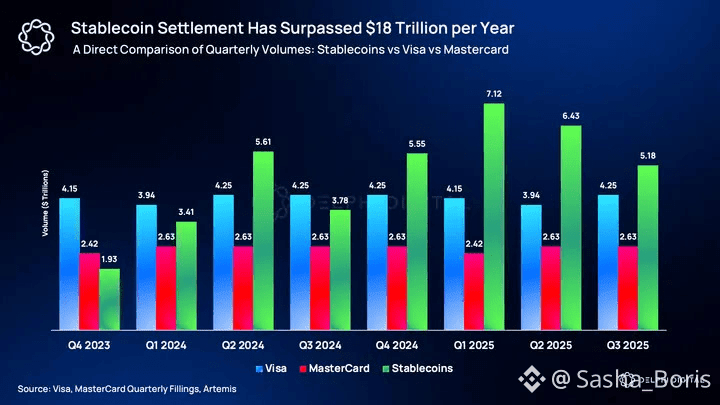

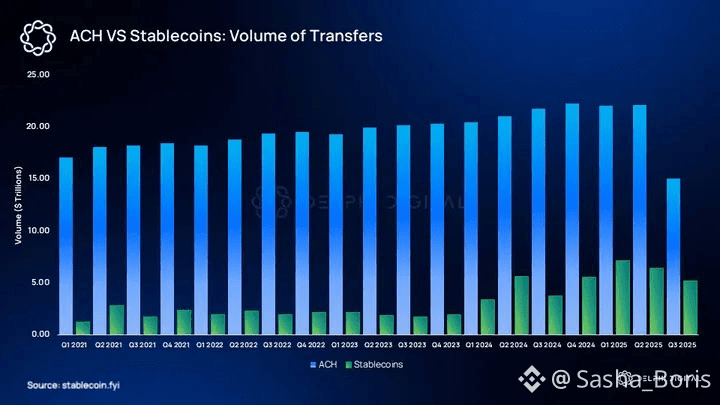

As blockchain infrastructure matures into a serious contender for global financial rails, a new generation of purpose-built networks is emerging—chains that no longer try to be everything for everyone, but instead focus on doing one critical job exceptionally well. Plasma ($XPL) belongs firmly in this category.

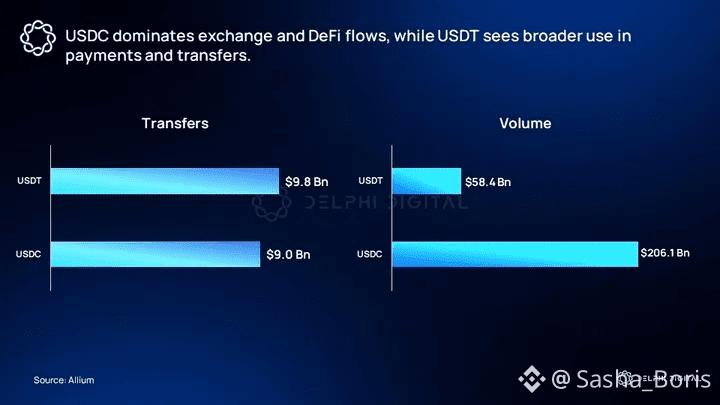

Plasma is not positioning itself as just another smart contract Layer-1. Instead, it is being built as a stablecoin-native settlement network, engineered from the ground up to become the default blockchain for dollar-denominated value transfer. Its vision is simple but powerful: make stablecoins function like real digital money at global scale—fast, cheap, reliable, and institution-ready.

