According to Alla Bakina, Director of the Central Bank’s National Payment System Department, the upcoming implementation of the digital Ruble presents opportunities in the payments arena. The bank estimates that it could reach 5% of the total payments in 7 years.

Central Bank Of Russia Talks Ruble Potential In Form Payments And Cross-Border Settlements

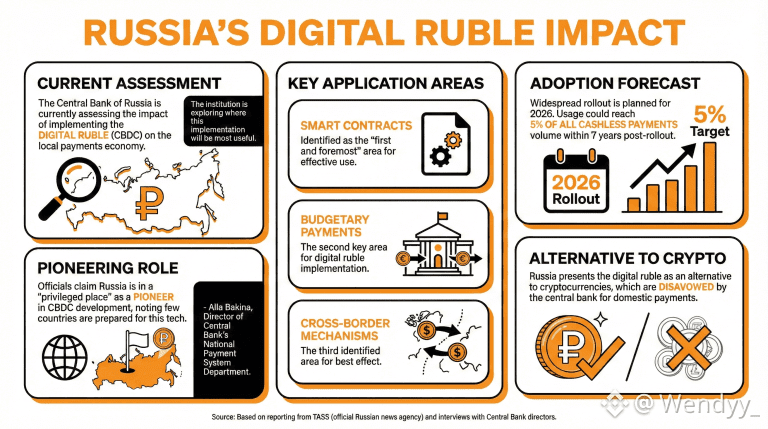

The Central Bank of Russia is already assessing the impact that implementing the digital ruble, the Russian central bank’s digital currency ( CBDC), will have on the local payments economy.

Alla Bakina, Director of the Central Bank’s National Payment System Department, remarked that the institution was exploring how this implementation would be most useful.

In an interview with TASS, the official Russian news agency, Bakina remarked that Russia was in a privileged place as there were “very few countries in the world” prepared to work with CBDCs, highlighting the country’s pioneering role in this kind of development.

He stated:

We are identifying and discovering areas where the capabilities of the digital ruble can be used to best effect. First and foremost, this is smart contracts. The second area is budgetary payments, and the third is cross-border mechanisms.

The bank estimates that the digital ruble usage can reach up to 5% of the volume of all cashless payments in the next 7 years after its widespread rollout in 2026. Russia presented the digital ruble as an alternative to cryptocurrencies, which have been disavowed by the central bank as domestic payment tools.

Russia is one of the few large economies on the route to issuing a large-scale CBDC. China is another nation that has embarked on a similar initiative with mixed results, while the European Union is still working on a pilot program for a digital euro. The U.S. government has rejected the issuance of a digital dollar and has supported stablecoins as tools to extend the hegemony of the U.S. currency.