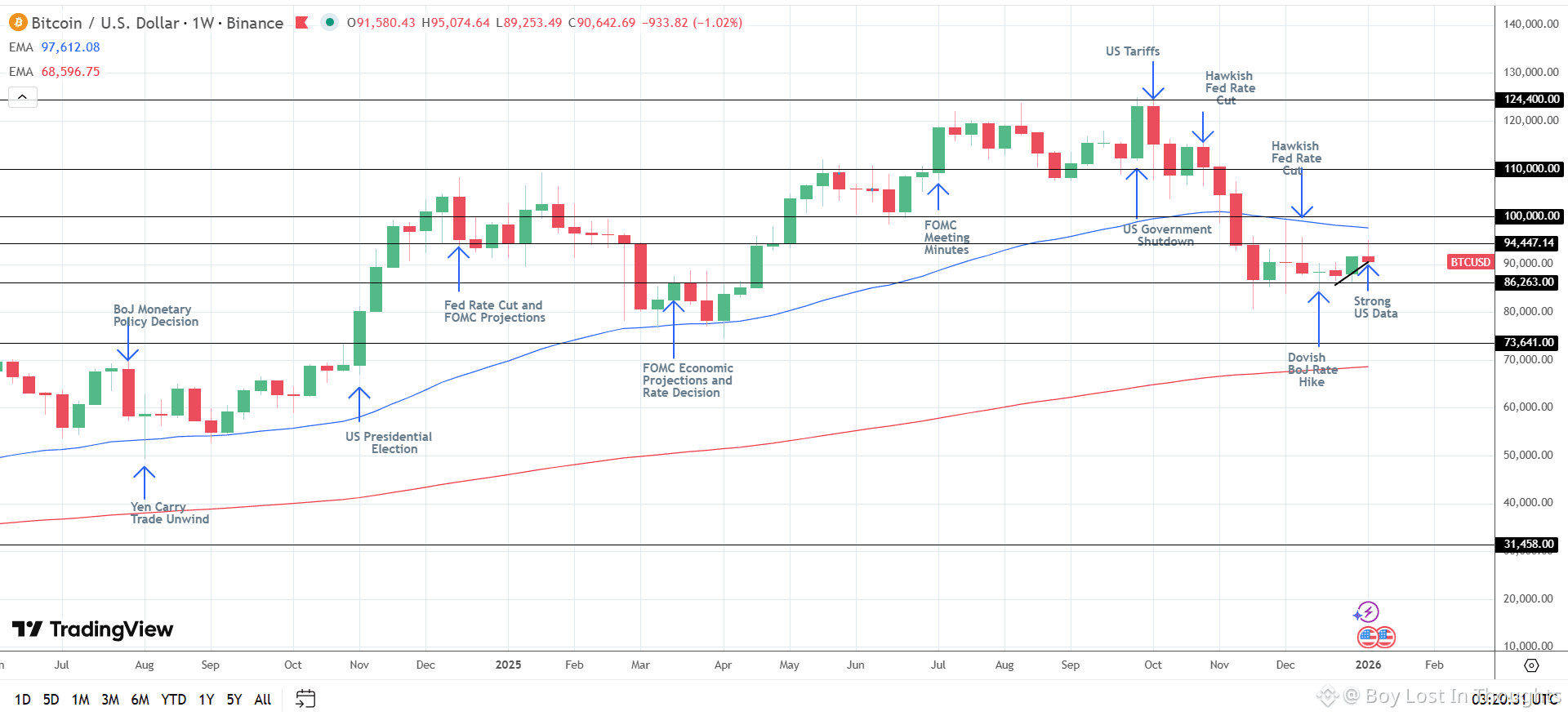

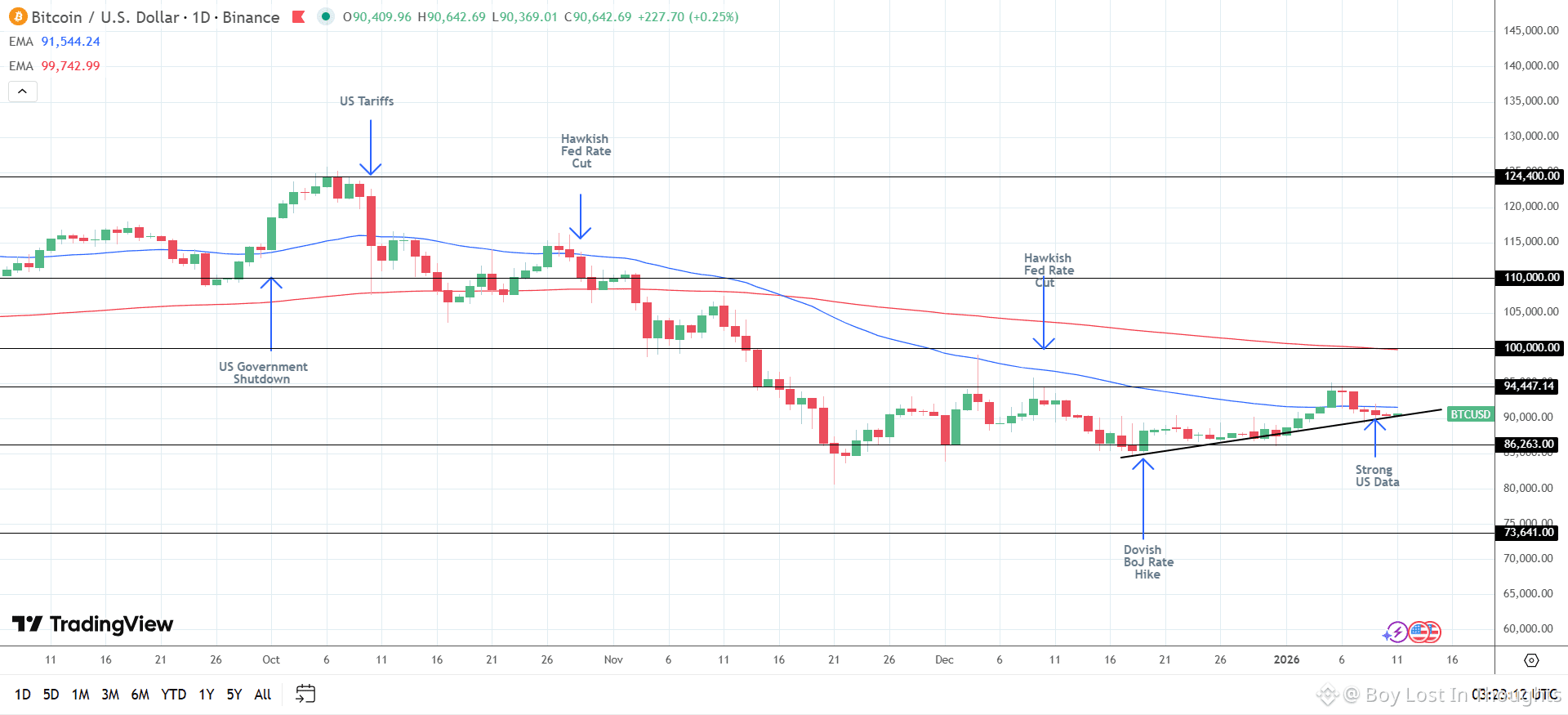

Recent robust US economic data has dampened expectations for an imminent Federal Reserve interest rate cut, leading to a cautious short-term shift in Bitcoin's trajectory. This shift resulted in significant outflows from US spot Bitcoin ETFs and pushed the BTC price back toward the $90,000 support level. Despite this pullback, the medium to long-term outlook remains bullish, supported by improving market sentiment, key legislative progress, and continued institutional interest.

Major Points Highlighted

Short-Term Pressure: Strong US Services PMI and jobs data reduced the probability of a March Fed rate cut, weakening demand for Bitcoin and related ETFs.

ETF Outflows: US BTC-spot ETFs saw weekly net outflows of $680.9 million, reversing the previous week's inflows, with Fidelity's FBTC and Grayscale's GBTC leading the withdrawals.

Key Support Level: Bitcoin's price retreated to around $90,000, which is now a critical technical support level to maintain the bullish structure.

Bullish Fundamentals Remain: Despite short-term headwinds, the medium-term outlook is supported by:

The Bitcoin Fear & Greed Index exiting the "Extreme Fear" zone.

Progress on US crypto market structure legislation.

Institutional moves like Morgan Stanley's ETF filing.

Key Risks: Downside risks include more hawkish central bank signals, sustained ETF outflows, and a break below the $90,000 support, which could target $80,523.

Price Targets: The analysis maintains a cautiously bullish short-term view with a path toward $100,000, and a medium-term (6-12 month) price target of $150,000.