The Hidden Dangers of Leveraged Futures Trading: A Case Study Analysis

Introduction

Cryptocurrency futures trading has become increasingly accessible to retail traders, but the ease of access often masks the substantial risks involved. This article examines an anonymized Binance futures trading account to illustrate the common pitfalls that can lead to significant losses, even for traders who experience occasional wins.

The Numbers: A Sobering Reality

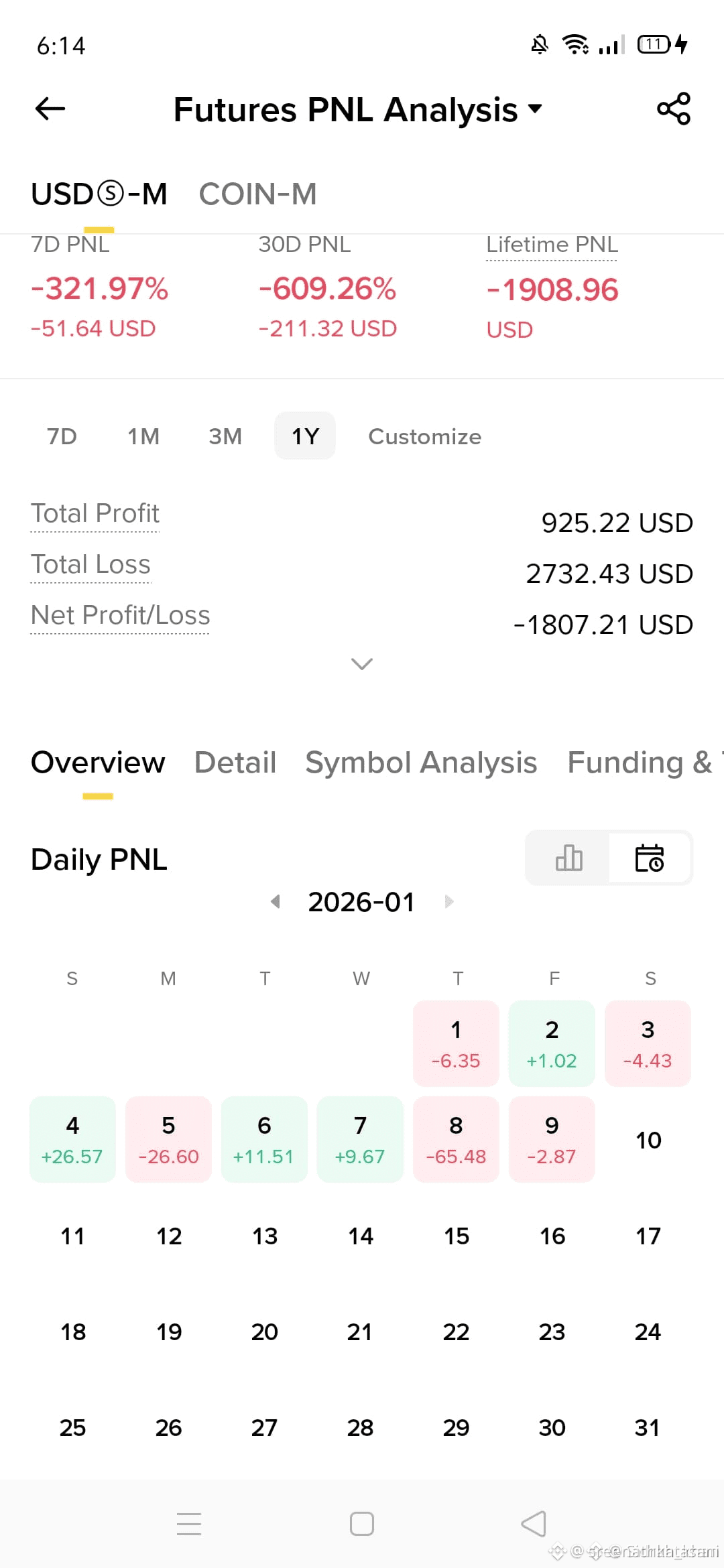

The account in question shows the following performance metrics:

Lifetime Net Loss: -$1,807.21 USD

Total Profits: $925.22 USD

Total Losses: $2,732.43 USD

7-Day Performance: -321.97% (-$51.64 USD)

30-Day Performance: -609.26% (-$211.32 USD)

At first glance, these percentage losses exceeding 100% might seem mathematically impossible. However, they reveal a critical aspect of this trader's approach: high leverage.

