The cryptocurrency market has long ceased to be a space reserved exclusively for speculation and sharp price swings. Today, it is increasingly used as a full-fledged financial ecosystem, where users seek not only capital growth but also stable and predictable income. This is especially relevant against the backdrop of global inflation, declining real returns on bank deposits, and growing distrust toward traditional financial institutions.

In this environment, stablecoins come to the forefront—first and foremost USDT, a digital equivalent of the US dollar that combines the stability of fiat currencies with the technological advantages of blockchain. And when a stablecoin is used not merely as a store of value but as an income-generating tool, one of the most in-demand DeFi products emerges — USDT staking.

USDT staking at 35% APR in Super Wallet is a special offer designed for those who want to earn significantly more than bank interest rates without taking on the risks associated with high crypto market volatility. In this article, we will take an in-depth look at how this model works, how such returns are generated, what risks exist, and why Super Wallet offers one of the most balanced solutions on the market.

What Is USDT and Why It Is Ideal for Staking

The Concept of Stablecoins

USDT (Tether) belongs to the class of stablecoins — cryptocurrencies whose value is pegged to fiat currencies, in this case the US dollar. A 1:1 peg means that 1 USDT always aims to maintain a value close to 1 USD.

The primary purpose of USDT is to eliminate the volatility typical of traditional cryptocurrencies and provide users with a stable settlement instrument within the blockchain ecosystem.

Why USDT

USDT is the most widespread and liquid stablecoin in the world. It is used:

on centralized and decentralized exchanges

in DeFi protocols

on lending and yield platforms

for international settlements

as a protective asset during market turbulence

Thanks to this, USDT has become the ideal foundation for conservative investment strategies focused on capital preservation and stable income.

What Is USDT Staking in Simple Terms

USDT staking is the process of placing stablecoins into special pools or strategies where they begin to work and generate yield. In logic, it resembles a bank deposit, but with fundamental differences:

income is generated through DeFi instruments

there is no bank acting as an intermediary

management is carried out via smart contracts

yields are significantly higher

Your USDT does not simply sit idle — it participates in the decentralized finance economy by providing liquidity, enabling lending, and supporting other processes for which protocols pay rewards.

What Does 35% APR Mean and Why This Is a Special Offer

Understanding APR

APR (Annual Percentage Rate) is an annual interest rate that shows the potential return over a year without taking compound interest into account. A 35% APR means that, under stable conditions, you can earn up to 35% of your deposited amount per year.

For stablecoins, such yield is considered high and is not always available. This is why the offer from Super Wallet is classified as a special one.

Why the Yield Is Above Market Average

The increased 35% APR is achieved through:

the use of complex DeFi strategies

optimized liquidity allocation

the scale of the Super platform

automated capital management

reduced operational costs

It is important to emphasize that Super Wallet does not rely on risky speculative schemes and does not promise “guaranteed profits,” but operates within a well-designed financial model with risk controls.

Super Wallet: A Next-Generation Platform

What Is Super Wallet

Super Wallet is not just a crypto wallet but a full-fledged DeFi platform that combines:

non-custodial asset storage

staking and yield strategies

portfolio management

Web3 access to decentralized services

a high level of security

Users maintain full control over their assets and make decisions independently without handing funds over to third parties.

The Philosophy of Super Wallet

Super Wallet is built around several core principles:

security and user control

transparency of yield mechanisms

automation without loss of flexibility

focus on long-term sustainability

usability even for beginners

How USDT Staking at 35% APR Works in Super Wallet

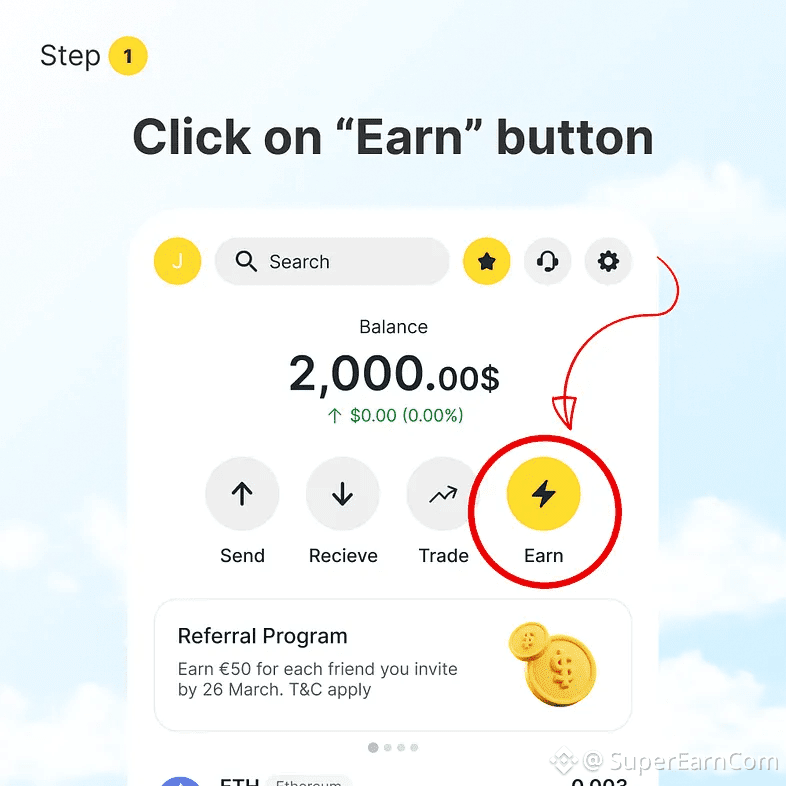

Step-by-Step Process

The user transfers USDT to Super Wallet

Selects the USDT staking offer at 35% APR

Places funds into the staking pool

Funds are automatically allocated across yield strategies

Yield accrual begins immediately after placement

The user tracks profits in real time

The process is fully automated and does not require manual management or advanced technical knowledge.

