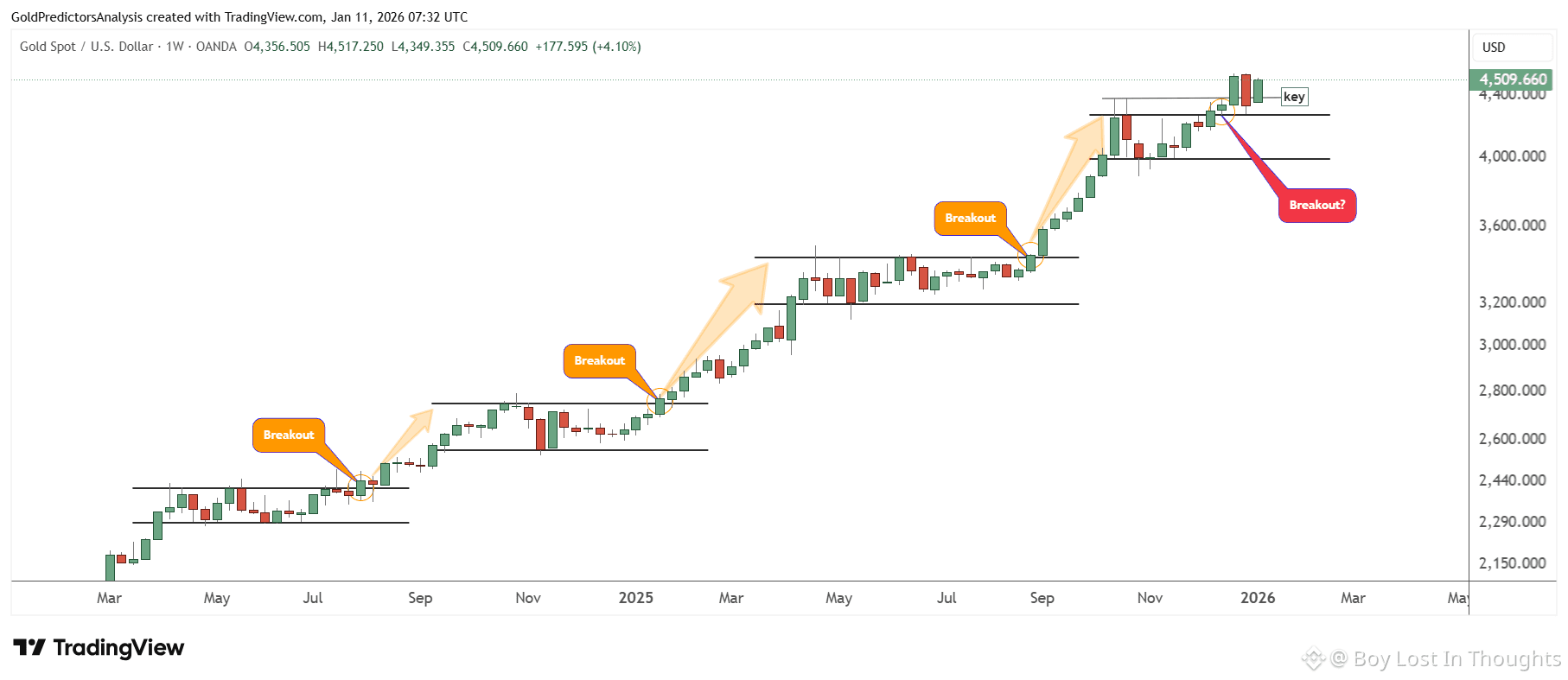

The analysis presents a strongly bullish case for gold in early 2026, arguing that a specific mix of macroeconomic and technical factors has set the stage for a continued surge, potentially toward $5,000. The recent breakout to new record highs is seen not as an isolated event, but as the beginning of a new phase in the bull market, further supported by related signals in silver and the U.S. dollar.

