Here’s the latest gold price analysis (as of December 25, 2025) with a photo/chart showing current market context:

📊 Gold Market Analysis — December 2025

🟡 Current Price & Trend

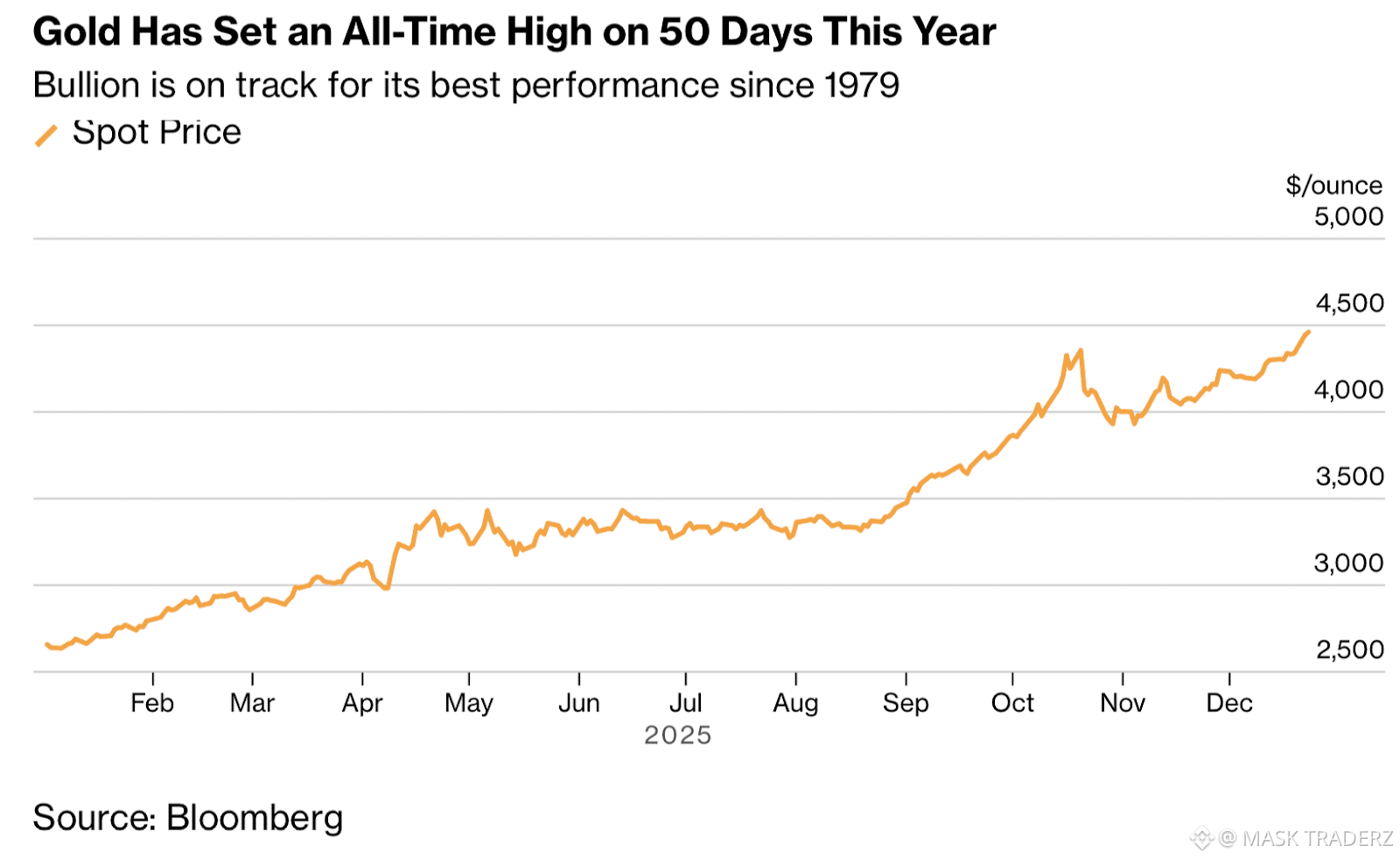

#GOLD prices have hit record highs above $4,500 per ounce, marking strong bullish momentum into year-end. Reuters+1

Live spot prices are trading around $4,490–$4,500 per ounce (subject to market hours). JM Bullion

Markets show some profit-taking/pullback as the rally pauses, likely due to thin year-end liquidity. FXEmpire

📈 What’s Driving the Rally

Bullish factors:

