Hey crypto traders! As we wrap up 2025, Chainlink (LINK) – the undisputed king of decentralized oracles – is trading in a deep consolidation zone amid the broader market correction. With Bitcoin hovering in the mid-$80K range and extreme fear dominating sentiment, LINK presents a classic "buy the dip" setup for those eyeing the 2026 bull extension.

Powered by real-world adoption in RWA tokenization, DeFi, and institutional finance, Chainlink remains fundamentally rock-solid. Recent highlights include the launch of the Chainlink Reserve (accumulating LINK from enterprise revenue), Grayscale's LINK ETF (GLNK), and key partnerships like Coinbase selecting CCIP for $7B+ wrapped assets bridging, plus integrations with Swift, Tradeweb, and FTSE Russell.

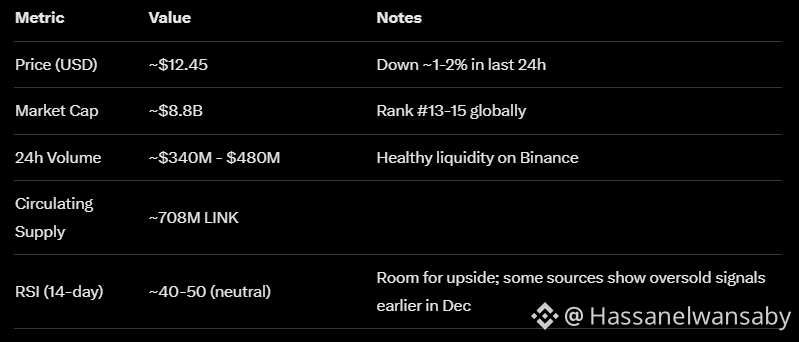

Current Market Snapshot (Dec 30, 2025))📊

Data aggregated from CoinMarketCap, CoinGecko, and TradingView.

Technical Analysis

LINK is consolidating in a $12–$14 range after rejecting resistance around $14.50 earlier in December. Key indicators:

RSI (14): Neutral around 40-50, with room to climb before overbought (>70). Recent dips approached oversold (<30), signaling potential rebound.

MACD: Showing early bullish divergence in some charts (histogram positive or narrowing bearish gap), hinting at momentum shift.

Bollinger Bands: Trading near the middle/lower band ($12–$13 support). A breakout above the upper band ($14–$15) could trigger rapid upside.

Support Levels: Strong demand zone at $12–$12.50; major yearly support ~$11–$12.

Resistance Levels: Immediate $13.50–$14.50; breakout targets $16–$18.

Overall trend: Bearish short-term (lower highs), but oversold conditions and whale accumulation suggest a reversal if BTC stabilizes.

Fundamentals & Recent Updates🏛

Chainlink dominates oracles with ~68% market share in secured value. 2025 was huge:

Chainlink Reserve: Accumulating LINK from enterprise/off-chain revenue for network sustainability.

Institutional Wins: Coinbase CCIP exclusive for wrapped assets; integrations with BlackRock (BUIDL), UBS, DTCC, and Tradeweb for on-chain Treasury data.

Product Launches: Chainlink Runtime Environment (CRE) for tokenized workflows; ongoing CCIP expansions.

Adoption Metrics: Powers trillions in TVL across DeFi/RWA; high GitHub activity ranks #1 in developer engagement.

These tie LINK demand directly to real-world growth – tokenized assets alone target $280T+ market.

Price Prediction for 2026📈

Analysts are mixed but lean bullish long-term:

hort-term (Q1 2026): $14–$18 if breakout occurs.

Mid-2026: $20–$30 common target (CoinCodex, Mudrex).

Optimistic: $40–$55+ on full RWA/institutional boom (some historical patterns suggest 3-5x from lows).

Conservative: $15–$25 if market remains choppy.

Risks: Broader crypto downturn or delayed adoption could keep LINK range-bound.

Trading Recommendation (Swing Trade on Binance🎯

Entry: $12.20–$12.80 (current demand zone + SMA support).

Targets: TP1 $14.50 (+18%), TP2 $18 (+45%), TP3 $25 (+100%+).

Stop Loss: $11.50 (10% below key support).

Leverage: 3x-5x on Futures for experienced traders.

Risk Management: 1-2% portfolio allocation; use trailing stop after TP1.

Scenarios: Best (BTC rally + CCIP news): 100%+ upside. Worst (deeper correction): -15-20% to $10.

Chainlink is undervalued relative to its utility – perfect for patient holders eyeing the 🚀next leg up in 2026!

Follow this account for more free premium recommendations, daily market updates, 🔔and pro trading signals. Don't miss the next big moves—hit that follow button now!

#Chainlink #LINK #CryptoGem #Altcoin #RWA赛道