HIGHLIGHTED MAJOR POINTS:

1. Macroeconomic "Sweet Spot" for Gold:

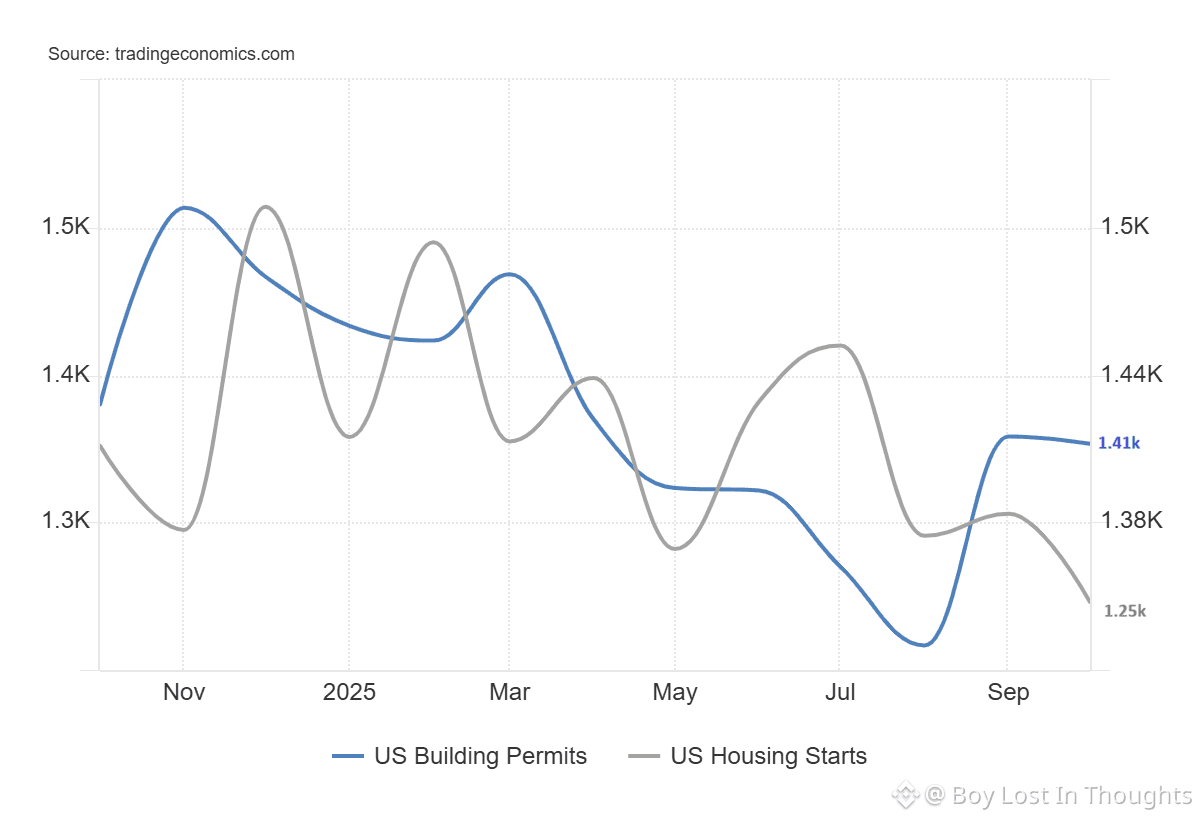

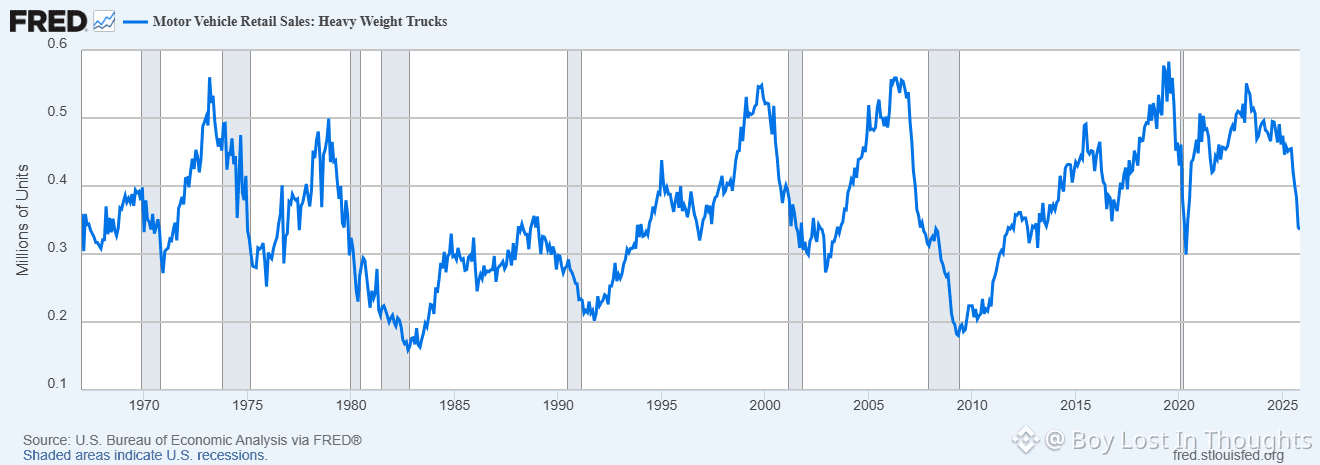

Cooling but Stable Growth: Recent data (slowing job growth, declining housing starts, weak heavy truck sales) signals an economic cooldown, keeping Fed rate cut expectations