✔ Safe-haven demand amid geopolitical tensions and global uncertainty. Reuters

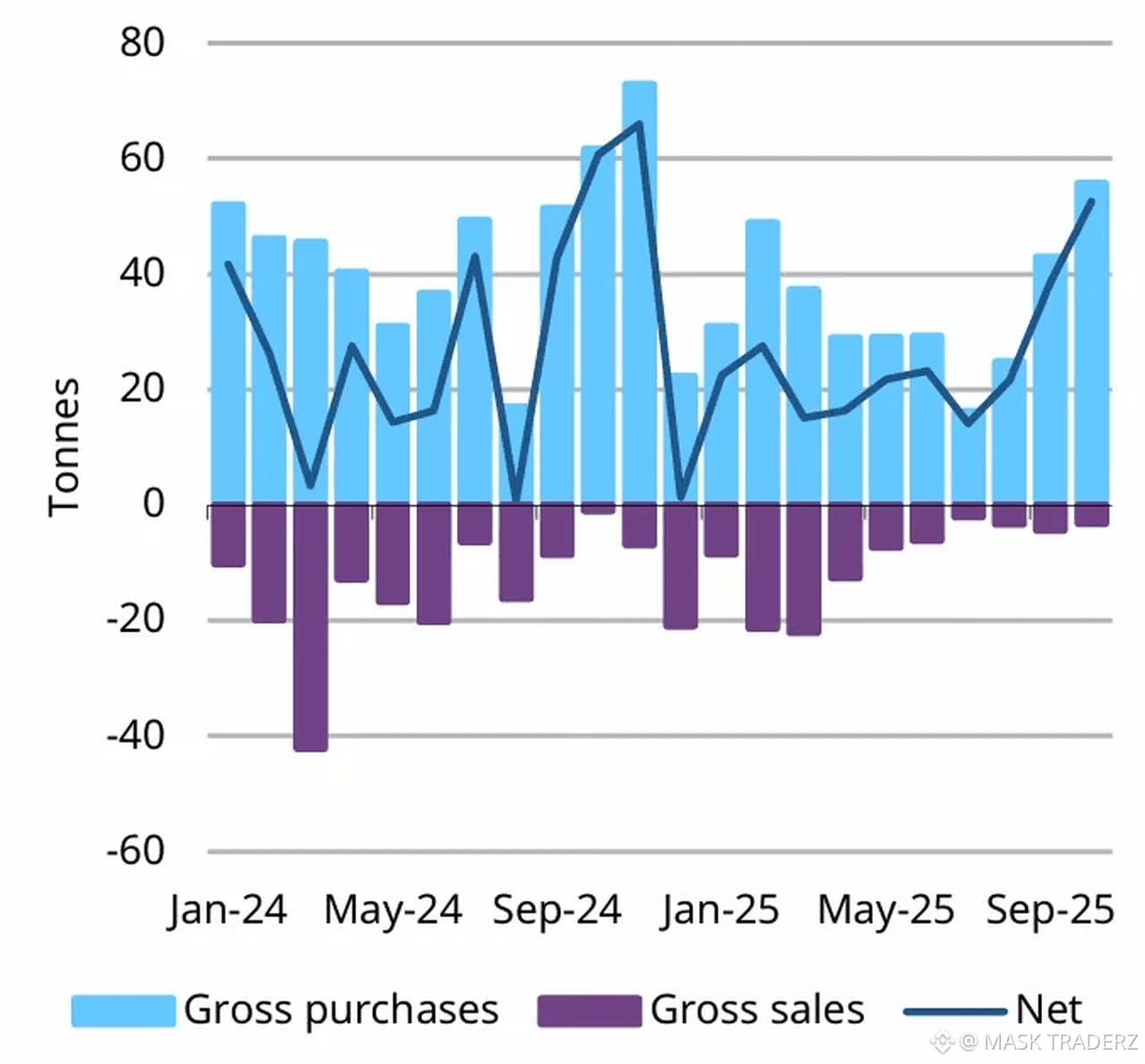

✔ Strong central bank buying and ETF inflows. Reuters

✔ Expectations of US Federal Reserve interest-rate cuts in 2026, which typically weaken the dollar and support gold. The Economic Times

Technical signals:

Prices retreated slightly after making new highs above $4,520 but remain near record levels, indicating trend continuation more likely than reversal for now. FXStreet

Cautionary notes:

Thin holiday trading volumes can exaggerate swings and short-term volatility. MarketWatch

📅 Short-to-Medium Term Outlook

Near term (days/weeks):

Algorithm-based forecasts suggest prices may continue edging higher into year-end (potentially toward ~$4,650). CoinCodex

Into 2026:

Some major banks forecast continued gains, with targets as high as $4,900 per ounce by end-2026. Reuters

Others warn of possible corrections if speculative momentum fades or macro drivers shift. The Times

🧠 What Traders Are Watching

Fed policy cues & expectations of rate cuts

U.S. dollar strength/weakness

Geopolitical risk events

Central bank gold purchases

Liquidity conditions around year-end

If you want, I can also provide key support/resistance levels for gold (#XAU /#USD ) and what that implies for trading decisions.