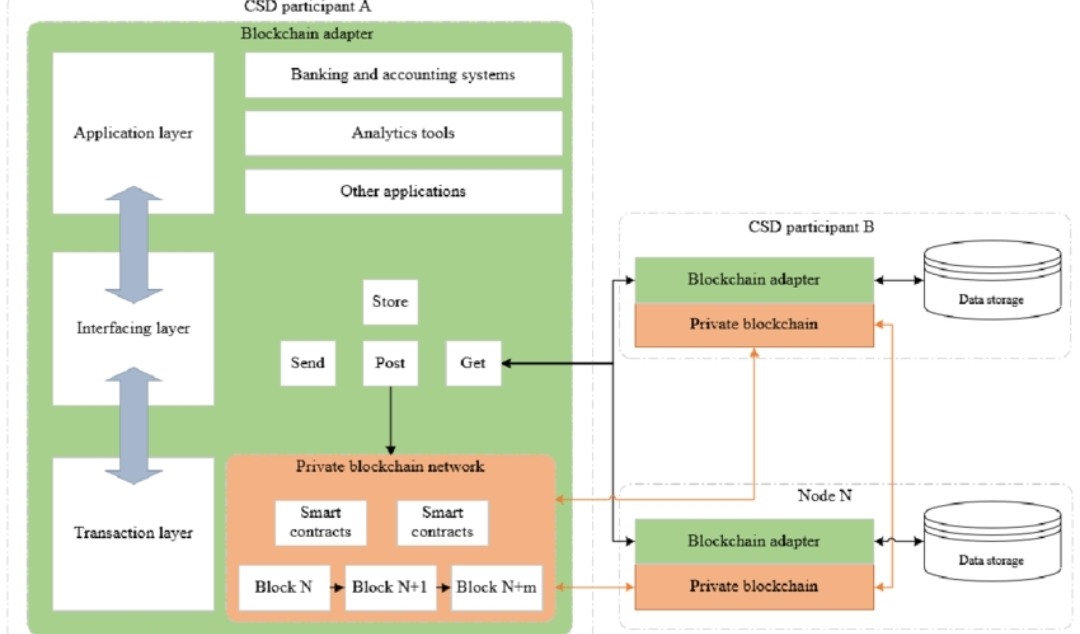

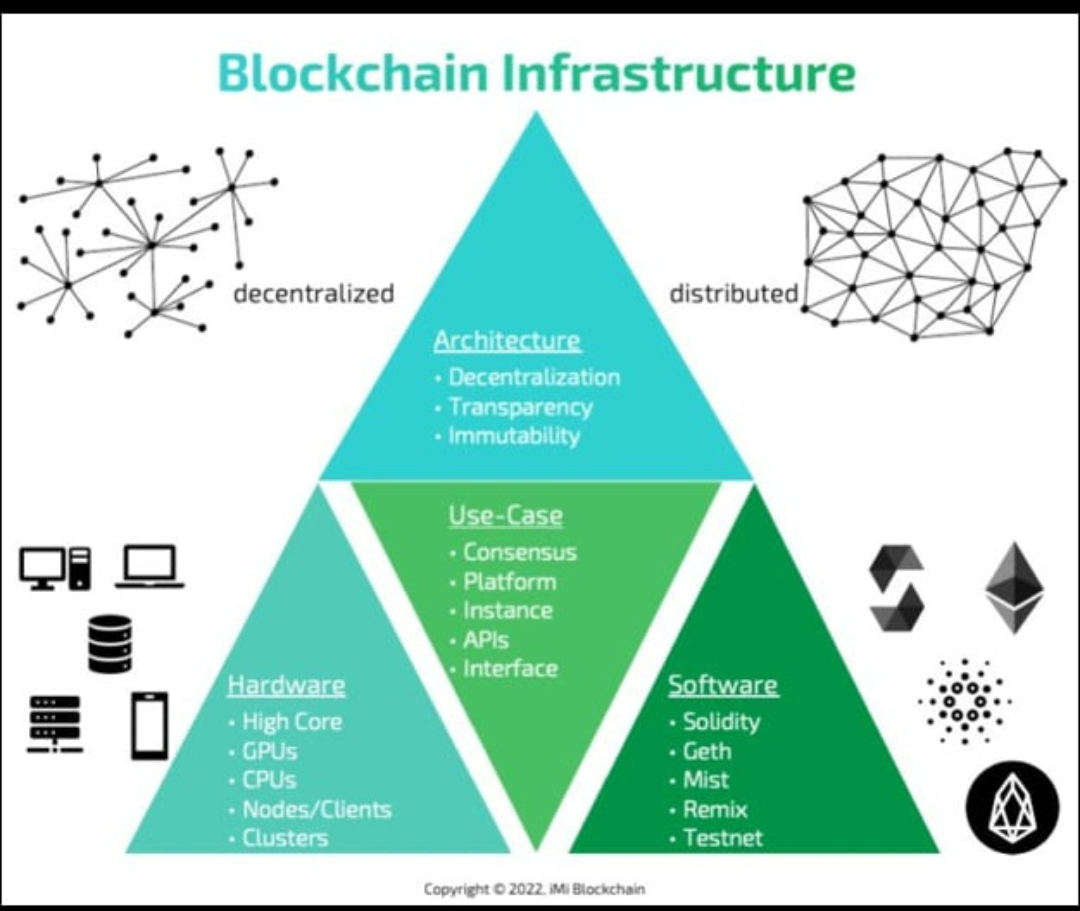

This is where settlement-first infrastructure shows its value. Systems like Plasma are not judged by peak bull-market throughput, but by how they behave when conditions are hostile.

Fast and consistent settlement reduces the time capital remains exposed to execution risk. Predictable behavior allows applications to rely on stable assumptions instead of constantly adapting to network instability.

In volatile environments, reliability is not a feature — it is a requirement.

Execution Consistency Prevents Systemic Errors

When markets move violently, even small delays or ordering inconsistencies can cascade across connected systems:

Accounting mismatches

Failed rebalancing strategies

Liquidity shortfalls

Risk controls breaking down

Predictable execution helps prevent these failures. Settlement consistency allows integrated systems to operate without constantly compensating for unexpected behavior.

Fee Stability Becomes Non-Negotiable

Volatile markets reduce tolerance for surprises. Treasury operations and automated risk systems depend on knowing transaction costs in advance.

Sudden fee spikes force institutions to over-engineer safety buffers or delay action — both dangerous in fast-moving conditions. Settlement-driven architectures help maintain clearer fee expectations, enabling smoother operations when timing matters most.

Security Confidence Is Tested in Downturns

Trust in final settlement is most fragile when sentiment is weak. During contractions, users gravitate toward systems built on conservative, proven security assumptions rather than experimental designs.

For stablecoin-heavy activity, certainty matters more than novelty. Finality must mean finality — especially when capital preservation is the goal.

Infrastructure Over Speculation

Viewed through this lens, XPL looks less like a short-term speculative asset and more like infrastructure tied to real economic behavior. Its relevance is linked to maintaining dependable settlement as capital shifts toward safety.

Bear markets do not eliminate activity — they refine it. Networks optimized for consistency and clarity may see steadier demand than those dependent on high-risk cycles.

When Conditions Are Toughest, Clarity Wins

Market stress reshapes how blockchains are used. Stablecoins increasingly anchor on-chain finance during uncertain times, and settlement reliability becomes the foundation everything else depends on.

Plasma’s design reflects this reality prioritizing clear, predictable, and dependable settlement when markets are at their most unforgiving.