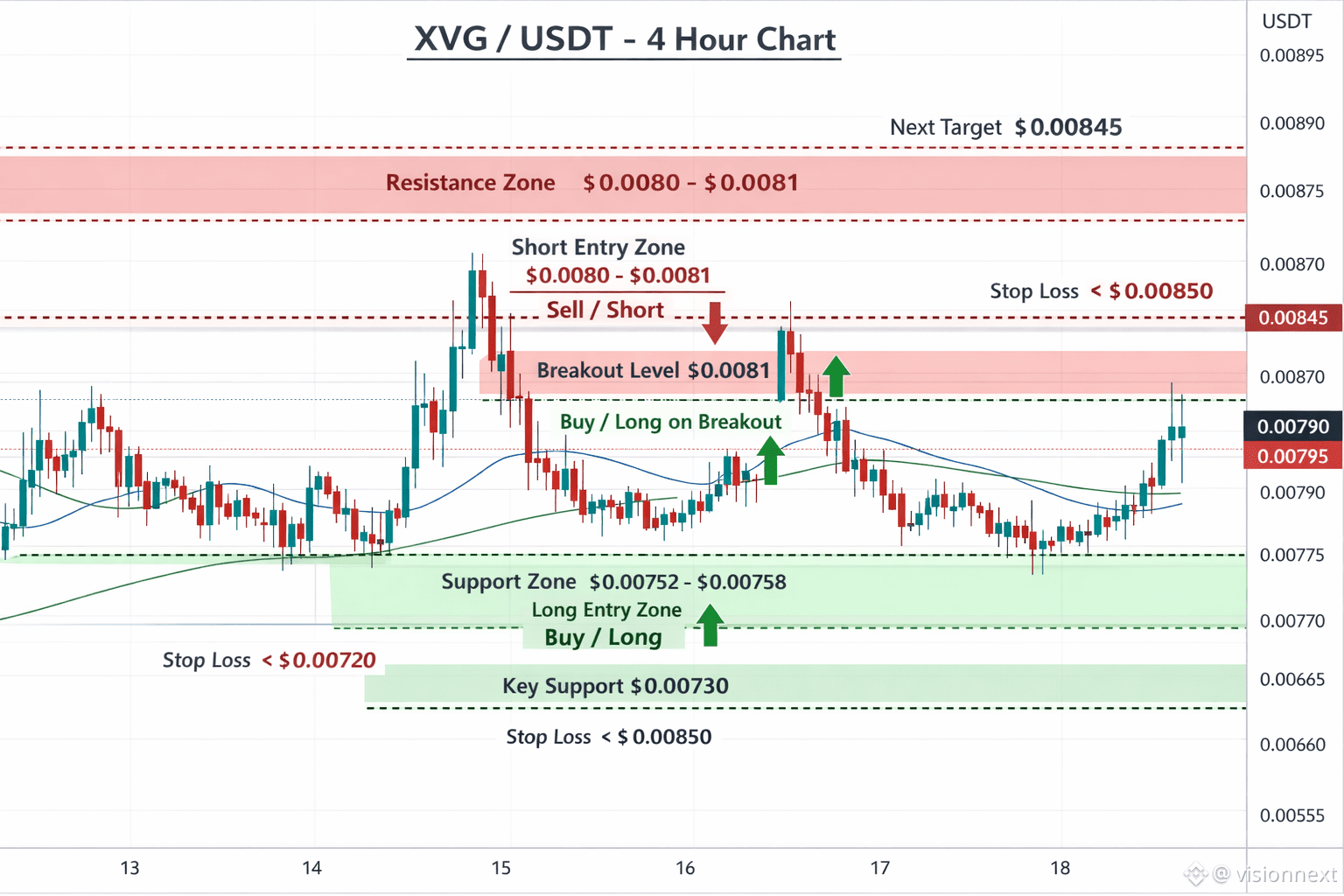

Here’s a precise, 4-hour timeframe analysis for $XVG USDT$XVG USDT (price ≈ $0.0079) with support & resistance levels plus entry/exit guidance in 10 clear lines:

