Chart Overview

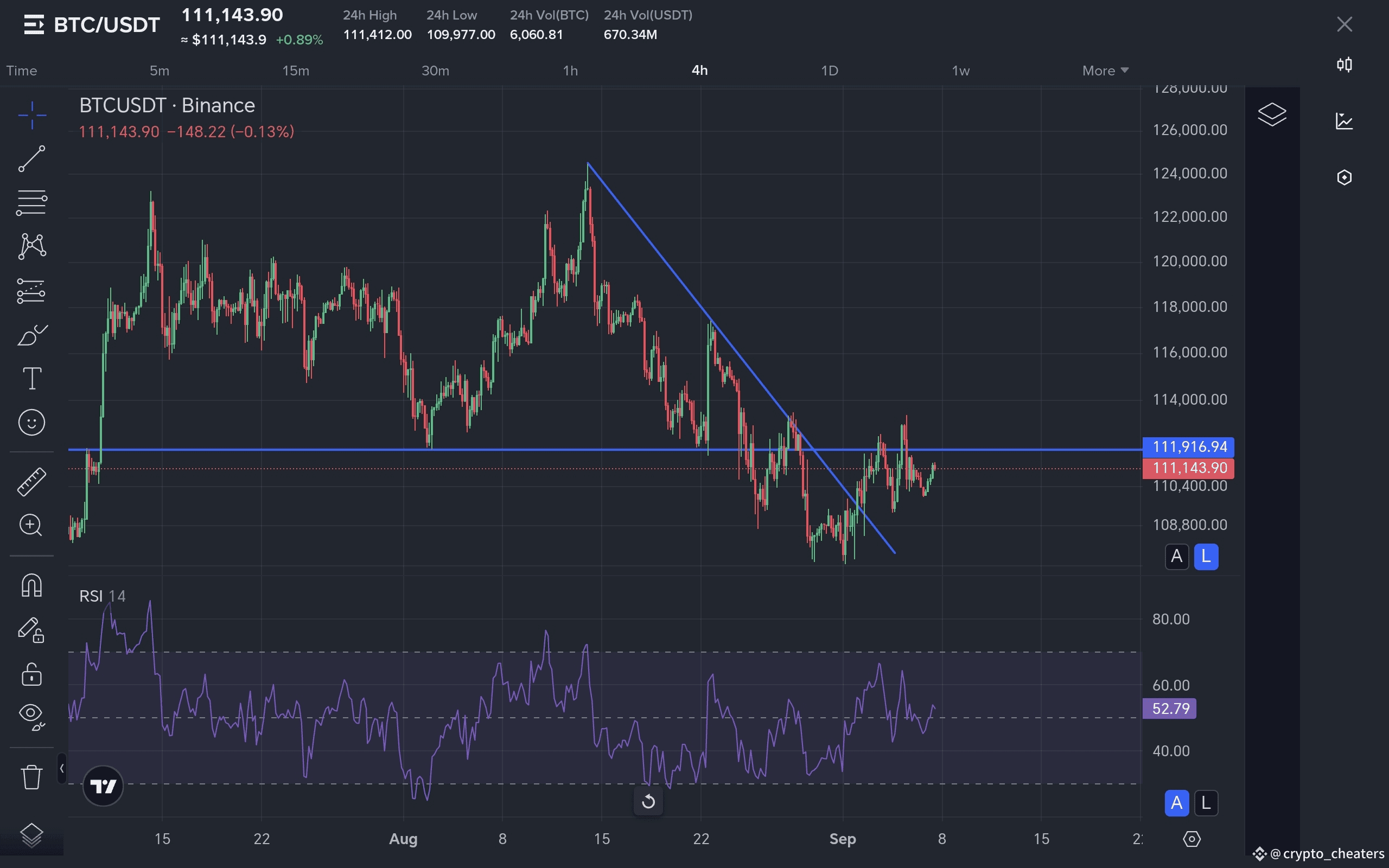

The latest 4-hour BTC/USDT chart shows consolidation near $111,900, which serves as a significant resistance level.

A falling wedge formation is visible—a classic bullish reversal pattern—with price testing the upper trendline near $111,900. If breakout occurs, it could trigger upward movement toward $120K–$127K .

Market Fundamentals & On-Chain Insights

1. Whale Inactivity & RSI Momentum

Whale activity has been muted, and RSI divergence suggests underlying bullish potential if BTC can clear $111,900 resistance .

2. Institutional Accumulation Zone

On-chain data supports DCA into the $111,900–$113,800 range, pointing to institutional accumulation around this level .

3. Illiquid Supply Rising

Long-term holders now control a record 14.3 million BTC, indicating sustained accumulation despite recent volatility .

4. Key Support & Resistance Ranges

Immediate support sits between $110K–$112K, with resistance zones ahead at $115K–$117K, and a breakout above $124K–$124.5K could validate bullish continuation .

Headline News Highlights

Whales Selling, Institutions Accumulating: Recent whale selling has pushed reserves to multi-year lows, yet institutional and government buying persists, reinforcing Bitcoin’s demand at current levels .

Scams on the Rise: As Bitcoin draws renewed attention, crypto-related scams—especially phishing and fake investment schemes—are also increasing. Traders must stay vigilant with security practices .

Your Commentary Expanded into Finance Square Style

> *“My view: BTC will likely oscillate within a tight range until it decisively breaks above $111,900. A confirmed breakout must be accompanied by the close of at least one full candle above this level to indicate sustainable upward movement.

If you have a different perspective, please share it here—learning from diverse views helps the community monitor the market more effectively.

I also invite comments and corrections from experienced traders and analysts to refine this analysis for everyone’s benefit.”*

Summary: What to Watch Next

Scenario What to Watch For Target Level

Bullish Breakout Price closes above $111.9K on the 4H chart with momentum $120K–$127K

Range Bound Stays between $110K–$112K, lacking breakout and volume $110K support area

Bearish Rejection Rejection under $110K could trigger deeper pullback and test lower support zone Below $107K

Final Note

Your analysis lays a strong foundation. Confirming a breakout with a clear candle close above $111,900—and accompanied by volume or RSI strength—would increase the validity of a bullish scenario. Meanwhile, rising illiquid supply and institutional accumulation support a resilient foundation.

Let’s open the floor for others—your view could help sharpen this outlook for the whole community.

#MarketPullback #BinanceHODLerOPEN #USNonFarmPayrollReport #RedSeptember

Follow me for latest update and comment if you want I post for you just comment coin name I can analyze and give you analyze plus trade setup