Cryptoquant found that large custody wallets accumulated $53 billion in Bitcoin over 12 months, suggesting that institutional demand for Bitcoin hasn’t gone away.

Listen

2:30

Cointelegraph in your social feed

Follow our Subscribe on

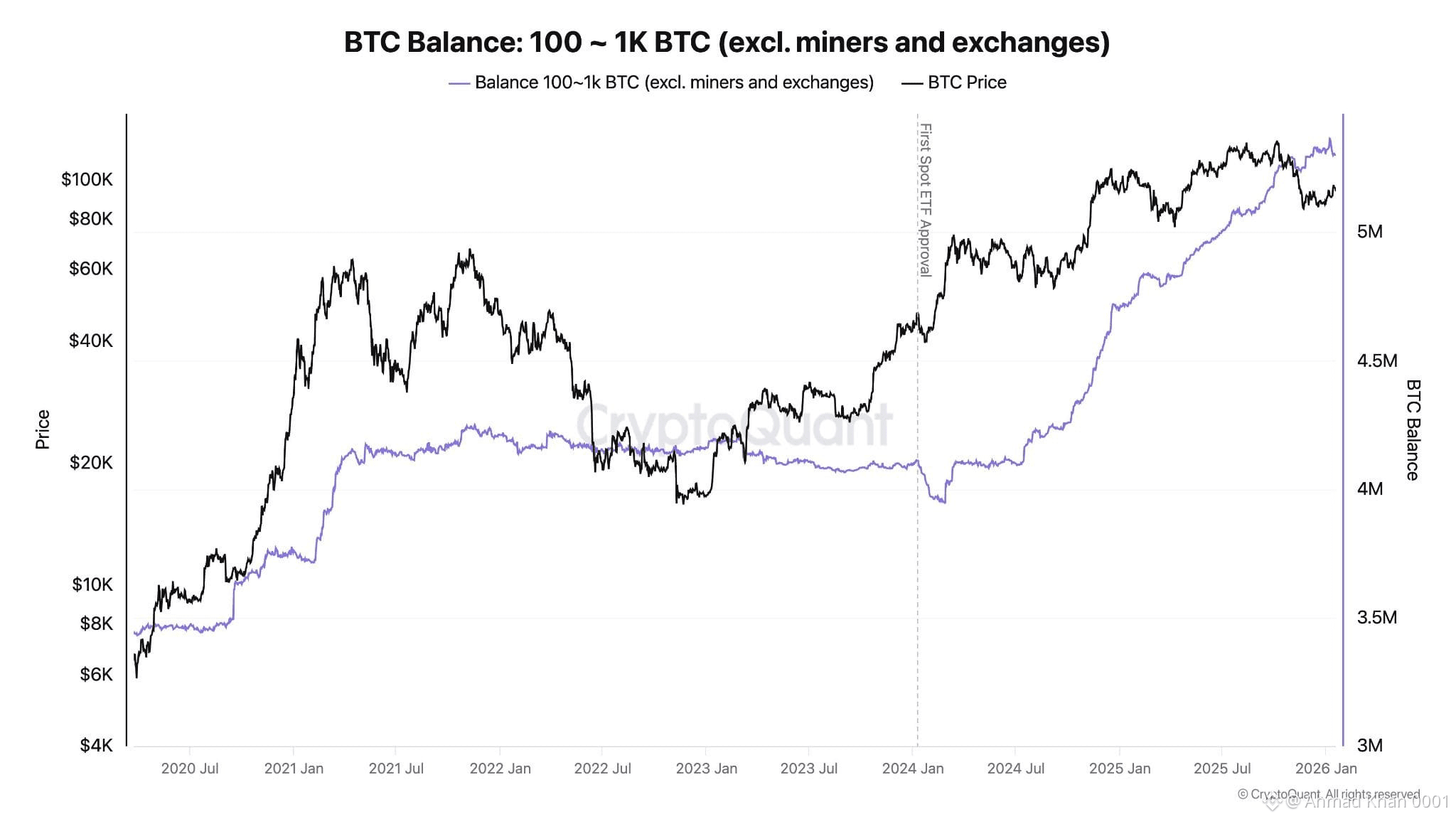

Bitcoin accumulation by wallets holding between 100 and 1,000 BTC could signal that there is continued interest in Bitcoin from institutional investors in the US.

“Institutional demand for Bitcoin remains strong,” said CryptoQuant founder Ki Young Ju on Tuesday, adding that 577,000 Bitcoin

BTC$91,113

has been added to this wallet cohort (which includes exchange-traded funds) over the past year, “and it’s still flowing in.”

“Excluding exchanges and miners, this gives a rough read on institutional demand.”

The increase is around 33% over the last 24 months, according to CryptoQuant, which is around the time when the first spot Bitcoin ETFs were launched.

Spot Bitcoin ETFs in the United States have seen an aggregate inflow of $1.2 billion so far this year, despite the underlying asset gaining around 6%.

“Institutions just began to invest in Bitcoin and Ethereum. I think this is just the beginning. Most people can’t imagine in 2030-2040,” replied political economist “Crypto Seth.”

DAT holdings surge 30% in six months

Part of the surge could also be down to digital asset treasuries.

Crypto DATs, led by Michael Saylor’s Strategy, have scooped up 260,000 BTC since July, worth roughly $24 billion at current market prices.

This marks an increase of 30% over the past six months, outpacing miner supply, reported Glassnode. They now collectively hold more than 1.1 million BTC.$BTC

$BTC #MarketRebound #BTC走势分析 #bitcoin #BitcoinDunyamiz #everyon