alive without indicating a severe crisis. This environment typically supports gold.

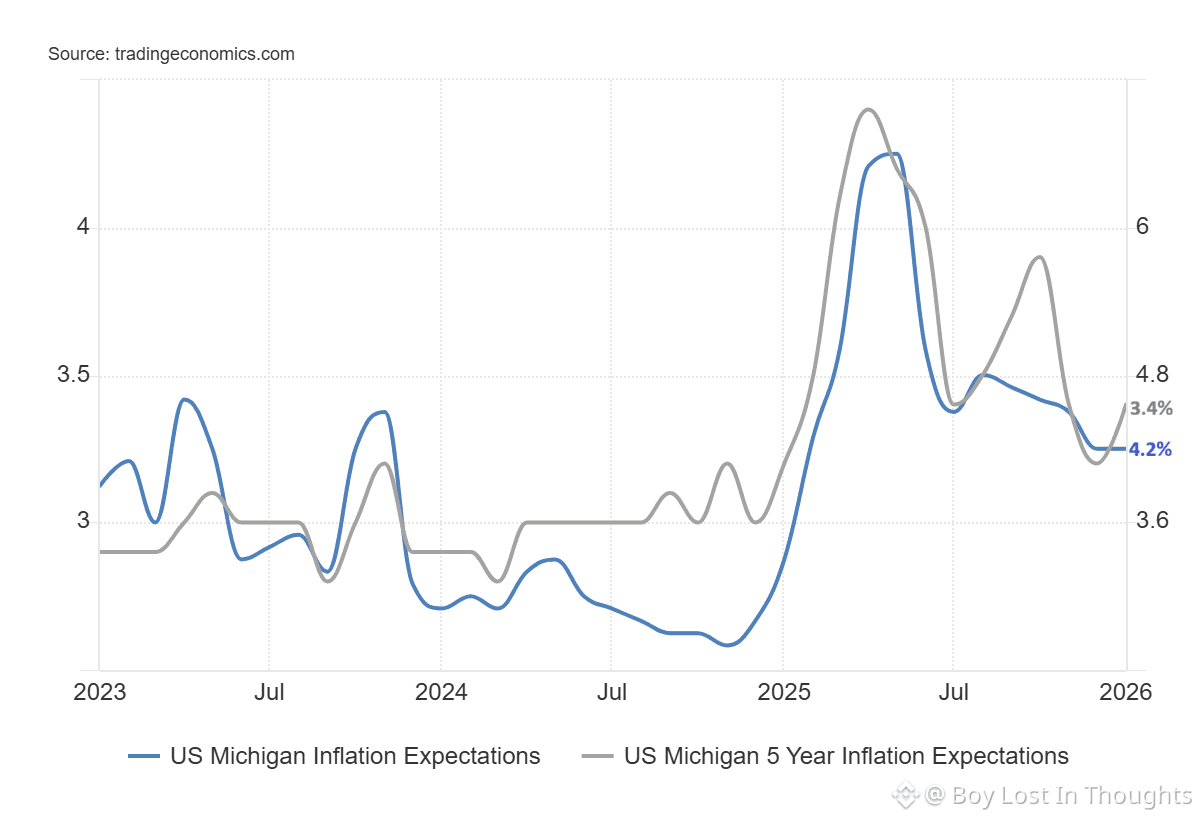

Persistent Inflation Fears: Despite cooling growth, consumer inflation expectations remain stubbornly high (4.2% for one-year), reinforcing gold's traditional role as an inflation hedge.

