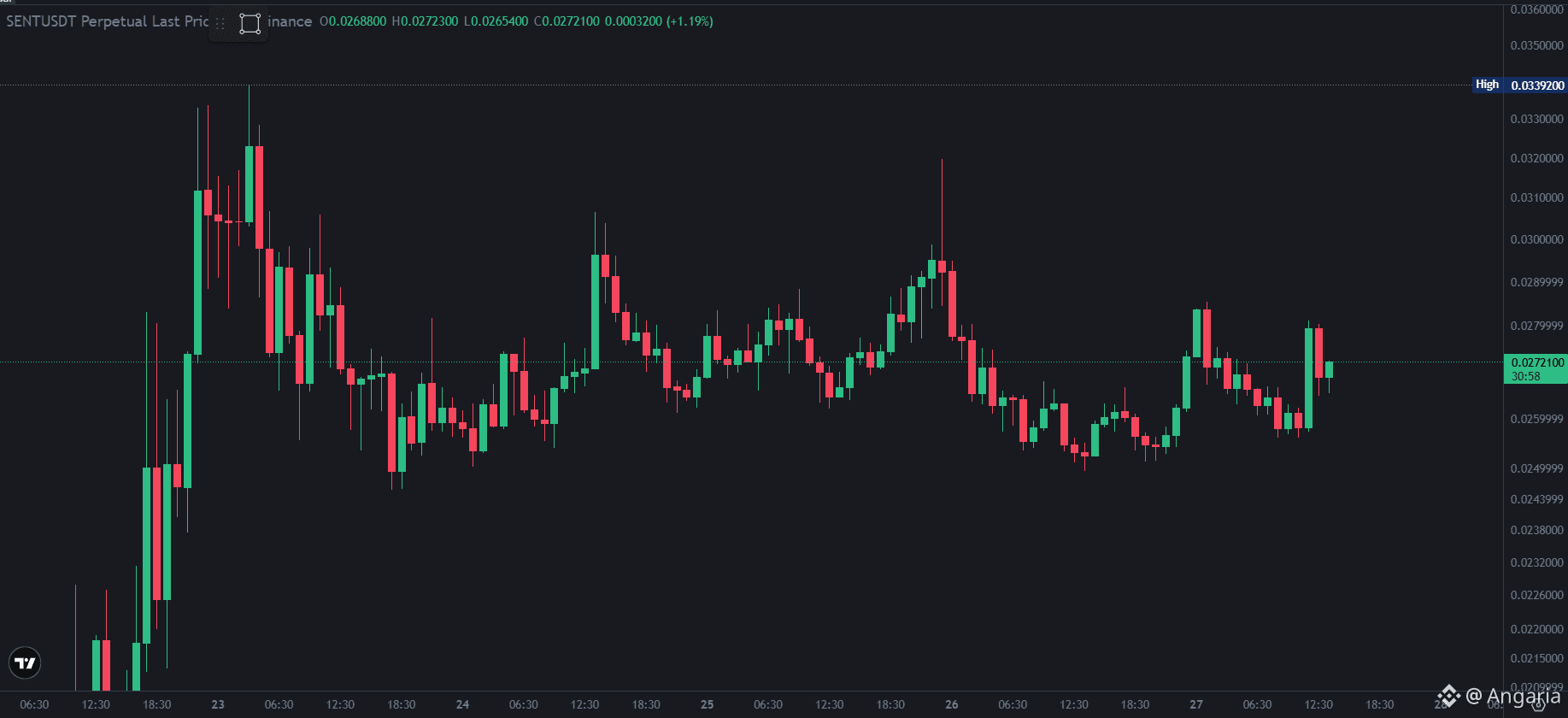

Showing Accumulation — Quiet Strength Before Expansion?

SENT has shifted from impulsive volatility to structured consolidation, and this is where smart positioning usually happens.

📊 What the chart is telling us:

• Price repeatedly holding the 0.025–0.026 demand zone

• Lower wicks getting bought fast → buyers defending levels

• Recent push reclaimed 0.027 area after sweep

• Volatility contraction → expansion likely next

This is no longer random movement — it’s range building, and ranges lead to breakouts.

💡 Key Structure Zones

🔹 Support: 0.0255 – 0.0260 (buyers stepped in multiple times)

🔹 Mid Control: ~0.0271 (current battle zone)

🔹 Breakout Trigger: Clean close above 0.0288–0.0290

🔹 Liquidity Target if breakout: 0.031+

As long as price holds above the demand base, this looks like bullish compression, not distribution.

⚠️ What would invalidate bullish bias?

A strong breakdown with acceptance below 0.025 — until then, dips look like positioning, not panic.

🎯 Trading Logic Here:

Breakout traders wait for structure break. Smart traders watch liquidity grabs inside the range.

👇 Your take:

Do you think SENT breaks upward toward 0.031, or do we see one more fake sweep down first?$BTC