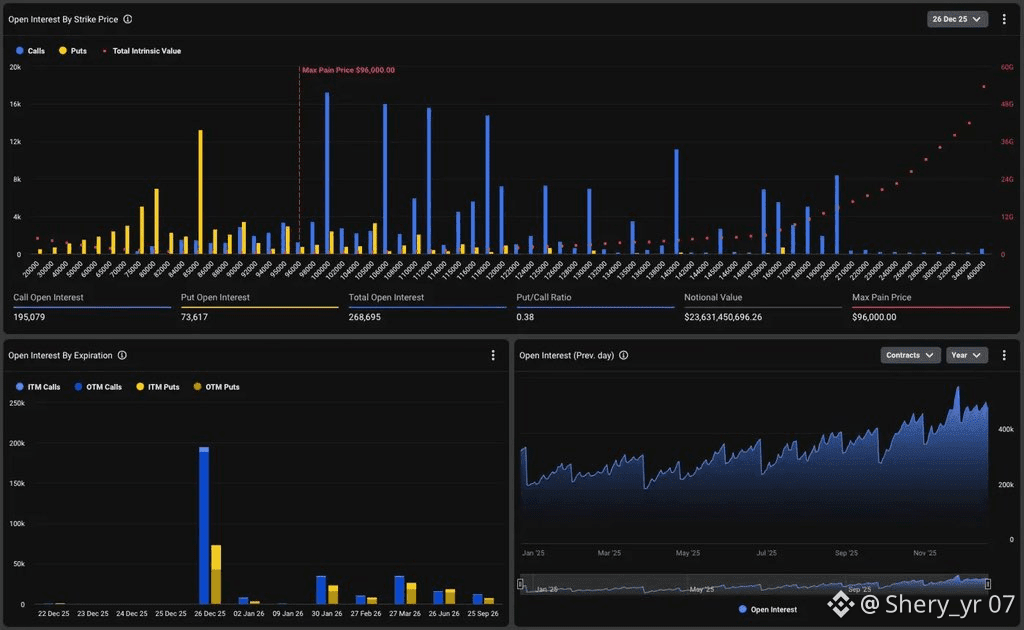

This Friday, on Dec 26, over $23.6 BILLION worth of Bitcoin options expire.

That’s the largest options expiry Bitcoin has EVER SEEN.

If you have any money in crypto, you SHOULD NOT ignore this.

Let me explain why it matters:

First, you need to understand what an options expiry actually is.

Options are leveraged bets on price. Calls bet BTC will be higher, and puts bet BTC will be lower.

When they expire, one of two things happens:

– They expire worthless

– Or they force hedging, buying, or selling in the spot market

With $23.6B rolling off at once, a huge amount of risk comes off dealer books in a single day.

That’s where volatility comes from.

Now look at how big this is in context.

2021 year-end expiry: ~$6B

2022: ~$2.4B

2023: ~$11B

2024: ~$19.8B

2025: $23.6B

This market is no longer driven by retail… this is institutional size risk being repriced in real time.

Why Friday matters specifically:

– Dealers are heavily hedged around key strikes

– Once expiry hits, those hedges come off

– That can cause sharp moves in either direction

Especially in low liquidity conditions and right now, liquidity is almost non existent.

Holiday week, less volume, so more impact per order. That’s how you get violent moves without news.

A lot of this open interest is clustered near major psychological levels and after expiry, it completely disappears.

That’s why you often see chop into expiry, then a clean move shortly after.

Volatility is literally the setup this week. You need to watch price after expiry, not just into it.

Btw, I’ve been studying macro for the last 22 years, and I’ve been in Bitcoin since 2013. I called the last two major market tops and bottoms.

When the next bottom is in and I start buying BTC again, I’ll say it here publicly so you can act on it.

If you still haven’t followed me, you’ll regret it.