Where Your USDT Is Working

USDT placed in staking is used in:

DeFi lending protocols

stable liquidity pools

arbitrage strategies

yield-generating stablecoin pairs

institutional-grade DeFi mechanisms

Each strategy undergoes preliminary selection and continuous monitoring.

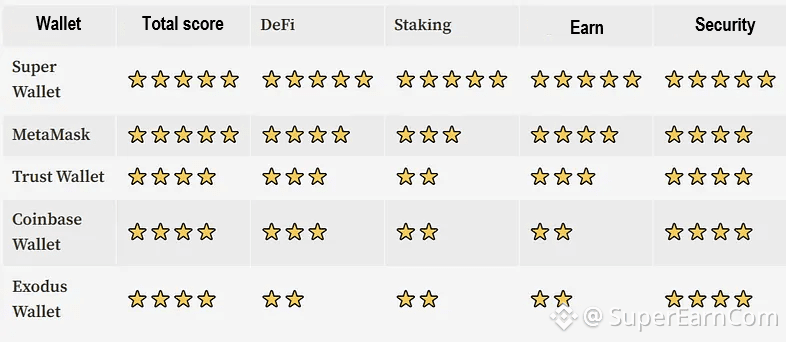

Comparison of Web3 wallets

Yield Accrual and Fund Withdrawal

How Yield Is Accrued

Yield from USDT staking at 35% APR in Super Wallet is generated based on the real performance of DeFi strategies. Depending on the offer conditions, the following may apply:

regular yield accrual

real-time profit accumulation

automatic compounding

transparent yield display in the Super Wallet interface

Users always see their current balance, accrued income, and overall performance.

Fund Withdrawal

One of the key advantages of USDT staking in Super Wallet is high liquidity.

fund withdrawal is available at any time

no rigid capital lock-up

partial or full USDT withdrawal is possible

users can reinvest funds at any moment

terms and fees are transparent and known in advance

This makes the product suitable both for long-term investors and users who value flexibility.

Security of USDT Staking in Super Wallet

Non-Custodial Approach

Super Wallet uses a non-custodial storage model, which means:

private keys belong exclusively to the user

the platform does not control user funds

assets are secured at the blockchain level

Even in the event of external issues, users retain full control over their capital.

Technical Protection and Control

To ensure security, Super Wallet applies:

multi-layer smart contract architecture

continuous transaction monitoring

limits on critical operations

automated protection mechanisms

rapid response to market changes

The security level of Super Wallet meets institutional standards.

Risks of USDT Staking and Super Wallet’s Approach

Potential Risks

Despite the stability of USDT, certain risks remain:

smart contract vulnerabilities

DeFi protocol risks

temporary yield fluctuations

systemic failures

regulatory changes

How Super Wallet Minimizes Risks

To reduce potential threats, Super Wallet employs:

strategy diversification

limits on fund allocation

selection of proven protocols

regular audits of strategy logic

dynamic rebalancing

The primary goal is capital preservation and income stability.

Who Is USDT Staking at 35% APR Suitable For

Ideal For:

investors focused on stable income

holders of capital in USDT

users tired of volatility

those seeking an alternative to bank deposits

long-term stablecoin holders

May Not Be Suitable If:

you are looking for fast speculative trades

you are unwilling to use DeFi

you cannot accept even moderate risks

you require absolute income guarantees

Comparison With Banks and Classic DeFi

Bank Deposits

low real yields

inflation erodes profits

withdrawal restrictions

rigid conditions

Classic DeFi Without Automation

complex interfaces

manual management required

high probability of user errors

lack of support

USDT Staking in Super Wallet

yields up to 35% APR

stable base asset

automated strategies

flexible withdrawals

high level of protection

Taxes and Income Reporting

Taxation of staking income depends on the legislation of the user’s country of residence. Super Wallet:

does not withhold taxes automatically

provides a full transaction history

allows export of data for reporting

Users are advised to consult local tax professionals regarding their obligations.

The Future of USDT Staking and the Role of Super Wallet

Stablecoin staking is becoming one of the key growth areas of DeFi. With increasing institutional interest, automation, and regulation, such products are expected to become even more in demand.

Super Wallet already offers:

competitive yields

a sustainable architecture

a strong focus on security

usability for a broad audience

In the future, the Super ecosystem will continue expanding its strategy lineup and strengthening capital protection.

Conclusion

USDT Staking at 35% APR: A Special Offer from Super Wallet is a modern and well-balanced solution for those who want to earn high yields on stablecoins without aggressive risk-taking. It combines the stability of USDT, the capabilities of DeFi, and the thoughtfully designed infrastructure of Super Wallet.

This is not a short-term experiment, but part of a long-term strategy aimed at creating a sustainable and transparent next-generation financial product.

Start earn USDT on Super Wallet: superearn.com/wallet