🔹 Low-liquidity time = very few buyers & sellers

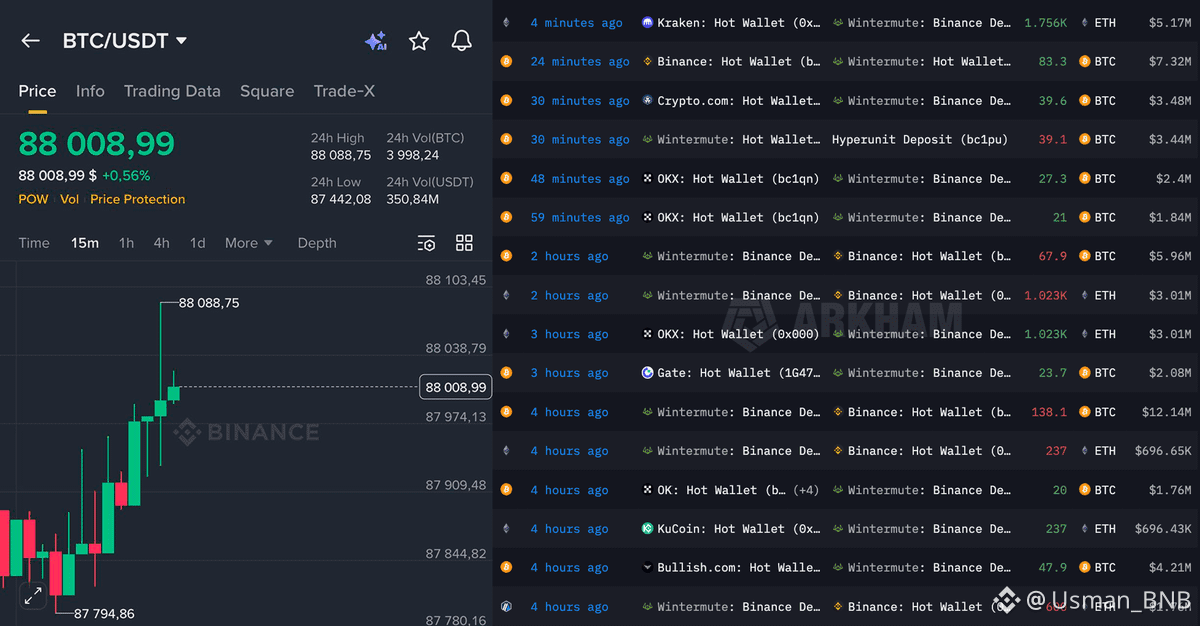

🔹 Big players place large buy orders in BTC & ETH

🔹 With little resistance, price jumps sharply

🔹 Short traders are using leverage

🔹 When price moves up, their losses increase fast

🔹 Exchanges force-close (liquidate) those shorts

🔹 Forced closures become market buy orders

🔹 This creates a chain reaction, pushing price higher

That’s how $50M+ shorts were liquidated in minutes.

⚠️ Is it manipulation?

It’s exploiting market structure. Big money knows where leverage is stacked and uses thin liquidity to trigger liquidations$BTC

BTCUSDT

Perpetuu

87,788.6

-0.58%

ETHUSDT

Perpetuu

2,979.4

+0.17%