Understanding the Leverage Problem

When a trader shows losses exceeding 100% of their position size, it indicates they're using significant leverage—borrowing money to amplify their trading positions. While leverage can magnify gains, it equally magnifies losses.

How Leverage Amplifies Risk

If a trader uses 10x leverage:

A 10% market move against them results in a 100% loss of their capital

A 5% move wipes out 50% of their account

Small market fluctuations become existential threats

The percentages shown in this account suggest the trader is consistently using high leverage, turning what might be manageable 5-10% market movements into account-devastating losses.

Analyzing the Daily Performance Pattern

Looking at the January 2026 trading calendar reveals an important pattern:

Winning Days:

January 2: +$1.02

January 4: +$26.57

January 6: +$11.51

January 7: +$9.67

Losing Days:

January 1: -$6.35

January 3: -$4.43

January 5: -$26.60

January 8: -$65.48

January 9: -$2.87

The Win Rate Illusion

While this trader has winning days, a closer examination reveals a troubling pattern: the losses significantly outweigh the wins. This is a common characteristic of undisciplined futures trading where:

Small wins provide psychological reinforcement

Large losses occur when positions move against the trader

Lack of stop-losses or risk management allows losses to spiral

Emotional trading leads to "revenge trading" after losses

The Psychology of Loss Escalation

The 30-day loss being significantly worse than the 7-day loss (-609% vs -321%) suggests one of several scenarios:

Increasing desperation: The trader may be increasing position sizes to "recover" earlier losses

Inconsistent strategy: Different approaches being tried without proper testing

Emotional decision-making: Fear and greed driving trades rather than analysis

Market conditions: Trading against prevailing market trends

Key Lessons from This Case Study

1. Leverage is a Double-Edged Sword

The most obvious lesson is that high leverage can destroy accounts quickly. For every trader who successfully uses leverage, countless others blow up their accounts. The math is unforgiving: you need to be right consistently, while being wrong just once or twice can be catastrophic.

2. Risk Management is Non-Negotiable

Professional traders typically risk only 1-2% of their capital per trade. This account's performance suggests much larger position sizing relative to account balance, which is why single days show losses that exceed daily wins by multiples.

3. Win Rate Doesn't Equal Profitability

Having more winning days than losing days means nothing if your average loss exceeds your average win. This account demonstrates the classic "death by a thousand cuts" where small wins are wiped out by occasional large losses.

4. The Total Loss Exceeds Total Profit by 3:1

The stark reality: this trader has lost $2,732.43 while only making $925.22 in profits. This means their losses are nearly three times their gains, resulting in the net loss of $1,807.21.

Red Flags Every Trader Should Recognize

If you see these patterns in your own trading:

Percentage losses exceeding 100% → You're using too much leverage

Exponentially worsening monthly performance → Your strategy isn't working

Large single-day losses → You lack proper stop-losses

Total losses significantly exceed total gains → You need to reassess your approach entirely

What Should This Trader Do?

For someone in this situation, here are evidence-based recommendations:

Immediate Actions

Stop trading immediately: Pause to prevent further losses

Reduce or eliminate leverage: Trade spot markets or use minimal leverage (2x maximum)

Implement strict risk management: Never risk more than 1-2% per trade

Set automatic stop-losses: Remove emotion from loss limitation

Long-Term Strategy

Education first: Study risk management, position sizing, and trading psychology

Paper trade: Practice strategies without real money

Start small: When returning to live trading, use minimal capital

Keep detailed journals: Track every trade, the reasoning, and emotional state

Consider professional help: Many successful traders use mentors or join structured programs

The Broader Context: Why Most Retail Traders Lose

This case study isn't unique. Studies consistently show that 70-90% of retail futures traders lose money. The reasons include:

Overconfidence bias: Believing you can beat the market without proper preparation

Availability bias: Remembering wins more than losses

Lack of edge: Trading without a genuine statistical advantage

Undercapitalization: Starting with too little capital to weather normal drawdowns

Emotional trading: Letting fear and greed override rational decisions

Conclusion

This anonymized case study serves as a cautionary tale about the real risks of leveraged futures trading. The combination of high leverage, poor risk management, and emotional decision-making created a perfect storm that turned $1,807 of real money into expensive lessons.

For those considering futures trading, remember: the goal isn't to make money fast—it's to not lose money first. Capital preservation should always be the priority, because you can't trade profitably if you've blown up your account.

The markets will always be there tomorrow. Your capital might not be if you're not careful.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves substantial risk of loss. Past performance is not indicative of future results.