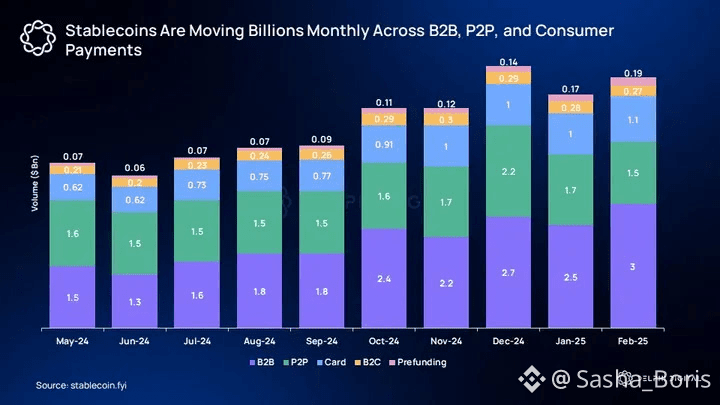

This strategic focus places Plasma at the intersection of crypto infrastructure, global payments, and the expanding stablecoin economy, which is increasingly being used for cross-border trade, remittances, payroll, treasury management, and on-chain finance.

1) The Core Thesis: Stablecoins as the Internet’s Money Layer

Plasma’s foundational idea is that stablecoins are no longer niche crypto assets. They are evolving into a parallel financial system for the digital economy—serving users who need frictionless access to dollars without relying on slow, expensive, and exclusionary banking infrastructure.

Where most blockchains treat stablecoins as just another token type, Plasma flips the model. It treats stablecoins—especially USDT and similar dollar-pegged assets—as first-class citizens. This means:

The base layer is optimized specifically for stablecoin transfers

Fees are designed to be near-zero for simple dollar transactions

Performance is tuned for high-frequency settlement

Network economics are structured around real financial usage, not speculative congestion

In practical terms, Plasma aims to become the on-chain equivalent of a global dollar clearinghouse, allowing billions of dollars to move daily with minimal friction.

2) Why Plasma Exists: The Problem with General-Purpose Blockchains

Plasma was designed in response to very real limitations in existing blockchain infrastructure.

On most general-purpose chains:

Transaction fees fluctuate wildly during network congestion

Settlement times can spike during demand surges

Stablecoin transfers compete with NFTs, meme coins, and arbitrage bots for block space

Users experience unpredictable costs for simple payments

Institutions struggle to build predictable financial products

These issues make traditional chains poorly suited for high-volume, low-margin financial flows, such as remittances, payroll, merchant settlements, and treasury transfers.

Plasma’s design removes this friction by isolating and prioritizing stablecoin activity at the base layer. Instead of competing with speculative traffic, stablecoin users operate in a network environment purpose-built for consistent performance and cost predictability.

3) Network Architecture: Built for Throughput, Finality, and Cost Stability

Plasma’s technical stack reflects its financial mission. Every major architectural choice is designed around speed, scale, and efficiency.

High Throughput Execution Layer

The network is engineered to process thousands of transactions per second, enabling it to support large-scale payment flows, exchange settlement activity, and enterprise treasury movement without performance degradation.

Fast Finality

Plasma targets rapid block finality to ensure transactions settle quickly and irreversibly. This is essential for financial use cases where delayed settlement increases counterparty risk and operational complexity.

Stablecoin-Optimized Fee Mechanics

Unlike traditional chains where gas fees spike under demand, Plasma’s fee model is optimized for predictable, ultra-low-cost stablecoin transfers. This makes it viable for:

Micro-transactions

Retail payments

High-volume merchant settlement

Frequent treasury rebalancing

EVM Compatibility

Plasma supports Ethereum Virtual Machine compatibility, enabling:

Direct deployment of Solidity smart contracts

Easy migration of DeFi protocols

Seamless integration with existing wallets and tooling

Lower onboarding friction for developers

This compatibility allows Plasma to grow an application ecosystem without forcing builders to learn new languages or rewrite code from scratch.

4) Native Bitcoin Interoperability: Bridging the Two Monetary Titans

One of Plasma’s most strategic features is its native Bitcoin bridge, which enables BTC to enter the Plasma ecosystem in a trust-minimized way.

This capability is critical for several reasons:

It allows Bitcoin liquidity to be used inside stablecoin-based DeFi

It enables BTC-backed stablecoin products

It supports cross-chain treasury strategies

It opens the door to hybrid financial instruments that combine Bitcoin’s store-of-value role with Plasma’s settlement efficiency

Rather than treating Bitcoin as a separate ecosystem, Plasma integrates it directly into its financial layer—positioning itself as a convergence point between on-chain dollars and on-chain digital gold.

