Silver is not just another commodity.

It is history compressed into a price chart.

It looks like gold, trades like a leveraged asset, reacts like a speculative stock, and collapses like a futures contract.

Among all commodities, silver is the most emotionally dangerous asset ever traded.

And history is brutally clear about one thing:

Every true silver bull market has ended in disaster.

Not correction.

Not consolidation.

Disaster.

Let’s strip away the myths, the narratives, and the hope—and look at what silver actually does when it captures the world’s imagination.

Silver: The Most Contradictory Asset in Finance

Silver lives in a permanent identity crisis:

It is money, yet no longer trusted as money

It is industrial, yet priced emotionally

It is scarce, yet not scarce enough

It is cheap, yet violently volatile

Gold rises on trust erosion.

Copper rises on growth.

Silver rises on belief—and collapses when belief runs out.

That is why silver bull markets don’t fade.

They implode.

The First Silver Bull Market (1970s–1980): When Speculation Challenged the System

Backdrop:

Collapse of Bretton Woods

The U.S. dollar detached from gold

Explosive global inflation

Widespread fear of fiat currency

The world wanted hard assets.

Silver became the weapon.

Price action:

Silver surged from under $2 to nearly $50 per ounce—

a 20x move in less than a decade.

The Catalyst: The Hunt Brothers

The Hunt brothers believed they could do the unthinkable:

corner the global silver market.

They bought:

Physical silver

Futures contracts

Massive leveraged exposure

Silver became more than a metal.

It became a symbol of anti-dollar rebellion.

How It Ended

The financial system does not tolerate rebellion.

Exchanges changed the rules

Margin requirements exploded

Liquidity vanished overnight

March 27, 1980:

Silver collapsed over 50% in a single day.

Investors were wiped out.

The Hunt brothers went from billionaires to debt prisoners.

Core lesson:

When speculation challenges financial rules, the rules always win.

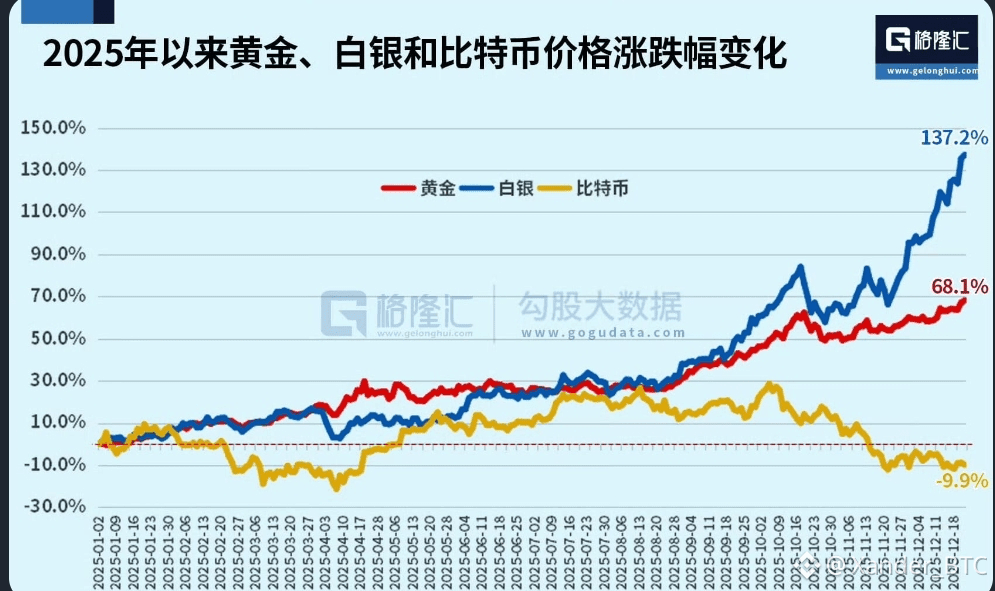

The Second Silver Bull Market (2008–2011): When Retail Euphoria Took Control

This time, the story sounded smarter.

More logical.

More “inevitable.”

Backdrop:

Global financial crisis

Central banks printing trillions

Zero interest rates

A global consensus: “Currencies will collapse”

Silver rose again—from $9 to nearly $50.

But this bull market had a new label:

“Gold for the poor”

“Leveraged gold”

“The ultimate inflation hedge”

Retail investors flooded in.

Leveraged funds piled on.

Narratives replaced analysis.

The Fatal Flaw

Silver’s market is too small.

Thin liquidity

Limited industrial demand

No structural long-term capital support

When emotions drive price in a shallow market, the exit disappears instantly.

The Collapse

After peaking in 2011:

Silver halved in months

Then entered a decade-long decline

Those who believed in “long-term silver optimism” weren’t defeated by volatility.

They were buried by time.

Core lesson:

When emotions consume all future expectations, price has nowhere to go but down.

The Dangerous Similarities Between Both Silver Bull Markets

Across 40 years, nothing changed—except the faces.

Both bull markets shared the same DNA:

1️⃣ Extreme distrust in currency

2️⃣ Excessive leverage

3️⃣ Narrative-driven buying, not demand-driven

4️⃣ Retail participation peaking at the top

And here lies silver’s cruelty:

When silver rises, it behaves like a stock.

When it falls, it behaves like a futures contract.

Over time, it behaves like a rock.

Why Silver Almost Never Has a “Happy Ending”

The reason is structural, not emotional.

Silver is:

Too small in market size

Too volatile in elasticity

Too emotional in participation

It can be pushed to extremes easily.

But it cannot stay there.

Silver bull markets:

Rise violently

Collapse faster

Leave behind stories—not wealth

The Real Danger Is Not Silver—It’s the Bull Market Illusion

Every silver rally revives the same phrases:

“This time is different”

“Silver is severely undervalued”

“It will reclaim historical highs”

But history doesn’t repeat prices.

It repeats human behavior.

When silver becomes the center of attention again, ask yourself honestly:

Am I early in a trend—

or am I arriving just in time to become part of the lesson?

Final Words

Silver has never lacked bull markets.

What it lacks is survivors.

Understanding silver’s history isn’t about fear.

It’s about refusing to become the next name in a cautionary tale.

Because in silver:

Emotion creates wealth for a few

Time destroys it for the many

And history has never shown mercy to those who forget that.