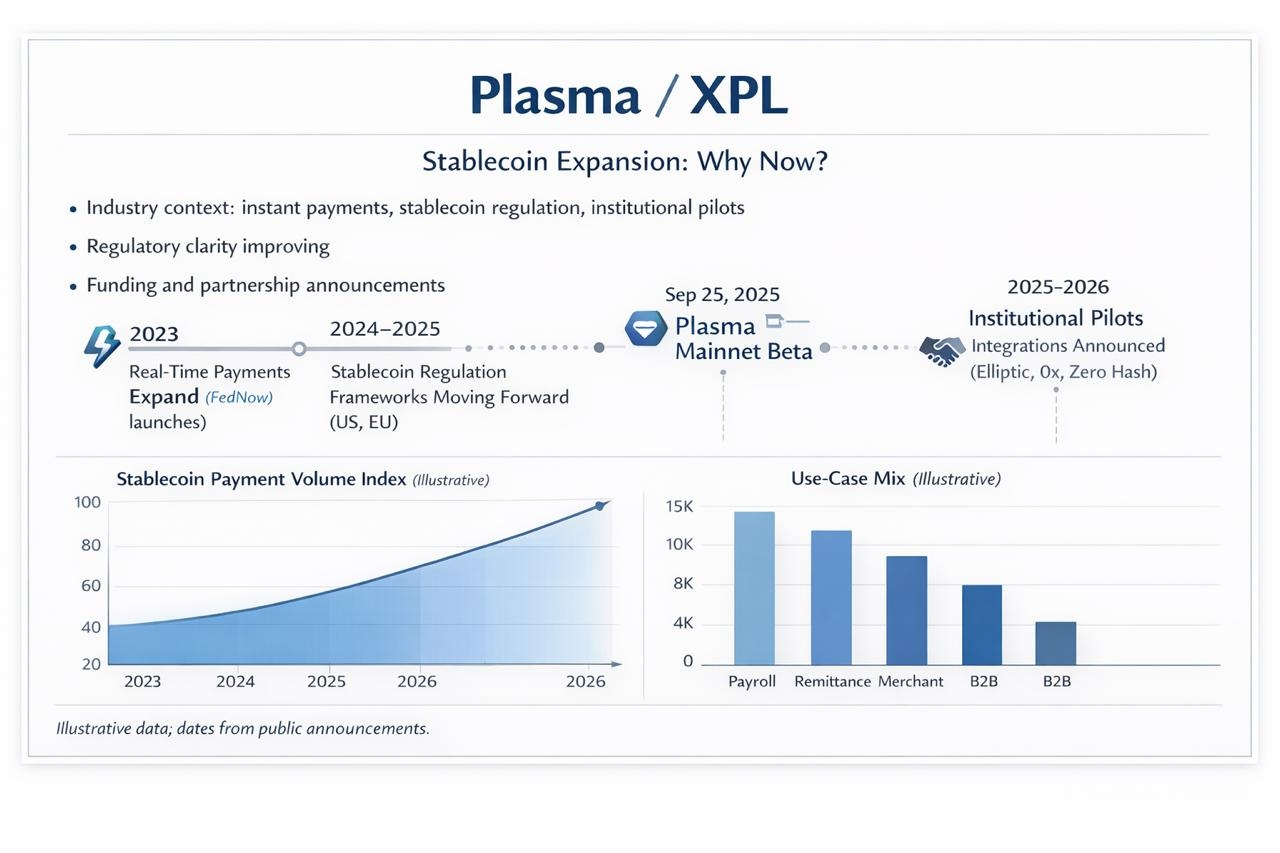

A few years ago, “digital dollars” still sounded like a science project: interesting, maybe inevitable, but easy to ignore if your paycheck cleared and your card worked. Now it feels more like plumbing. People don’t get excited about plumbing, but when it creaks—late payouts to contractors, weekend delays, cross-border transfers that behave like they’re traveling by fax—you suddenly care about the pipes. Stablecoins, the dollar-pegged tokens that live on blockchains, have become a workaround for some of those creaks. They’re also arriving at a moment when instant payments systems like the Fed’s FedNow have made “money moves now” feel like a normal expectation. That’s where the idea of “Plasma partnerships” lands for me. Plasma positions itself as a stablecoin-first Layer 1 built for USD₮ payments at scale. I’m skeptical by default, because every new rail says it will be faster than the last one. What changes the tone is the way the ecosystem is being stitched together around the rail. Elliptic has partnered with Plasma to support compliance monitoring. Zero Hash has announced support aimed at expanding access to stablecoin payments on the network. 0x says its Swap API is live on Plasma, a reminder that “payments” often need liquidity infrastructure nearby, even if the end user never sees it. Those deals are the connective tissue that turns a protocol into something operators can integrate.

The wider environment has shifted in a way that makes this feel less speculative. In July 2025, the U.S. passed the GENIUS Act to set national rules for payment stablecoins—but it also makes one thing crystal clear: these coins aren’t government-backed, and they aren’t federally insured. And the fight isn’t over: Reuters reported in February 2026 that banks and crypto companies were still butting heads over whether stablecoins should be allowed to pay interest or rewards. Meanwhile, incumbents are experimenting in public. Circle announced a payments network meant to connect financial institutions for real-time cross-border settlement using stablecoins like USDC and EURC. Visa said in December 2025 that U.S. institutions can settle via its stablecoin program using USDC, pointing to more than $3.5B in annualized stablecoin settlement volume. PayPal and Coinbase have pushed PYUSD toward everyday use by removing transaction fees on Coinbase and enabling direct redemptions into U.S. dollars. There’s also a slightly unsettling maturity to the stablecoin world. The Financial Times recently described Tether, the issuer of USDT, plotting a broad expansion and making investments far beyond its original role.

When I try to hold the whole picture in my head, I come back to a simple question: if a stablecoin looks like dollars, why doesn’t it behave like dollars everywhere? The answer is that “behave like dollars” is a bundle of things—finality, reversibility, consumer protections, and confidence in the issuer—and those pieces don’t travel automatically with a token. Plasma-style partnerships are one attempt to build more of that reality into the rail, so digital dollars can move faster without pretending trust and accountability are optional.