$BTC Bitcoin’s sudden surge toward $90,000 wasn’t the result of broad market demand, strong fundamentals, or retail conviction.

It was engineered.

And the evidence is visible, verifiable, and fully public.

While timelines are flooded with celebration posts and bullish takes, almost no one is asking the most important question:

Who actually bought this move — and why?

🔍 The Answer Is in the Flows

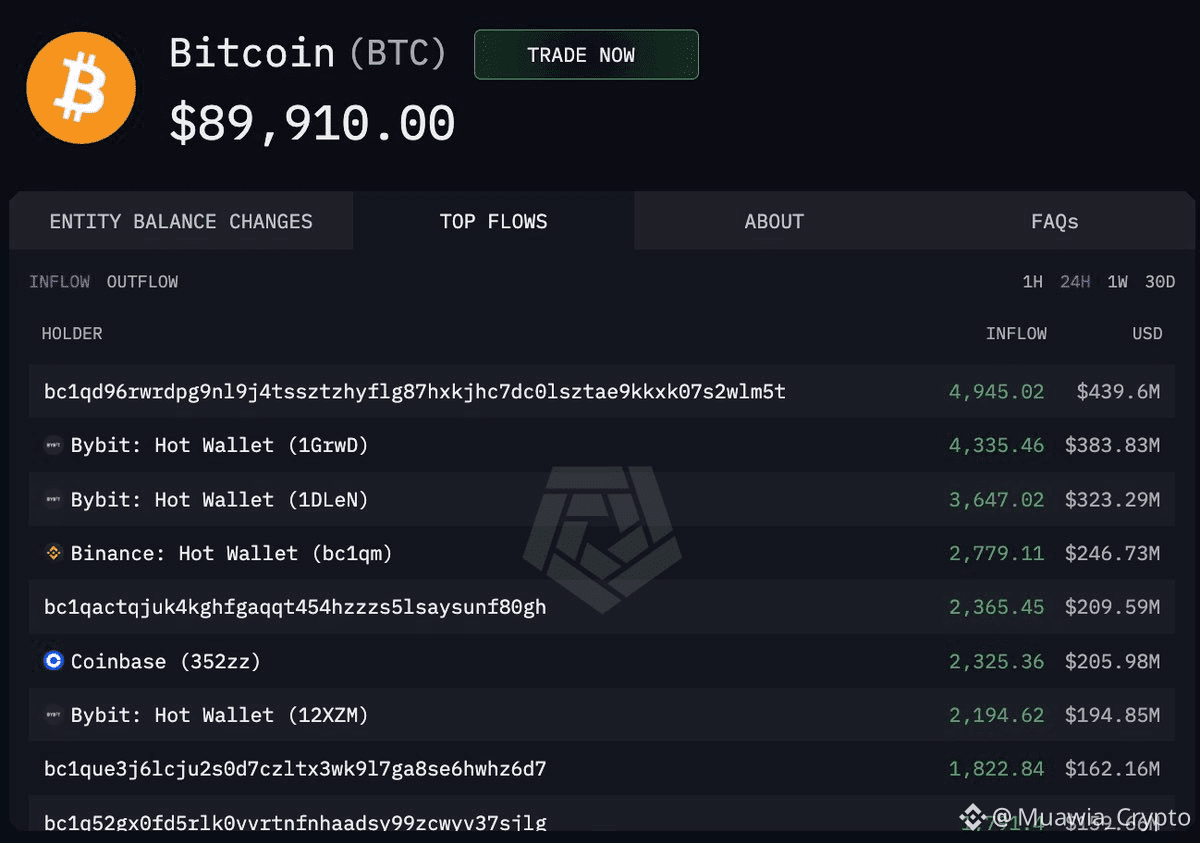

On-chain and exchange data over the last several hours reveals something highly unusual:

Large, coordinated spot buying

Concentrated across major venues: Binance, Bybit, Kraken

Market-making entities such as Wintermute involved

Aggregate inflows totaling ~$2.5 BILLION in a very short time window

This is not organic accumulation.

This is precision capital deployment.

⚠️ Why This Worked So Easily

At the time of the move, liquidity was extremely thin.

When order books are shallow, price becomes vulnerable. You don’t need tens of billions to move the market — a few billion deployed aggressively is enough.

The result?

Price is driven sharply higher

Shorts are forced into liquidation

Momentum traders and late longs FOMO in

Leverage stacks up rapidly on the long side

This isn’t speculation — it’s textbook market structure exploitation.

🧠 The Real Objective: LIQUIDATIONS

The goal was never “price discovery.”

It was position cleansing.

Once enough shorts were wiped and leverage flipped long-heavy, the setup was complete.

That’s when distribution begins.

Large holders unload into trapped longs, volatility expands, and price retraces violently — liquidating both sides of the book.

This cycle repeats every time liquidity conditions allow it.

🧩 Exit Liquidity Explained

Retail isn’t being invited into a rally.

Retail is the rally.

In traditional markets, this behavior would raise immediate regulatory alarms. For individuals, it would be classified as market manipulation.

For large players operating in opaque, global crypto markets?

It’s just another trading session.

📌 Perspective Matters

Markets don’t move randomly. They move toward maximum pain.

Understanding that difference is what separates participants from liquidity.

And for context:

I publicly identified the cycle bottom near $16,000 three years ago — when fear was absolute.

I also called the cycle top at $126,000 in October, before sentiment fully turned.

This isn’t luck.

It’s structure, data, and patience.

If you missed previous calls, that’s fine.

Opportunities don’t disappear — they rotate.

But ignoring market mechanics?

That’s how people keep learning the hard way.

Stay sharp.