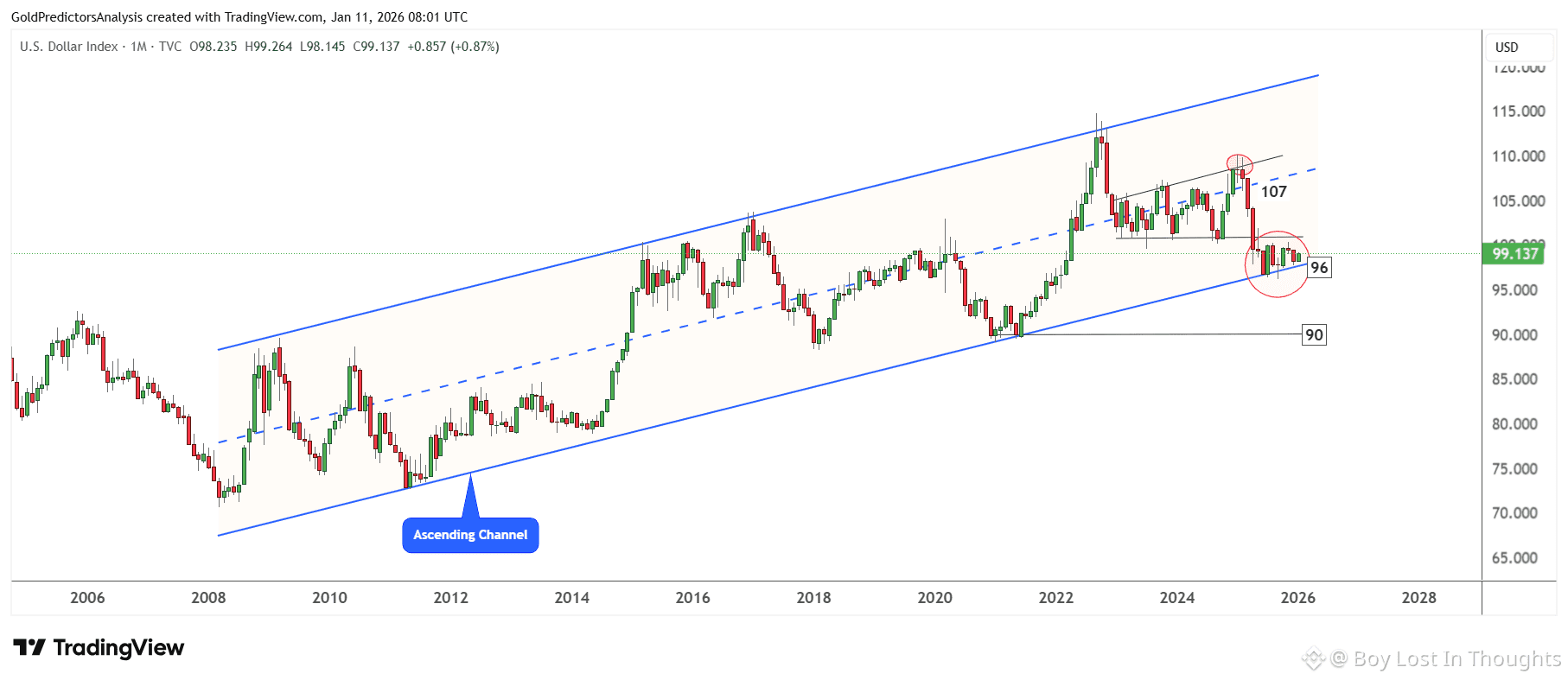

Dovish Fed Expectations: The market is pricing in rate cuts, which lowers the opportunity cost of holding non-yielding gold and weakens the U.S. dollar.