5) XPL Token: Economic Engine of the Network

The XPL token is not an afterthought—it is a core component of Plasma’s economic and security model.

Transaction and Execution Fees

While stablecoin transfers are optimized for minimal cost, XPL is used to pay for:

Advanced smart contract execution

DeFi protocol interactions

Cross-chain operations

Complex financial logic

This ensures that network resource usage is economically balanced without burdening basic payments.

Staking and Consensus Security

Validators stake XPL to participate in block production and network consensus. This staking mechanism:

Secures the settlement layer

Aligns validator incentives with network health

Creates long-term token demand tied to usage growth

Ecosystem Incentives

XPL fuels Plasma’s growth engine by funding:

Developer grants

Liquidity incentives

User onboarding programs

Infrastructure expansion

This creates a feedback loop where rising network activity strengthens token utility, which in turn attracts more builders and capital.

Supply Structure and Sustainability

The token’s fixed maximum supply is structured to balance:

Early ecosystem bootstrapping

Long-term inflation control

Validator incentives

User adoption rewards

This avoids the excessive token emissions that have destabilized many Layer-1 economies.

6) Launch Phase: Liquidity Surge and Early Adoption

Plasma’s mainnet beta launch marked a major milestone—and the response was immediate.

Within its initial rollout phase:

Billions of dollars in stablecoin liquidity flowed into the network

Early DeFi protocols attracted significant total value locked

Exchange integrations drove trading volume

Payment rails and wallets began onboarding users

This rapid capital inflow signaled strong market demand for a dedicated stablecoin settlement layer rather than another speculative smart contract platform.

7) Early DeFi and Financial Infrastructure Growth

Plasma’s ecosystem is expanding beyond simple transfers into a full-scale financial layer.

Key verticals already taking shape include:

Stablecoin lending and borrowing markets

Yield-generating vaults for idle capital

Cross-chain liquidity routing protocols

Merchant payment gateways

DAO treasury management tools

Institutional settlement rails

This ecosystem breadth reinforces Plasma’s positioning as a financial backbone, not just a transaction network.

8) Market Behavior: Volatility vs. Infrastructure Value

Like most newly launched Layer-1 tokens, XPL has experienced significant price volatility during its early trading life. This reflects:

Speculative trading behavior

Market uncertainty around long-term adoption

Broader crypto market conditions

Early liquidity dynamics

However, Plasma’s value proposition is fundamentally long-term and usage-driven, not hype-driven.

As stablecoin volumes grow globally, the demand for a high-performance settlement layer could rise dramatically—aligning token value with real financial throughput rather than narrative cycles.

9) Strategic Positioning: Not Competing, Specializing

Plasma is not trying to outcompete Ethereum, Solana, or other major Layer-1s across all verticals.

Instead, it is specializing in a single, rapidly expanding niche:

Becoming the default blockchain for stablecoin settlement.

This focused strategy gives Plasma several advantages:

Clear product-market fit

Strong narrative coherence

Lower direct competition

Strong institutional appeal

Predictable infrastructure demand

By anchoring itself to real financial usage, Plasma reduces its reliance on speculative adoption waves.

10) Long-Term Vision: The Digital Dollar Backbone

Plasma’s ultimate goal is to transform stablecoins from trading tools into true global money rails.

If successful, the network could underpin:

Cross-border payroll systems

International merchant payments

On-chain trade finance

Institutional treasury operations

Government and enterprise stablecoin issuance

Consumer payment apps

In this future, Plasma would function as the invisible infrastructure layer beneath global digital commerce—handling settlement while users simply experience fast, cheap, dollar-denominated payments.

Final Outlook

Plasma ($XPL) represents a strategic evolution in blockchain design: a shift away from generic smart contract networks toward specialized financial infrastructure.

By building a stablecoin-native Layer-1 optimized for performance, predictability, and institutional readiness, Plasma is positioning itself as a core settlement engine for the next generation of digital finance.

Rather than chasing hype cycles, it is anchoring itself to a structural trend with massive long-term potential: the global adoption of stablecoins as everyday money.