In one hour, it dropped from 4.8 to 0.8:

Behind the flash crash of the meme coin is actually a structural flaw in perpetual contracts and AMM.

Yesterday, another meme coin completed its 'mission'.

This coin is called Light, which claims to be a 'Bitcoin ecological project'. It started on December 10th and was pumped dozens of times in just a few days. Then, within one hour, the price plummeted from $4.8 directly to $0.8, almost completing a standard 'runaway flash crash'.

If you think this is coincidental, you might be underestimating the maturity of this play.

One, it's not about how much capital there is, but 'how little spot is released'

Light's operation methods are actually very classic:

The project party controls the vast majority of the spot chips

Only releases a very small portion of the spot into the market

Does not go to mainstream exchanges, only chooses small exchanges or DEX

This time Light mainly pulled the market on PancakeSwap (CAKE).

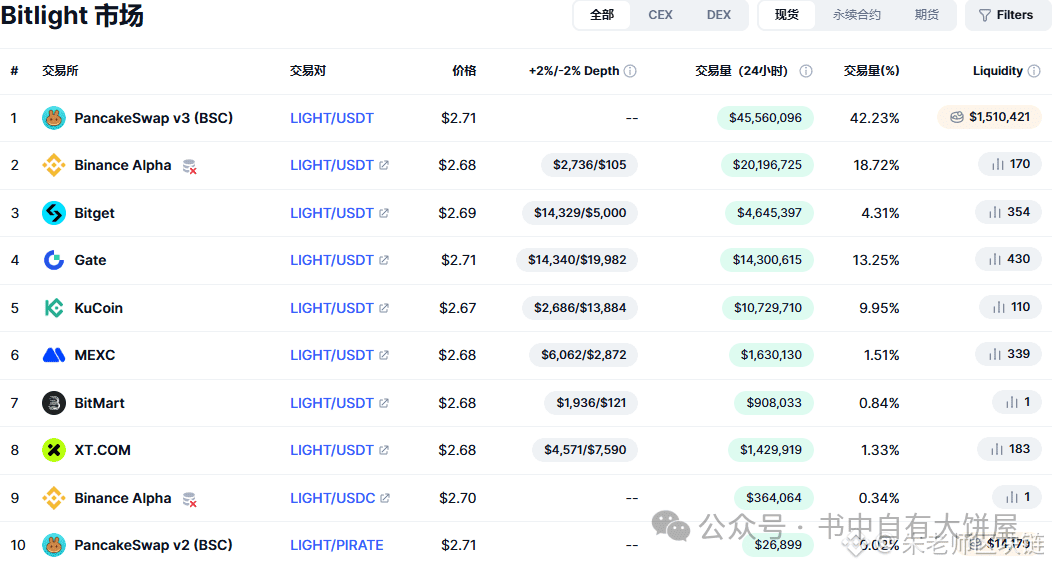

Let's look at a very key set of data:

The 24-hour trading volume of this trading pair on CAKE: 45 million USD

Accounted for 42% of the total network trading volume

Reverse calculate the total network 24-hour trading volume to only about 100 million USD

But the project party claims this is a 'fully circulating' project.

If estimated at a daily trading volume of 100 million USD, the real circulating and freely tradable spot scale may only be at the million USD level.

Two, locking up spot with high APR makes liquidity 'thinner'

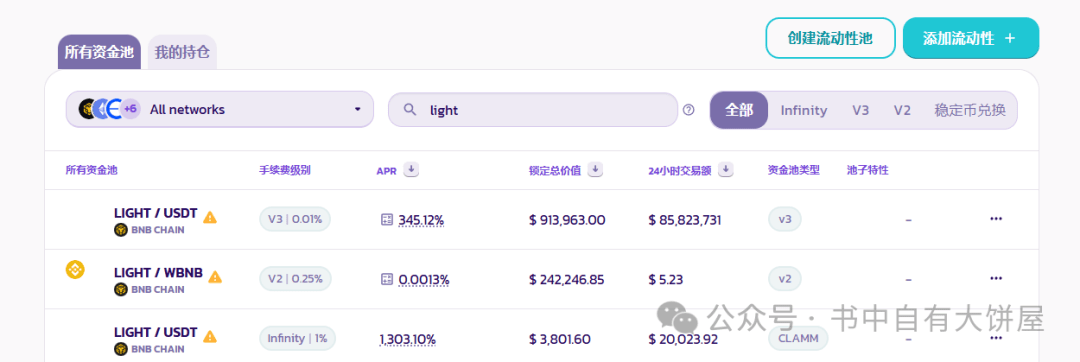

I further looked at the scale of the AMM pool for this trading pair on CAKE:

