Or Destroy It by Exiting at the Wrong Moment! 📉🚀💰

The chart attached from Goldman Sachs is one of the most dangerous documents you may ever see in your investing life. It proves that just a handful of days can be the difference between becoming a millionaire—or remaining an average investor. The statistics are shocking and completely demolish the idea of “daily trading.”

📊 The Numbers (The Mind-Blowing Gap):

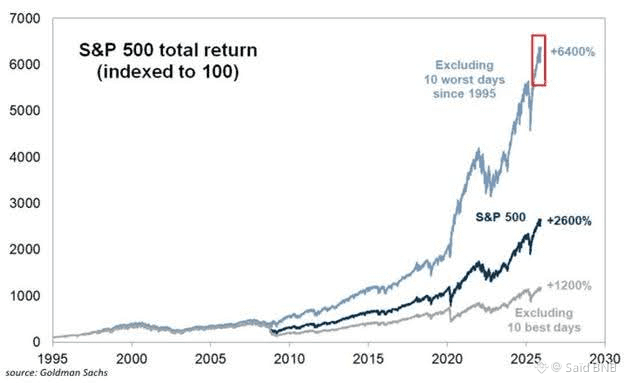

A comparison of the S&P 500 performance from 1995 to 2025 in three scenarios:

1️⃣ The Dream Scenario (light blue line):

If you could—by some magic—avoid only the worst 10 days in the market, your returns would skyrocket to +6,400%!

2️⃣ Reality (dark blue line):

The actual index return (including every good and bad day) is +2,600%.

This means those 10 bad days wiped out more than half of your potential gains.

3️⃣ The Nightmare Scenario (gray line):

If you tried to time the market and mistakenly missed the best 10 days, your returns would collapse to only +1,200%.

⚠️ What the Chart Really Says (The Terror of Critical Days):

The most dangerous line in the entire analysis is:

“A few critical days can determine decades of performance.”

The terrifying gap widens sharply during 2008 and 2020, when 8 of the worst 10 days in market history occurred.

The lesson: The worst crashes are often followed by the strongest rebounds. Trying to escape the “blue” zone can trap you in the “gray” disaster.

🔍 What’s Behind the Curtain? (The Illusion of Timing):

Why is this chart frightening?

Because it tempts us with an impossible fantasy:

“What if I just sold one day before the crash?”

But the painful truth is that no one has a crystal ball.

The investor who sells in panic (to avoid the bad days) almost always misses the massive rebound that follows immediately after (the best days).

The difference between +6,400% and +1,200% isn’t intelligence—

it’s luck in timing, or patience in staying invested.

💡

This chart is undeniable proof of the famous saying:

“Time in the market beats timing the market.”

Staying invested—despite the pain—delivers +2,600%.

Jumping in and out trying to catch tops and bottoms is a gamble that can cost you 5x your potential wealth.

Fortune is built on the days when blood is in the streets—not when everything is calm.

💬 Discussion:

Be honest—are you someone who sells and runs at the first sign of a crash to “protect capital”?

Or do you stick to a Buy & Hold strategy no matter what happens?