Reconciling Privacy with Regulatory Demands in Modern Finance

There’s a fundamental tension at the heart of blockchain technology: radical transparency versus the need for privacy. The original promise of blockchain was openness—anyone can see transactions, audit balances, and verify activity in real time. But in the world of regulated finance, that level of public scrutiny can create as many problems as it solves.

Financial entities—banks, asset managers, custodians, and investment platforms—are bound by strict privacy laws and compliance standards. Their clients trust them to keep personal details, investment strategies, and transaction histories confidential. At the same time, these institutions are eager to tap into the speed, efficiency, and trustless automation that blockchain brings. But how can they do so without sacrificing the security of sensitive data or running afoul of global privacy regulations?

Enter Dusk—a blockchain platform purpose-built for the complex demands of regulated financial markets. Dusk doesn’t just tack privacy onto an existing framework; it’s engineered from the ground up to ensure financial activity remains secure, private, and compliant, all while preserving the critical transparency necessary for trust and regulatory oversight.

Let’s dive deeper into how Dusk achieves this delicate balance.

The Core Challenge: Openness vs. Confidentiality

Traditional public blockchains operate like fishbowls—every transaction, balance, and contract is visible to anyone with an internet connection. This model works well for open DeFi platforms, but it’s a nonstarter for institutions that handle private wealth, trade-sensitive strategies, or proprietary client information.

In regulated finance, data such as investor identities, portfolio compositions, trade sizes, and internal compliance documentation must be tightly controlled. Publicly exposing this information isn’t just a privacy misstep—it can be a legal violation and a reputational risk, potentially opening the door to front-running, data theft, or regulatory penalties.

The real challenge is to provide verifiable proof that institutions are operating responsibly—complying with anti-money laundering (AML) rules, performing proper KYC checks, and adhering to trading limits—without exposing the granular details that should remain confidential.

How Dusk Delivers Privacy Without Sacrificing Auditability

Dusk’s architecture is centered around privacy—but it doesn’t come at the expense of regulatory requirements. Here’s how Dusk’s unique approach makes this possible:

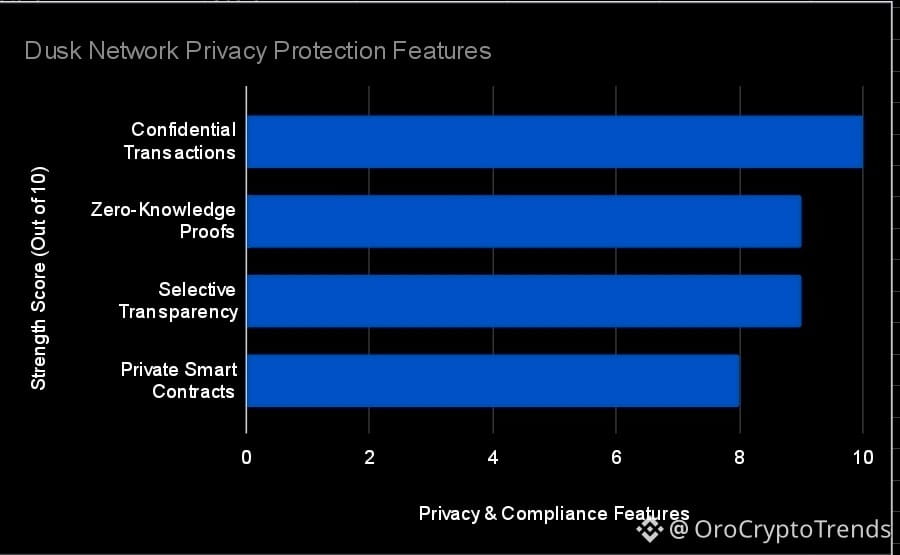

1. Confidential Transactions

Dusk employs cryptographic techniques to keep transaction details private by default. Rather than broadcasting the who, what, and how much of every transfer, Dusk encrypts this information, ensuring only authorized parties can access it. For institutions, this means they can settle trades, distribute dividends, or rebalance portfolios on-chain without revealing sensitive information to competitors or the public.