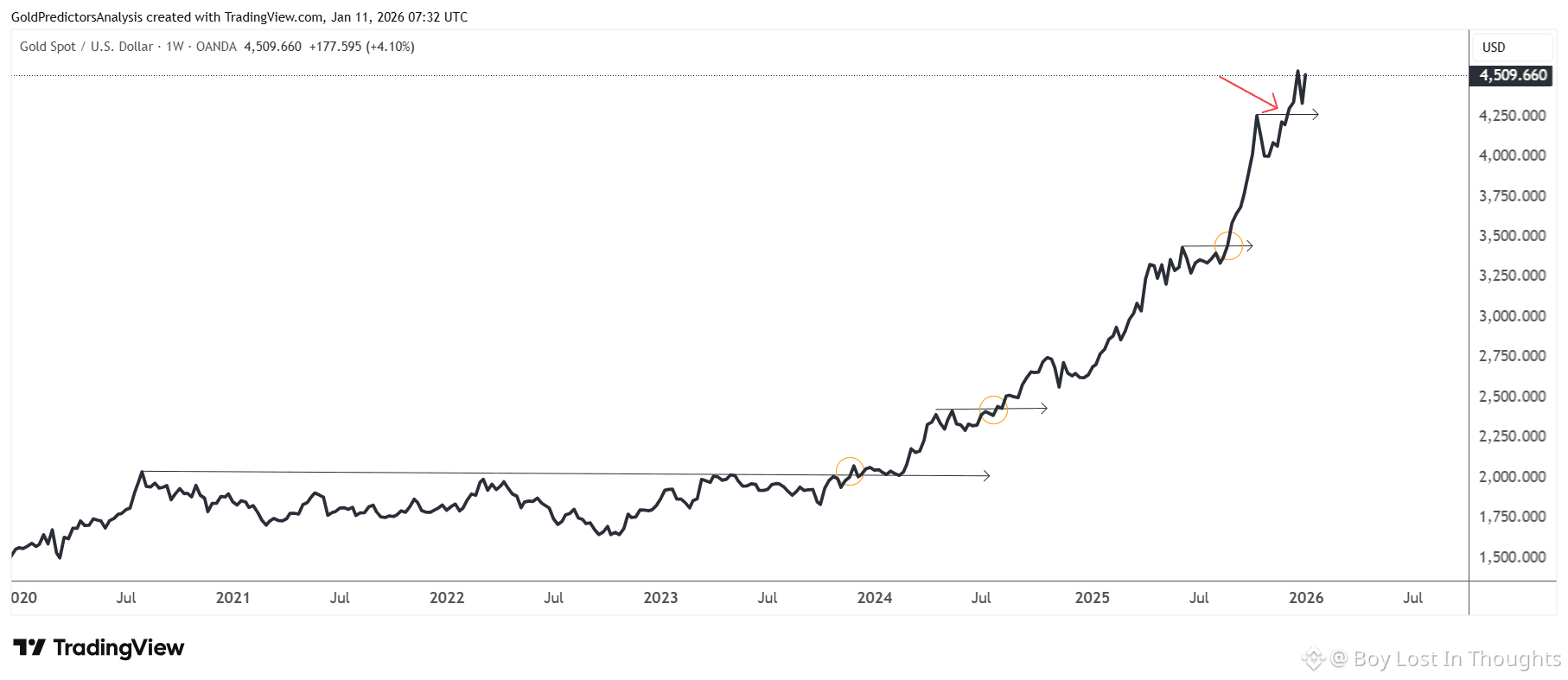

2. Bullish Technical Structure Confirms the Trend:

Gold's price action shows a repetitive and powerful pattern: periods of consolidation (e.g., Apr-Jul 2024, Apr-Aug 2025) are followed by strong, sustained rallies.

The recent breakout above the October 2025 high and a successful retest of the $4,260 support level are classic technical signals that the foundation is set for the next leg higher in 2026.

3. Critical Corroborating Signals from Related Markets:

U.S. Dollar Weakness U.S. Dollar Weakness: The Dollar Index is threatening a major breakdown below a long-term channel. A sustained drop below 96 would provide significant tailwinds for dollar-denominated gold.

