The $DUSK protocol represents a pioneering shift in the blockchain landscape, specifically engineered to merge the high-stakes requirements of regulated financial markets with the decentralized ethos of Web3. By focusing on privacy, compliance, and institutional-grade security, Dusk has carved out a unique niche as a "Privacy Layer-1" for Real-World Assets (RWAs).

Central to this ecosystem is the DUSK token, which serves as the lifeblood of the network—powering consensus, facilitating transactions, and incentivizing the very security that makes the protocol viable for institutional adoption.

Core Token Metrics and Supply Dynamics

The economic foundation of the Dusk protocol is built upon a transparent and long-term supply model. Understanding these metrics is essential for grasping how the network maintains value and attracts participants.

Supply Structure

The DUSK token operates under a strictly defined supply cap to ensure predictability for investors and network operators alike.

Initial Supply: 500,000,000 DUSK. This supply consists of the original tokens issued during the early stages of the project, including those on the Ethereum (ERC20) and Binance Smart Chain (BEP20) networks.

Total Emitted Supply: 500,000,000 DUSK. These tokens are not available at launch but are programmatically released over a 36-year horizon to reward those who secure the network through staking.

Maximum Supply: 1,000,000,000 DUSK. This is the hard cap of the protocol; no additional tokens can ever be created beyond this billion-token limit.

The Migration Path

As the Dusk Mainnet is now live, the protocol has entered a critical transition phase. Historically, DUSK existed primarily as a "wrapped" token on other blockchains. To participate in the native ecosystem—such as running a node or staking—users must move their assets to the native Dusk blockchain.

This is achieved through a Burner Contract. When a user "migrates," they lock their ERC20 or BEP20 tokens into a smart contract on the source chain. In return, the Dusk protocol issues an equivalent amount of native DUSK on the mainnet. This process ensures that the total circulating supply remains constant across all chains, preventing any inflationary leakage during the migration.

Token Utility: The Multidimensional Role of DUSK

DUSK is far more than a simple medium of exchange; it is a functional tool required for every core operation within the network. Its utility is designed to create a "circular economy" where demand for network services translates into demand for the token.

Staking and Consensus

The most vital role of the token is providing security. Dusk uses a unique consensus mechanism known as Succinct Attestation (SA). To participate as a validator or a block generator, participants must lock up a minimum of 1,000 DUSK. This stake acts as "skin in the game," ensuring that participants have a financial incentive to follow the rules and maintain high uptime.

Network Fees and "Gas"

Similar to other smart contract platforms, every action on Dusk—from sending a simple payment to deploying a complex decentralized application (dApp)—requires computational resources. These resources are paid for in Gas.

LUX: To allow for precision in small transactions, gas prices are denominated in LUX,

Dynamic Pricing: Gas prices fluctuate based on network demand. This ensures that the network remains efficient and prevents spam attacks by making them prohibitively expensive during times of high congestion.

dApp Deployment and Services

For developers, DUSK is the required currency for deploying confidential smart contracts. Furthermore, service providers within the Dusk ecosystem—such as those offering specialized Zero-Knowledge (ZK) proof generation or data storage—accept DUSK as the primary payment method.

Incentive Structure and Rewards

A blockchain is only as strong as its community of operators. Dusk’s incentive structure is meticulously balanced to reward participation while funding the continuous research and development needed to stay at the cutting edge of cryptography.

The Block Reward Composition

Each time a block is successfully added to the Dusk blockchain, a reward is generated. This reward consists of two distinct parts:

New Emissions: Programmatically released tokens from the 500 million emission pool.

Transaction Fees: The sum of all gas fees paid by users whose transactions were included in that specific block.