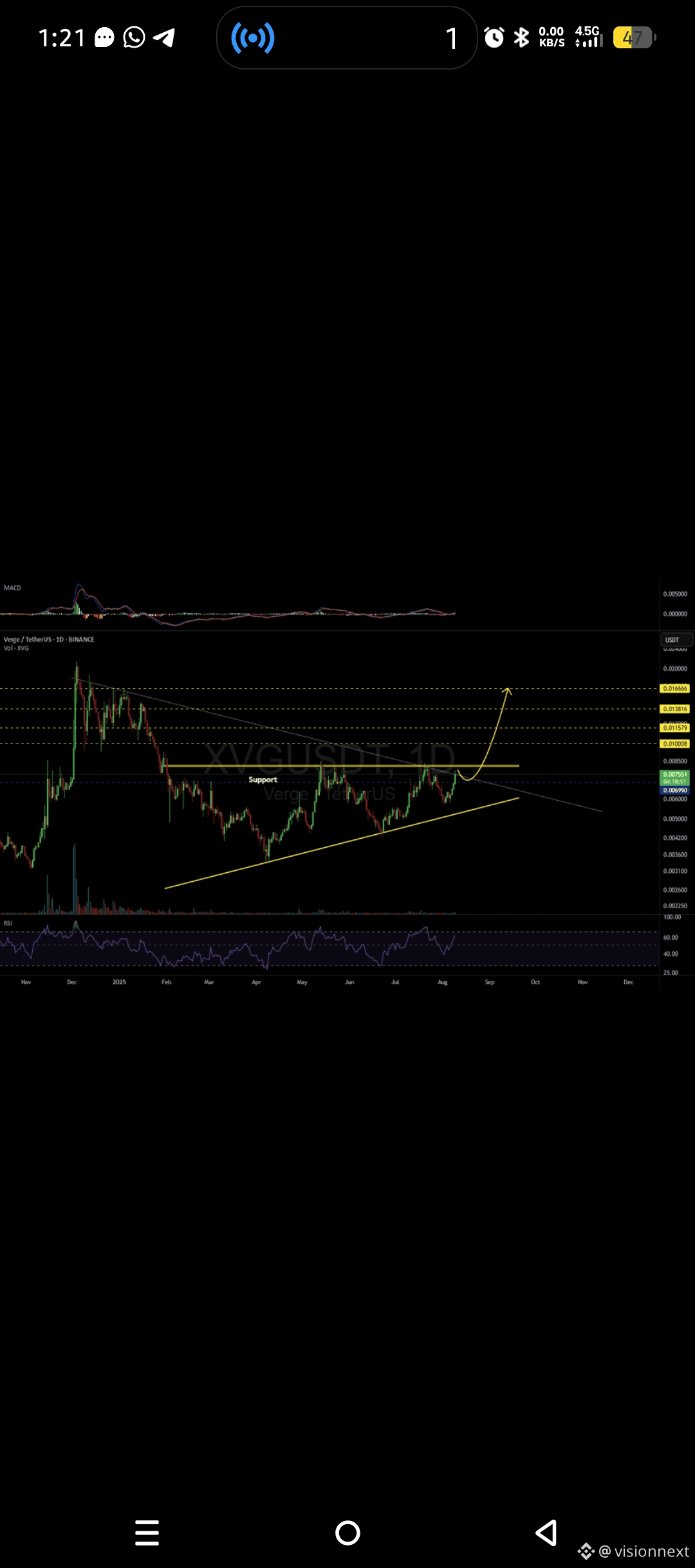

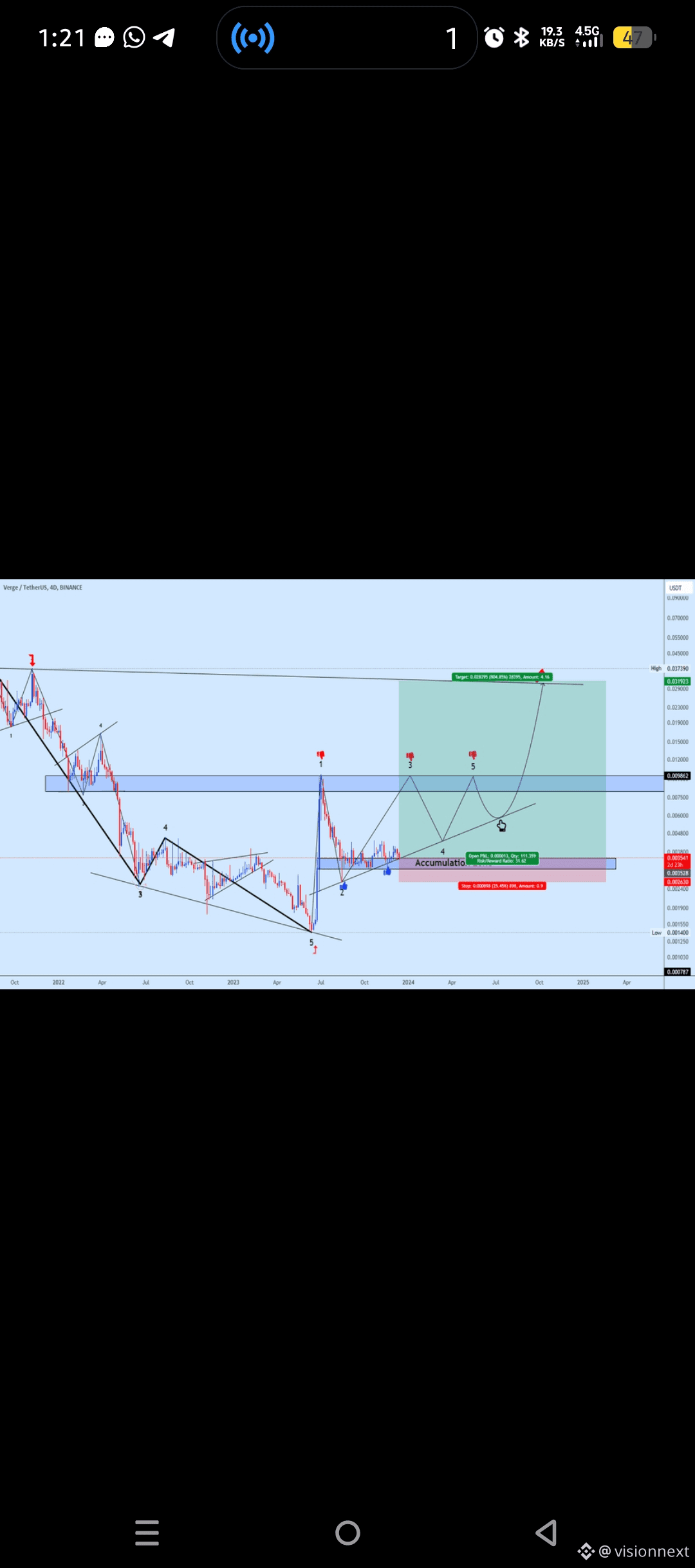

📌 1. Current Context: On the 4-hour chart, XVG is trading near short-term resistance after bouncing from lower levels — momentum shows mixed signals with volatility intact. �

📌 2. Immediate Resistance: ~$0.0080–$0.0081 is the first key resistance cluster where sellers have repeatedly emerged recently. �

📌 3. Secondary Resistance: A breakout above $0.0081 targets ~$0.00845 — next supply zone before bigger overhead resistance. �

📌 4. Near Support: $0.00752–$0.00758 is an active support zone on the 4-hour chart — price has respected this area as demand. �

📌 5. Lower Support: $0.0073 acts as a stronger short-term support; break below could push toward $0.0070. �

📌 6. Entry for Long (Aggressive): Enter long near $0.0075–$0.0076 if the candle structure shows rejection (e.g., wicks, bullish engulfing). �

📌 7. Entry for Long (Conservative): Wait for a clear breakout above $0.0081 with volume — confirms bullish continuation. �

📌 8. Exit/Take Profits (Long): First target $0.0081, second $0.00845–$0.0085 if momentum stays strong. �

📌 9. Entry for Short: Enter short near resistance $0.0080–$0.0081 if price rejects and breaks back below $0.0079 on the 4-hour — shows supply pressure. �

📌 10. Stop-Loss & Risk: For longs, place SL below $0.0072; for shorts, SL above $0.0085 to manage risk if breakout invalidates setup. �

AInvest

AInvest

CoinCheckup

AInvest

CoinLore

AInvest

CoinCheckup

CoinCheckup

AInvest

CoinCheckup

🔁 Summary:

• Bullish scenario: Strong breakout above $0.0081 → target $0.00845+.

• Bearish s cenario: Rejection at resistance and break below $0.0075–$0.0073 → downside toward $0.0070. �$XVG

cenario: Rejection at resistance and break below $0.0075–$0.0073 → downside toward $0.0070. �$XVG