Peak pool total: about 1.5 million USD

After the flash crash: only 900,000 USD left

Meanwhile, the pool APR once increased from 100% to 300%

The purpose of this step is very clear:

It's not to let you make money, but to make you deposit the spot into the pool.

Because once the spot is locked in the pool:

The chips freely circulating in the market further decrease

The project's control over prices is even stronger

Three, the fatal flaw of AMM: small pools, fixed prices

DEX uses AMM (constant product formula) pricing mechanism:

Prices are not determined by 'market consensus', but by 'how much is left in the pool'.

This leads to an extremely dangerous result:

Want to make the priceDouble

Only need to buyAbout 20% of the tokensWant to make the priceTen times

Only need to buyAbout 34% of the tokens

In other words:

As long as you control a small pool of millions, you can create a 'price illusion' worth billions.

And Light's overall market value reaches 1.1 billion USD.

This is typical:

Using a 'small pool' to manipulate a 'pretended large pool'.

Four, spot is a tool, the real harvesting is in contracts

Let's take a look at the data from the contract market.

X's 24-hour contract trading volume on Light: 1.9 billion USD

DEX spot trading volume: about 80 million USD

What does this mean?

The size of the contract market is more than 20 times that of the spot.

Thus, this game becomes:

Want to pull the market

Control DEX spot prices with very little capital

Open a large number of long positions on contracts at the same timeWant to run away

Contract closes long positions

Directly crash the DEX

Controlling the spot ≈ controlling the contract anchor price

And the cost may only require 1% of the spot market value.

Five, perpetual contracts: Why is it becoming the 'dealer's artifact'

Many underestimate the structural risks of perpetual contracts.

Perpetual contracts have no delivery date; their only 'stabilizer' is just one:

Funding Rate

When the contract price deviates from the spot:

Exchanges will punish one side through the funding rate

Forcing the market to 'chase the spot price'

But on these meme coins, the funding rate often:

Settled every hour

Up to 2%

This means:

If you go against the trend

You may have to pay up to 48% of the holding cost in one day

In two days, it can wipe out your principal

You don't even need to be liquidated,

Time itself will kill you.

Six, history has proven: such things cannot survive in traditional finance

The concept of perpetual contracts was first proposed by Nobel economist Robert Shiller in 1992, and it was Arthur Hayes of BitMEX who truly made it happen.

But ironically:

Arthur Hayes himself hardly plays contracts,

But it brought a monster to the entire crypto market: 'no expiration date + high-frequency liquidation'.

In the traditional financial system:

With futures delivery

With options hedging

With regulation

With central bank backing

Even in extreme manipulation behavior, the central bank will intervene directly.

The most typical example is the manipulation of silver by the Hunt brothers in 1980:

Controlled 70%-80% of the global circulating silver

Cooperate with futures bulls

Pulled silver from $6 to $50

Severely impacted the real industry

In the end, the Federal Reserve and regulatory agencies intervened directly,

Bankrupted the Hunt brothers.

Seven, the real problem is only one

Futures have magnified the risk, but at least:

With delivery dates

With leverage limits

With regulatory constraints

And perpetual contracts:

No expiration date

Extremely high leverage

Web3 exchanges are almost unregulated

24-hour trading, can run away in 1 hour

The most fatal is:

Only 1% of the capital is needed,

To manipulate an item with a 100 times volume.

This is not 'high risk',

This is structural unfairness.

And retail investors are almost always the last ones to take the fall because in this game, you can't defeat someone who can control the dealer with very low costs!$ETH