If you’re trading futures or options, understanding Open Interest (OI) can be a game-changer. It’s one of the most underused indicators — yet it can tell you who’s really in the market, how strong trends are, and when reversals may happen.

📊 What Is Open Interest?

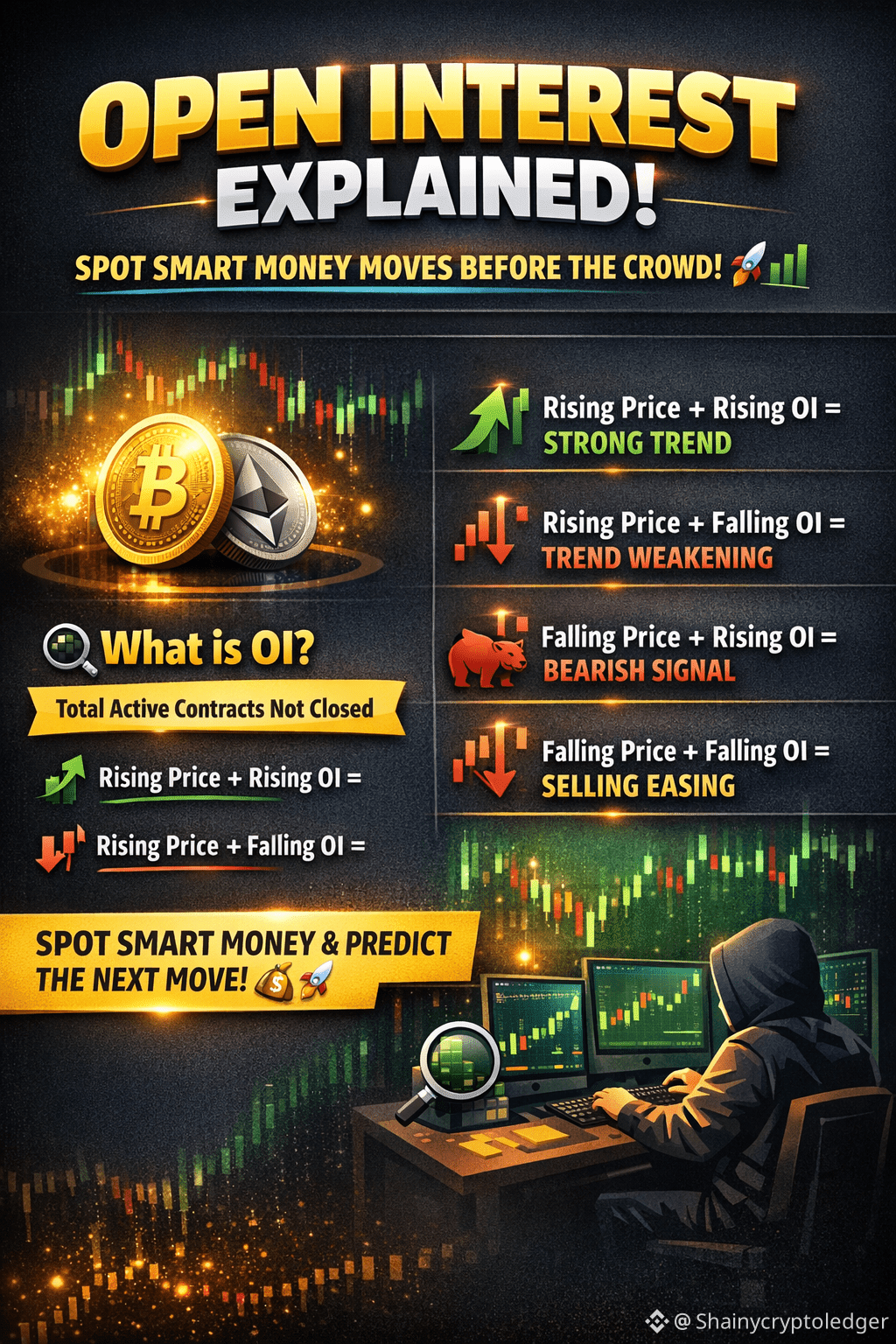

Open Interest is the total number of active contracts (futures or options) that haven’t been settled or closed.

When you buy or sell a new contract, OI increases.

When a contract is closed, expired, or exercised, OI decreases.

Unlike volume, which shows activity in a day, OI shows total exposure in the market. It helps you see whether money is flowing in or out.

🔑 Why Traders Care About Open Interest

Trend Confirmation

Rising price + rising OI = strong bullish trend

Falling price + rising OI = strong bearish trend

Potential Reversals

Rising price + declining OI = trend may weaken

Falling price + declining OI = selling pressure is easing

Liquidity & Volatility Insight

Higher OI = more contracts, more liquidity

More liquidity = easier entries/exits, lower slippage

Understanding Market Sentiment

If OI is concentrated on calls, traders may expect upward movement

If OI is concentrated on puts, traders may expect downward movement

⚡ How To Use Open Interest in Crypto Trading

Spot momentum plays: Rising OI + rising price in Bitcoin or altcoins often signals strong continuation.

Options trading: Check whether calls or puts dominate OI to gauge market bias.

Futures scalping: Watch sudden OI spikes — they can indicate whale positioning or large hedge activity.

💡 Final Take

Open Interest isn’t just a number — it’s a window into market structure.

Traders who ignore it are missing insider signals about trend strength, liquidity, and potential reversals.

Combine OI with volume, price action, and technical analysis, and you’ll get a much clearer picture of the market — whether you’re trading #bitcoin , #Ethereum , or #altcoins .

Pro Tip: Use OI to spot smart money moves early and position ahead of the crowd. 🚀