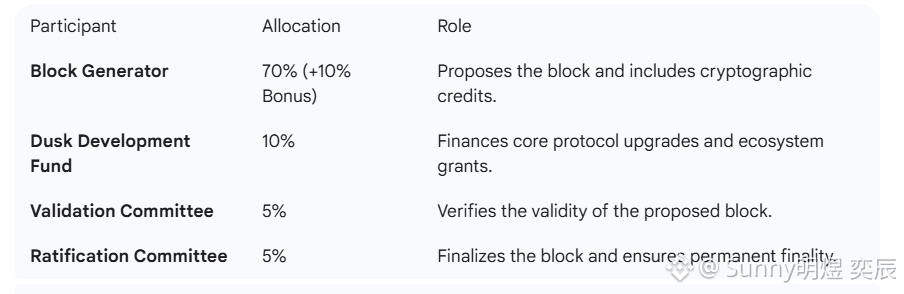

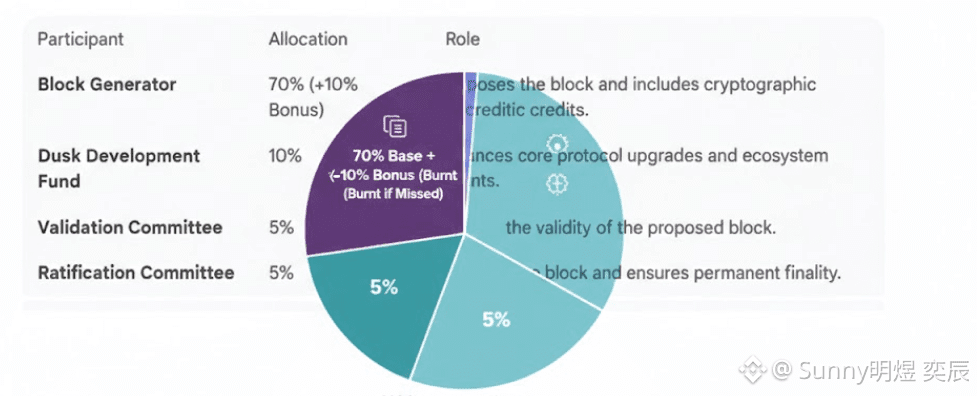

Reward Distribution

The protocol distributes these rewards among various stakeholders to ensure the entire "machinery" of the network is maintained:

The 10% bonus for generators is tied to the inclusion of "credits" in the certificate. If a generator fails to include these, that portion of the reward is burned, introducing a slight deflationary pressure to the token supply.

The 36-Year Emission Schedule

$DUSK has adopted a "Long Tail" emission model, similar in spirit to Bitcoin but tailored for a Proof-of-Stake environment. This schedule is designed to provide high rewards in the early years to bootstrap the network, gradually tapering off as the ecosystem matures and transaction fees become the primary driver of validator income.

Geometric Decay Model

The emission is divided into 9 periods, each lasting 4 years.

The Halving Mechanism: Every four years, the number of tokens emitted per block is reduced.

Sustainability: By spreading the emission over nearly four decades, Dusk avoids "reward cliffs" that could lead to sudden validator exodus. It ensures that the transition from an emission-based economy to a fee-based economy is smooth and predictable.

Security Through "Soft Slashing"

In many Proof-of-Stake networks, "slashing" refers to the permanent destruction of a user's staked tokens if they misbehave. Dusk takes a more nuanced approach called Soft Slashing, which prioritizes network health without being unnecessarily punitive to well-intentioned operators who might face technical difficulties.

When Slashing Occurs

Slashing is triggered by:

Running outdated or malicious node software.

Frequent downtime or missing "assigned duties" (e.g., failing to vote in a committee).

The Consequences

Suspension: The node is temporarily removed from the consensus process. During this time, it cannot earn any rewards. The more frequent the faults, the longer the suspension period.

Penalization: Instead of burning the tokens, a portion of the stake (starting at 10%) is moved to the claimable rewards pool. This means the tokens are not "lost" to the system but are essentially given away to other, more reliable participants.

This system encourages high-quality node operation while acknowledging that hardware failures or internet outages can happen to anyone.

