CZ denies Binance ever traded on BitMEX or booked 60,000 BTC in hedge profits during the March 2020 crash, calling the viral allegation “fake news” and technically impossible.

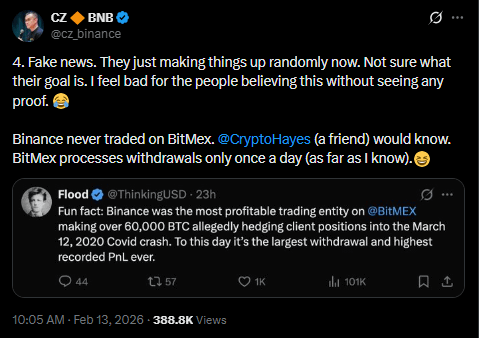

CZ responds to a viral post alleging Binance hedged client flow on BitMEX for over 60,000 BTC in profit during the March 2020 “Covid crash,” dismissing it as fabricated “fake news”.

He stresses that Binance “never traded on BitMex” and points to the exchange’s once‑daily withdrawal schedule at the time as a practical barrier to real‑time hedging of that size.

Commentators and BitMEX itself say there are no records of such flows, framing the debate as another example of rumor‑driven FUD and how old anecdotes morph into conspiracy narratives.

Binance founder Changpeng “CZ” Zhao has moved to quash fresh allegations that the exchange secretly booked more than 60,000 BTC in profits by hedging client risk on BitMEX during the March 2020 crash, dismissing the claim as “fake news” and emblematic of the rumor‑driven warfare that still defines much of crypto trading culture.

CZ pushes back on BitMEX hedge narrative

Responding to a viral post from Flood, CEO of fullstack_trade on Hyperliquid, CZ said the allegation that Binance hedged flow on BitMEX for over 60,000 BTC in profit during the Covid‑era liquidation cascade was entirely fabricated. “4. Fake news. They just making things up randomly now. Not sure what their goal is. I feel bad for the people believing this without seeing any proof,” he wrote, adding bluntly that “Binance never traded on BitMex.” Zhao tagged BitMEX co‑founder Arthur Hayes to underline a key operational constraint at the time, noting that “BitMex processes withdrawals only once a day,” a structure that would have made real‑time risk‑hedging of that magnitude effectively impossible.

Market participants quickly weighed in to deconstruct the 60,000 BTC storyline. “Exactly. BitMEX’s once-a-day withdrawal window back in 2020 made it impossible for an exchange to use it for a real-time hedge of that size,” commentator Murtuza J. Merchant argued, stressing that “no entity would trap 60,000 BTC in a manual multi-sig during a black swan crash.” He suggested the “60k figure is likely just a garbled memory of old” market anecdotes rather than a verifiable trade record. BitMEX itself has since confirmed that it has no records supporting the alleged flows and pointed to its upgrade from once‑daily batched withdrawals to real‑time payouts as part of broader infrastructure changes since 2020.