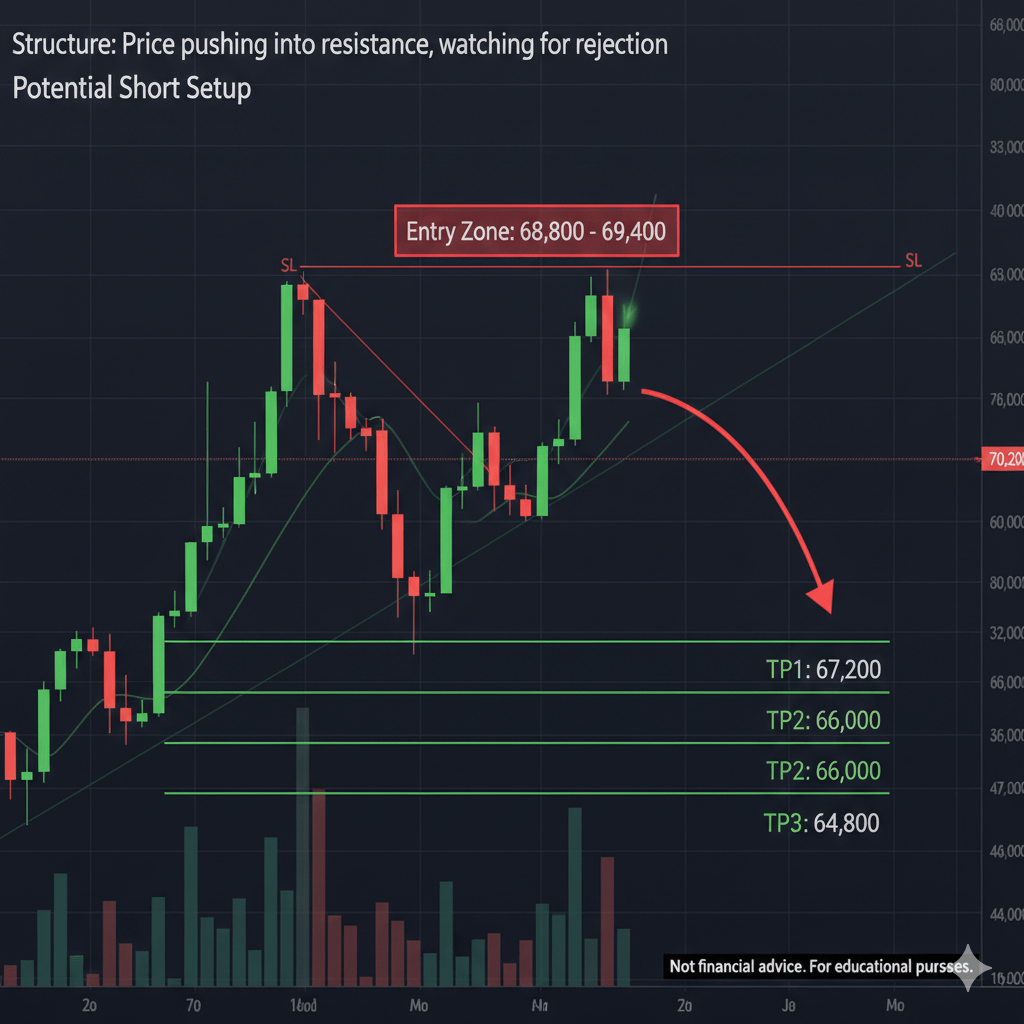

In Short:$BTC

The market is showing some serious impulsive expansion, pushing price directly into a major resistance zone. While the momentum has been strong, we are starting to look for signs of short-term exhaustion.

I’m currently mapping out a potential short setup, but the key here is patience. We aren't just "fading" the move; we are waiting for the price to tell us it's tired.$BTC

🔍 The Strategy: Identifying the Rejection

We are looking for a lower high formation or a clear rejection near the recent peaks to confirm that the upside move is losing steam.

Pro Tip: Avoid shorting into strong momentum candles. Wait for the candles to get smaller or show long upper wicks (wicking out) before considering an entry.

📊 The Trade Setup

Parameters Level's

Entry zone. 68,800-69,400

(Prefer rejection weak ratest)

Stop loss (SL). 70,200

Take Profit 67,200

Take Profit 2. 66,000

Take Profit 3. 64,800

🛡️ Risk Management & Structure

The current structure shows price pushing into resistance after a fast move up. If we see a failure to break higher, it opens the door for a downside continuation toward our target levels.

If the bulls manage to print a strong closing candle above the entry zone with high volume, the thesis is invalidated. Protect your capital first!

Disclaimer: This is my personal market view and not financial advice. Always do your own research.