BlackRock just made a move the crypto market cannot afford to ignore.

Over the past three days, the world’s largest asset manager has withdrawn approximately $1.24 billion worth of crypto, sparking intense discussion among analysts watching institutional behavior.

📊 Breakdown of the Withdrawals

On-chain data indicates BlackRock recently moved assets off platforms:

• 12,658 $BTC ≈ $1.21B

• 9,515 $ETH ≈ $31.3M

Transfers of this magnitude are not retail behavior. They typically reflect deliberate institutional positioning, not emotional or short-term trading.

🏦 BlackRock’s Ongoing Crypto Exposure

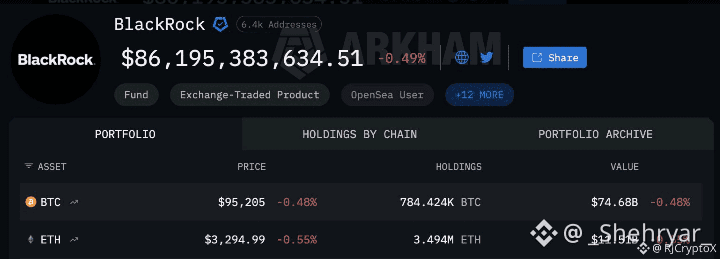

Despite the withdrawals, BlackRock’s crypto footprint remains enormous. According to Arkham data, the firm still holds:

• 784,400 BTC ≈ $74.68B

• 3.49M ETH ≈ $11.51B

This reinforces a key point: this is not an exit. It’s strategic capital management.

🧠 What This Move Likely Signals

When institutions move assets off platforms, it often points to:

• Custody restructuring

• Long-term holding strategies

• Preparation for upcoming structural or market shifts

Historically, these kinds of moves precede major market phases, not panic events.

🔍 The Bigger Picture

While retail traders react to candles and headlines, institutions reposition quietly. BlackRock’s activity is a reminder that smart money doesn’t chase narratives — it builds positions before the crowd realizes what’s happening.

The market may look calm on the surface…

But underneath, the giants are already moving 🚀

#Bitcoin #Ethereum #InstitutionalFlow #CryptoMarkets #SmartMoney