Here’s the current situation (as of Dec 2025) for Bitcoin miners and their profitability — based on real on-chain & market data and industry reports:

📊 Current Bitcoin Market Snapshot

BTC ~ $90 k — price movements directly influence miners’ USD revenue (block rewards * BTC price). Higher price = higher revenue; lower price = tighter margins.

🔥 Miner Profitability & Puell Multiple

Puell Mu ltiple Status

ltiple Status

Recent data indicates:

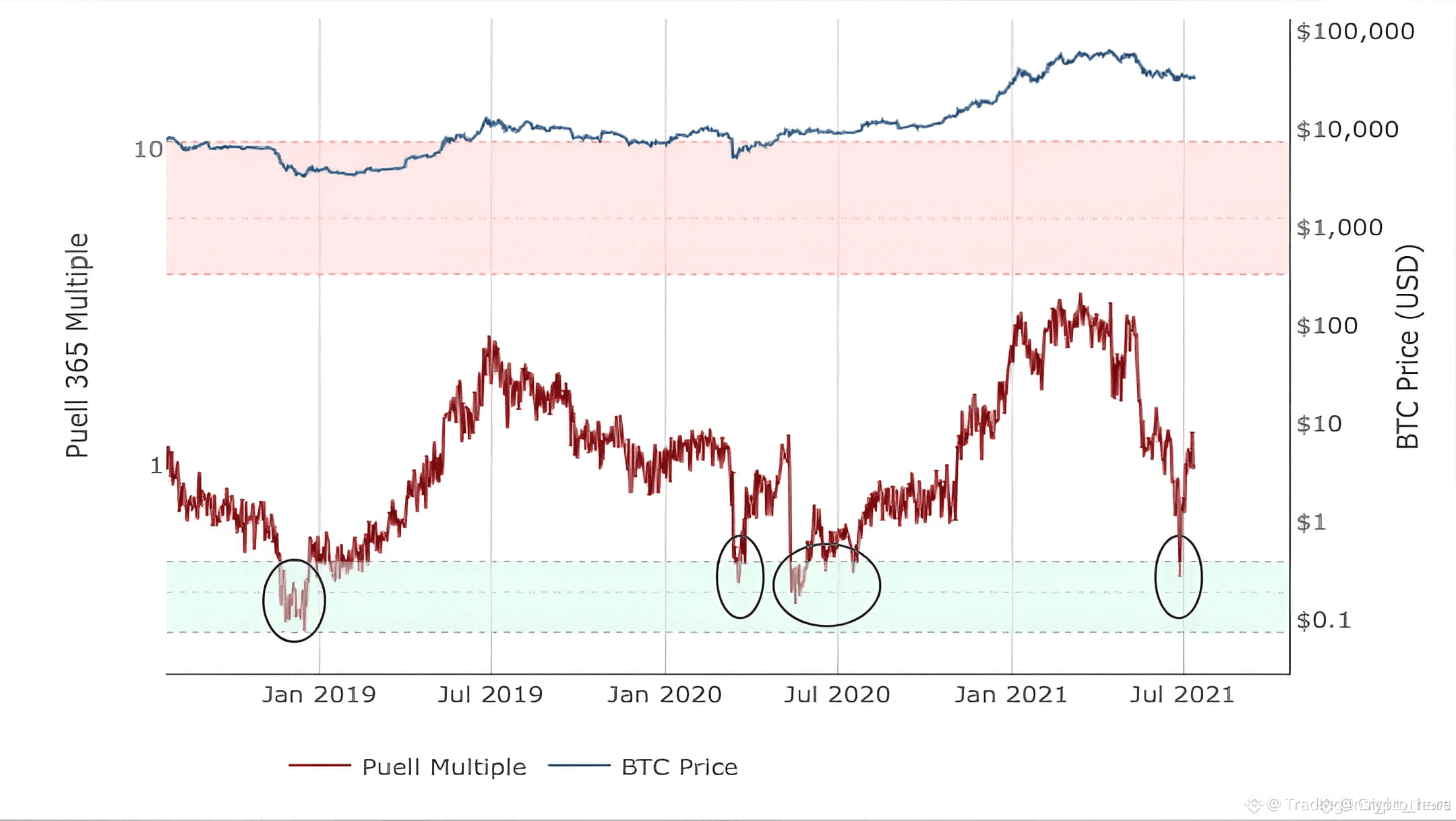

The Puell Multiple has dropped to ~0.67, which is below average miner revenue, but above the deep capitulation zone (0.50).

Interpretation

< 1 → Miners’ daily revenue is below their 365-day average → selling pressure tends to ease.

> 4 → historically signals overheating and miner profit frenzies (not the case now).

🎯 Conclusion: Miner revenue is not currently at extreme highs — miners aren't earning huge windfall profits compared to the last year.

🧩 Profitability in USD Terms

What Reports are Showing

Mining remains generally profitable for efficient, large miners with low electricity costs and modern ASIC hardware — but margins are compressed.

Some data show miner gross profit margin still positive (e.g., ~12–30%) for efficient operations.

Older rigs and miners with higher energy costs are struggling more and may run near breakeven or loss.

Factors Pressuring Profits

✔ higher network difficulty (more competition)

✔ halved block reward (from 6.25 to 3.125 BTC)

✔ rising electricity costs in key regions

✔ compressed hashprice (revenue per unit of hash power)

All these make mining challenging but still viable for the most efficient operators.

⚡ Why Some Miners Are Shifting Strategy

Industry news shows:

Some major miners are pivoting part of their capacity to AI & data center work because mining profits are less predictable and energy competition is high.

This doesn’t mean all miners are unprofitable — but it highlights pressure on margins and a search for higher-return workloads.

📌 Quick Summary

IndicatorCurrent StatusWhat it SuggestsPuell Multiple~0.67Revenue below yearly avg → reduced miner selling pressure Miner ProfitsModerate but compressedMany efficient miners still profitable; old/expensive ones struggle Energy CostsStill a major cost factorCan make break-even harder for some miners Industry TrendSome pivoting to AI/data centersRevenue diversification due to mining profitability pressure

🧠 What This Means for Miner Selling Pressure

✔ Puell Multiple below 1 suggests less structural selling pressure from miners relative to last year.

✔ Miner profits aren’t so high that they’re dumping for maximal revenue like during market tops.

✔ Miners with high costs may still need to sell BTC to cover expenses, but overall stress on the network is not extreme capitulation yet.

If you want, I can also show a historical Puell Multiple chart to compare current levels with past miner bottoms and tops — useful for seeing where miner revenue stands in context.