#Contentos #COS #TradeyAI #AIAgent #AI #Write2Earn

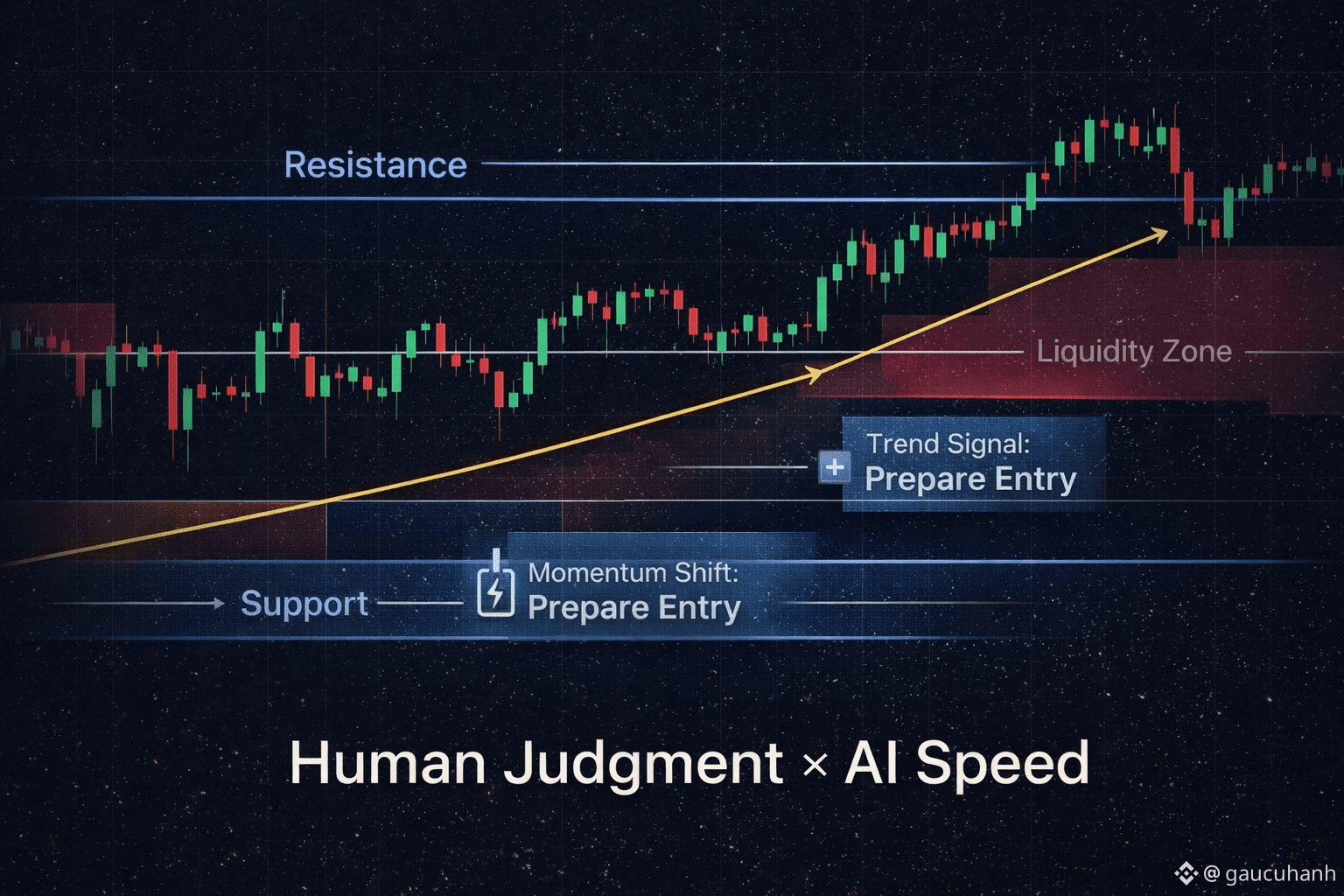

Intraday trading is not about predicting the future. Intraday trading is no longer just trader vs market. It’s about reacting faster than the market invalidates your idea. it’s human judgment combined with AI speed.

In intraday trading, time is alpha.

The rise of AI in trading is not about automation replacing humans — it is about augmentation. Intraday traders, in particular, are increasingly turning to AI assistants to gain an edge in speed, clarity, and consistency.