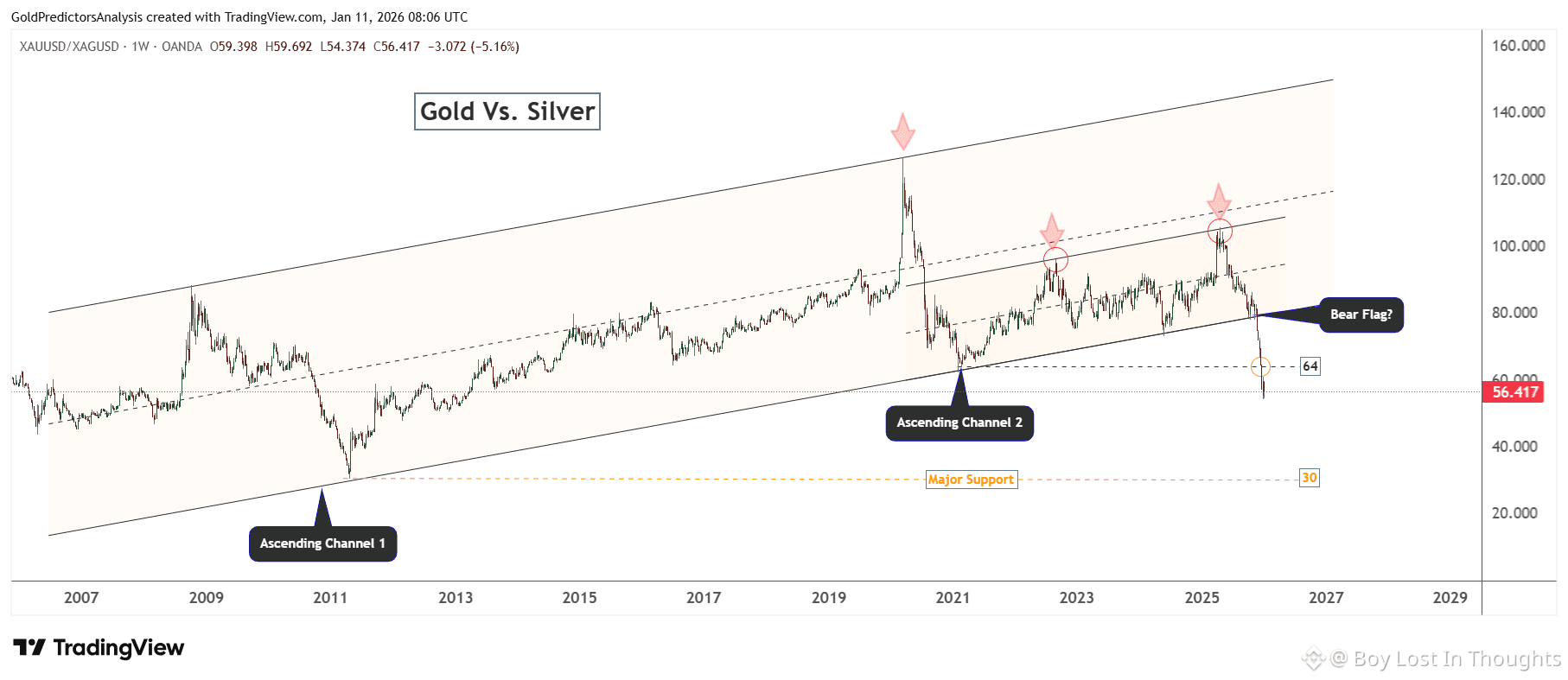

Silver Outperformance Signal Silver Outperformance Signal: The breakdown of the Gold-to-Silver Ratio below 60 suggests silver is poised to outperform, which historically validates the start of a broad, powerful precious metals rally.

4. Clear Risk Level and Outlook:

Bullish Base Case: The path of least resistance is higher, targeting a move toward $5,000, as long as gold holds above the $4,260 support zone.

Key Risk Warning: A sustained break below $4,260 would negate the immediate breakout thesis and signal a period of deeper consolidation, potentially delaying the next major upside move.