Hello everyone,

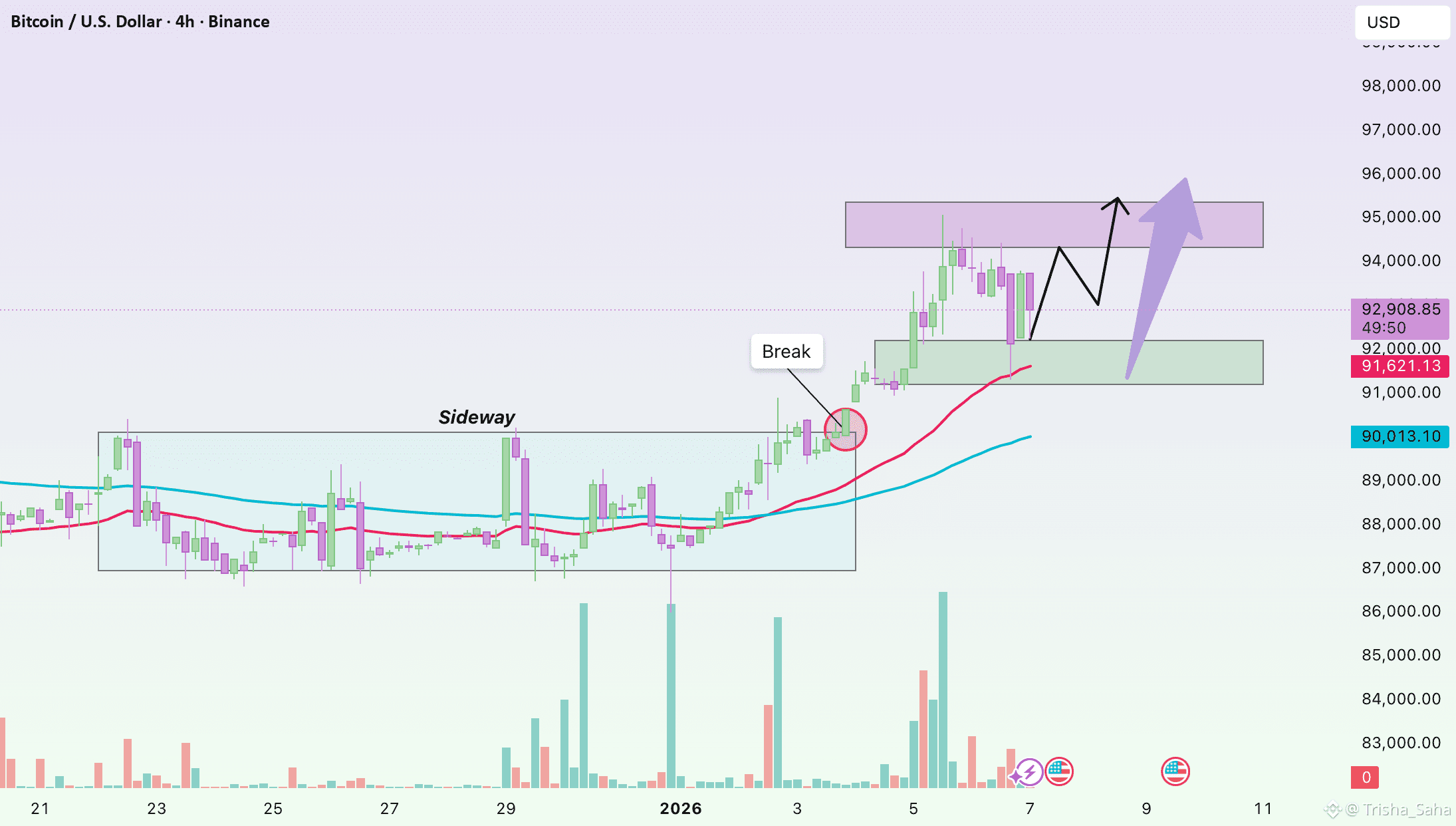

Looking at the BTC/USD H4 chart, what stands out to me is not the few recent red candles, but the way the market is slowing down after a very decisive rally. After moving from the 88,000 area up toward nearly 95,000, Bitcoin has started to cool off and pull back into the 92,000–93,000 zone. To me, this is a fairly natural price reaction following a strong advance, as capital needs time to rebalance before the market commits to its next directional move.

From a technical standpoint, the medium-term bullish bias has not been compromised. Price is currently pulling back into the confluence zone of EMA 34 and EMA 89 — an area that often acts as a “support base” within a healthy trend. The fact that BTC continues to hold above the slower EMA suggests that bullish momentum has not been broken, and that the current retracement is more consistent with short-term profit-taking than with genuine distribution.

A constructive detail lies in the price behavior during the recent pullback. Selling volume has not expanded, while the corrective candles show narrower ranges compared to the prior impulsive advance. This indicates that supply pressure is fading, while buyers have not stepped aside. Historically, this type of price action often leads to a brief consolidation phase before the market resumes its primary direction.

Stepping back from the chart to look at the broader context, the current macro backdrop remains supportive for Bitcoin. Recent US economic data point to easing inflation while growth remains moderate. This makes a shift toward a more aggressive monetary stance less likely, helping to preserve a relatively stable “risk-on” environment for risk assets.

In addition, early-year market sentiment has improved noticeably after the holiday period.

Capital is flowing back into equities and crypto, and Bitcoin is often among the first beneficiaries when risk appetite improves. Reports from international financial media also suggest that institutional money has not exited the market, but is instead repositioning after the strong year-end rally — a narrative that aligns well with what the H4 chart is currently showing.