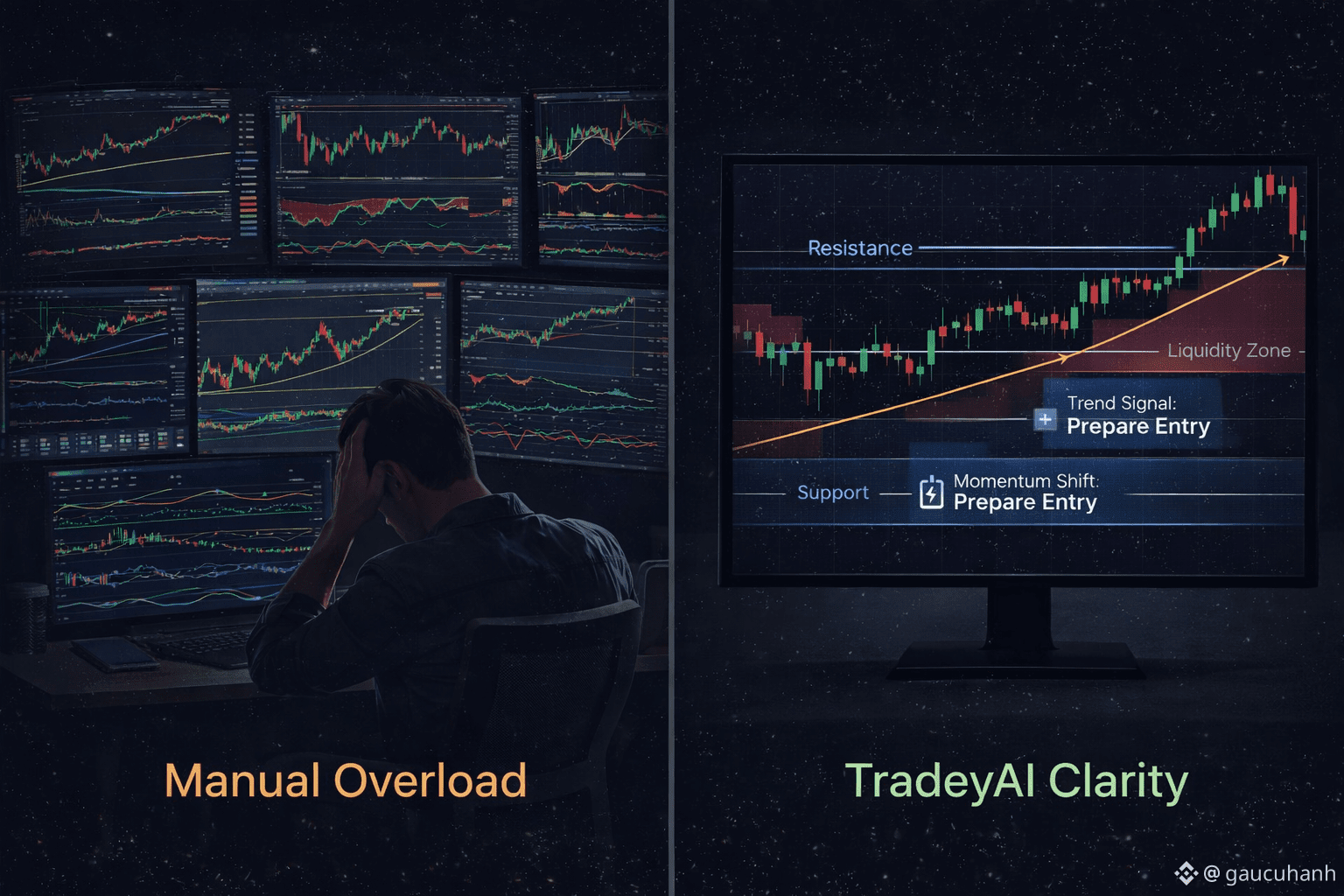

The Intraday Trading Challenge

Intraday trading requires:

Constant market monitoring

Rapid interpretation of price action

Emotional discipline under pressure

For assets like BTC, ETH, and XRP, price movements can invalidate a trade idea within minutes. Traditional manual analysis struggles to keep up.

What TradeyAI Brings to the Table

TradeyAI functions as an AI-powered trading assistant, offering:

Continuous market trend analysis

Real-time identification of key technical levels

Entry signal support during critical moments

Instead of scanning charts endlessly, traders can focus on decision-making and risk management.

One clear chart creates decisions.

BTC and ETH: Managing Market Noise

In highly liquid markets, false signals are common. TradeyAI helps filter noise by focusing on structural market behavior rather than isolated indicators.

XRP: A Case for Precision

XRP often experiences sudden intraday moves driven by sentiment or news. TradeyAI’s real-time tracking helps traders stay alert to emerging setups without overreacting to every price spike.

Human Judgment + AI Speed

AI does not eliminate risk — but it reduces unnecessary delay. By combining human experience with AI-driven insights, traders can:

Improve timing

Maintain consistency

Reduce emotional bias

Another key benefit of AI-assisted intraday trading is decision clarity under uncertainty. When markets move fast, traders often hesitate — not because they lack knowledge, but because too many variables compete for attention. TradeyAI helps narrow focus to what truly matters at each moment: structure, momentum, and context. By reducing cognitive overload, AI allows traders to act with confidence instead of doubt. In intraday trading, fewer decisions — made faster and with clarity — often outperform complex analysis done too late.

Final Takeaway

Intraday markets reward traders who act decisively and logically. AI assistants like TradeyAI are becoming essential tools — not because they predict the future, but because they help traders react faster and smarter.

Do you see AI trading assistants as a tool or a threat to trader skills? Would you trust an AI assistant for entry timing, or only as a confirmation tool?

Curious to hear different perspectives 👇