BTC and BNB Price Correlation: Same Strategy or Mutual Market Support?

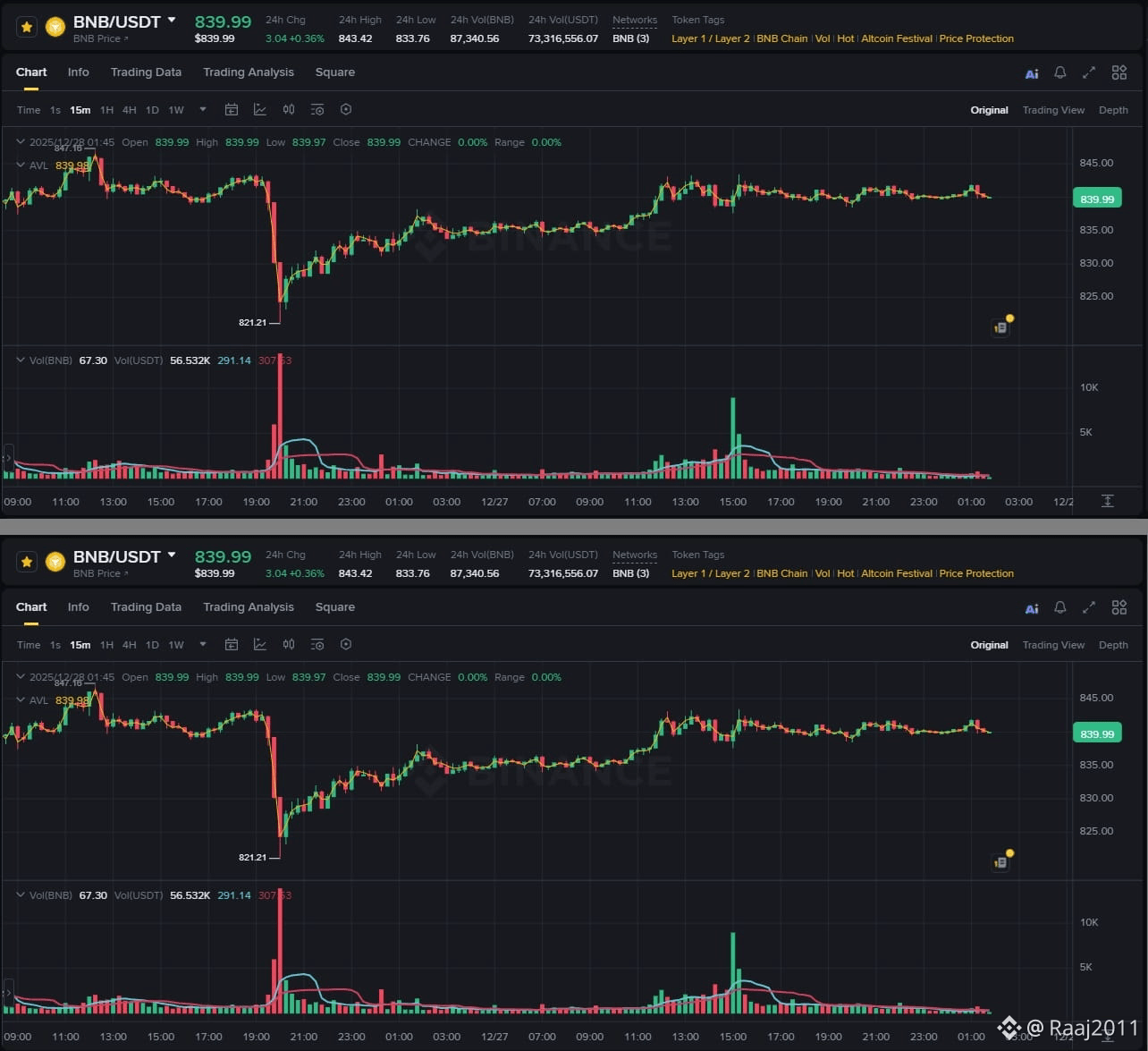

Recent price movements in the crypto market have led investors to question whether Bitcoin (BTC) and BNB are following the same strategic path or simply supporting each other through natural market dynamics. While both assets often move in alignment during key phases, the reasons behind this behavior are more complex than a single explanation.

Market Leadership vs. Ecosystem Strength

BTC remains the primary market driver, influencing overall sentiment, liquidity flow, and risk appetite. When Bitcoin stabilizes or trends upward, it typically reduces market uncertainty, allowing capital to flow into high-confidence altcoins. BNB, backed by the Binance ecosystem and BNB Chain utility, is often among the first beneficiaries of this renewed confidence.

This does not necessarily indicate a shared strategy, but rather a hierarchical market relationship—BTC leads sentiment, while BNB responds through ecosystem-driven demand.

Correlation Does Not Equal Coordination

Price correlation between BTC and BNB can be explained by several structural factors:

Shared exposure to macroeconomic conditions

Overlapping investor bases

Algorithmic and index-based trading strategies

Liquidity rotation between large-cap crypto assets

These factors can create synchronized price behavior without any deliberate coordination or mutual support mechanism.

Is There Mutual Support?

In a broader sense, yes—but indirectly. BTC provides market stability and trust, while BNB reinforces confidence through consistent utility, token burns, and on-chain activity. This creates a feedback loop where strong BTC performance improves sentiment, and BNB’s fundamentals help sustain capital engagement within the ecosystem.

However, this “support” is structural, not strategic. There is no clear evidence that BTC and BNB are actively supporting each other through a unified market strategy.

Strategic Positioning by Market Participants

Large investors often prioritize assets with:

High liquidity

Strong fundamentals

Established infrastructure

BTC and BNB both meet these criteria, making them natural choices during periods of consolidation or cautious optimism. This selective positioning can amplify the appearance of strategic alignment.

Conclusion

The observed correlation between BTC and BNB is more accurately described as market-driven alignment rather than a shared strategy. BTC sets the tone, while BNB reflects ecosystem confidence and utility-based demand. Together, they illustrate how leadership assets and utility-driven tokens can move in sync without direct coordination.

Understanding this distinction helps investors avoid overinterpreting correlation and focus instead on fundamentals, market structure, and long-term trends.

#BTC #bnb #WriteToEarnUpgrade #USBitcoinReservesSurge #USJobsData