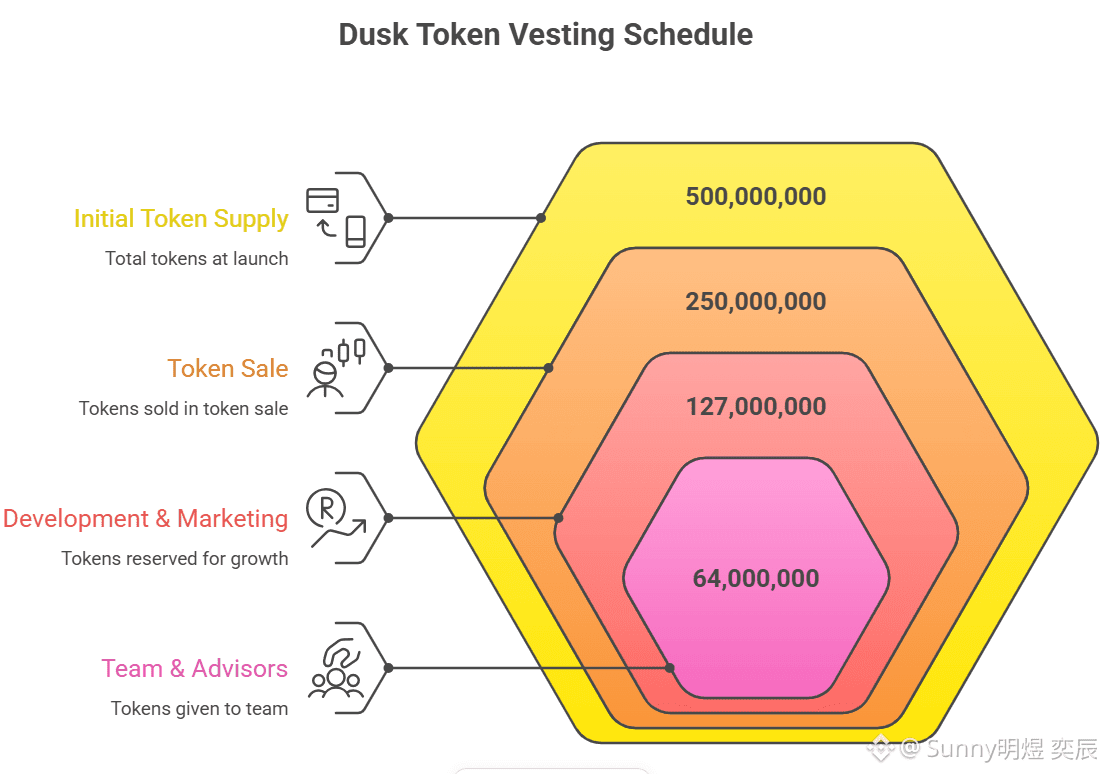

Strategic Allocation and Vesting

To ensure the long-term commitment of the founding team and early supporters, Dusk implemented a rigorous vesting schedule. This period concluded in April 2022, meaning that the vast majority of the initial 500 million tokens are now fully vested and in circulation (or held by the deployer for ecosystem growth).

Token Sale (50%): Provided the initial funding to build the protocol.

Team & Advisors (12.8%): Incentivized the core builders and strategic partners.

Development & Marketing (25.4%): Reserved for technical R&D and growing the global community.

Looking Ahead: The Role of RWAs

As we move through 2026, the DUSK tokenomics are being put to the test by real-world adoption. Partnerships with licensed exchanges like NPEX are beginning to bring hundreds of millions of euros in regulated securities onto the blockchain.

In this environment, $DUSK transcends its role as a "crypto asset" and becomes a settlement layer currency. When a regulated bond or equity is traded on Dusk, the transaction is powered by DUSK gas, and the privacy of the trade is guaranteed by the ZK-proofs that the token incentives support.

By aligning the interests of institutional players, retail stakers, and core developers, the Dusk protocol has built a tokenomic engine designed for the next thirty years of financial evolution.