This approach not only protects investor confidentiality but also mitigates the risk of data-driven attacks and preserves institutional alpha, all while maintaining the benefits of blockchain—immutability, audit trails, and rapid settlement.

2. Selective Transparency Mechanisms

Dusk recognizes that privacy must coexist with regulatory oversight. Its selective transparency features allow institutions to grant access to specific data sets only to authorized entities—such as regulators, auditors, or compliance officers—on a need-to-know basis. The public blockchain remains secure and opaque, but those with proper clearance can unlock the necessary information to perform audits, ensure regulatory compliance, and investigate suspicious activity.

This dual-layered approach fosters trust: investors know their data is safe from public view, but regulators retain the ability to enforce compliance and uphold market integrity.

3. Zero-Knowledge Proofs: Trust Without Disclosure

A cornerstone of Dusk’s privacy model is zero-knowledge cryptography. This advanced technique allows one party to prove to another that a statement is true—such as verifying someone’s eligibility or compliance status—without revealing any underlying personal data.

For example, an investor can demonstrate they have passed all required KYC/AML checks without ever exposing their passport number or address on the blockchain. Similarly, institutions can prove that their portfolio allocations meet regulatory thresholds without sharing proprietary trading data. This not only streamlines compliance but also reduces the attack surface for data breaches, a critical concern in modern finance.

4. Privacy-Focused Smart Contracts

Most blockchain smart contracts are fully transparent, exposing every rule and input to the public. Dusk’s private smart contracts enable sophisticated financial logic—like complex fund management, automated compliance verifications, or conditional asset transfers—to be executed securely and confidentially. The contract’s logic is verifiable and enforceable, yet the sensitive business data it processes remains shielded from competitors and unauthorized parties.

This unlocks a new era of programmable finance for institutions, allowing them to automate processes and launch innovative products without compromising on privacy or regulatory obligations.

Why This Matters for Investors

For individual and institutional investors alike, Dusk’s privacy-first approach offers tangible advantages:

- Enhanced Data Protection: Personal and financial details are never exposed to the public, significantly reducing the risk of identity theft, front-running, or data misuse.

- Regulatory Confidence: Platforms built on Dusk can easily demonstrate compliance, building trust with both clients and regulators.

- Reduced Operational Risk: With privacy and compliance handled at the protocol level, institutions can focus on innovation and service, rather than constantly worrying about leaks or regulatory slip-ups.

Dusk’s infrastructure creates an environment where investors can confidently participate in digital markets, knowing their interests are protected from both cyber threats and regulatory pitfalls.

Where Dusk’s Privacy Toolkit Shines

The need for privacy isn’t limited to one corner of finance. Dusk’s technology is especially impactful in scenarios such as:

- Tokenized securities markets, where shares, bonds, and funds can be traded efficiently without leaking sensitive investor data.

- Private investment funds and venture capital, where allocations and strategies are highly guarded.

- Regulated trading venues seeking to modernize without exposing clients to unnecessary risks.

- Digital identity solutions, where verifying credentials is essential but revealing personal documentation is not.

In these domains, privacy is not a luxury; it’s a legal and ethical imperative.

Conclusion: Building Trust in the Next Era of Finance

Dusk demonstrates that transparency and privacy are not mutually exclusive. By weaving together confidential transactions, selective transparency, zero-knowledge proofs, and private smart contracts, Dusk creates a robust foundation where investor protection and regulatory compliance reinforce each other on-chain, rather than being at odds.

As financial markets evolve and more assets move onto blockchain rails, the ability to balance confidentiality with verifiability will be critical. Dusk is pioneering this path, enabling institutions, investors, and regulators to embrace the future of finance—secure, compliant, and privacy-preserving by design.

Disclaimer Not Financial Advice