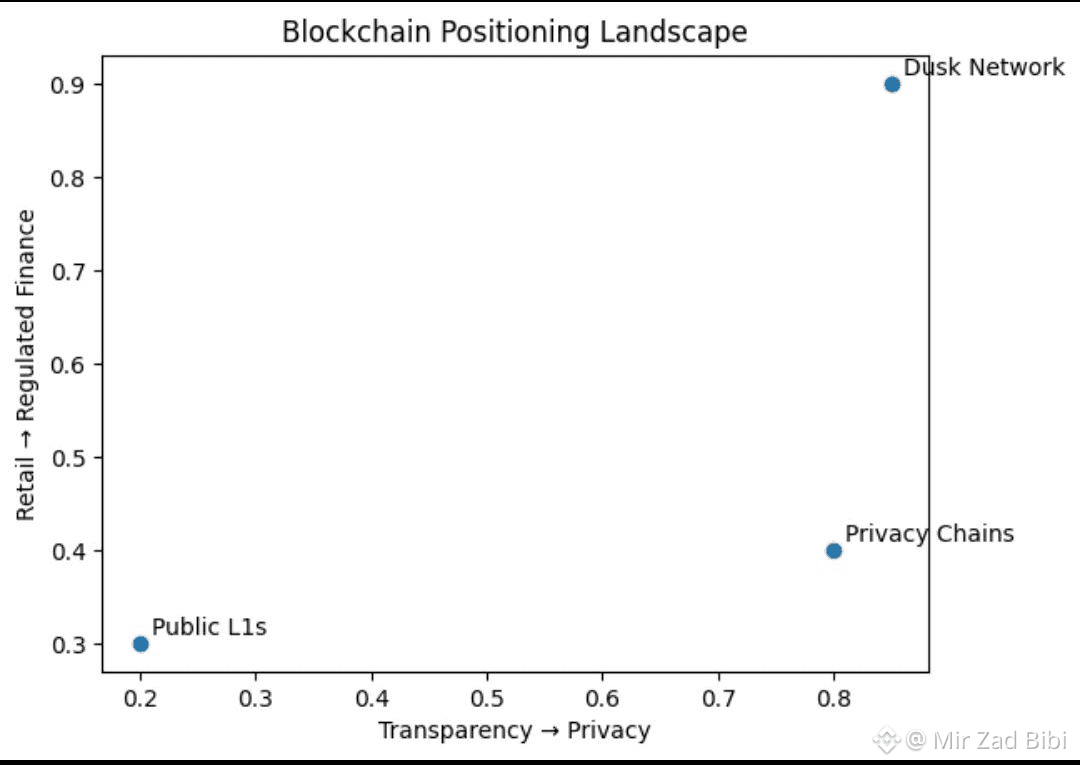

Dusk Network is no longer just a privacy-first blockchain experiment. The project has evolved into a purpose-built Layer 1 focused on regulated finance, tokenized securities, and real-world assets that require confidentiality without sacrificing compliance.

As institutions move onchain, the demand is shifting from anonymous transactions to selective privacy — where sensitive data is protected, but verification remains transparent. This is the space Dusk is targeting.

Privacy Built for Compliance, Not Avoidance

Dusk’s core differentiation lies in its zero-knowledge architecture designed specifically for regulated markets. Transactions can remain confidential while still producing cryptographic proofs that auditors, regulators, and counterparties can verify when required.

This approach aligns with how real-world financial systems operate: privacy by default, disclosure by permission. For tokenized equities, bonds, or funds, this model is not optional — it is essential.

EVM Compatibility Changes the Adoption Curve

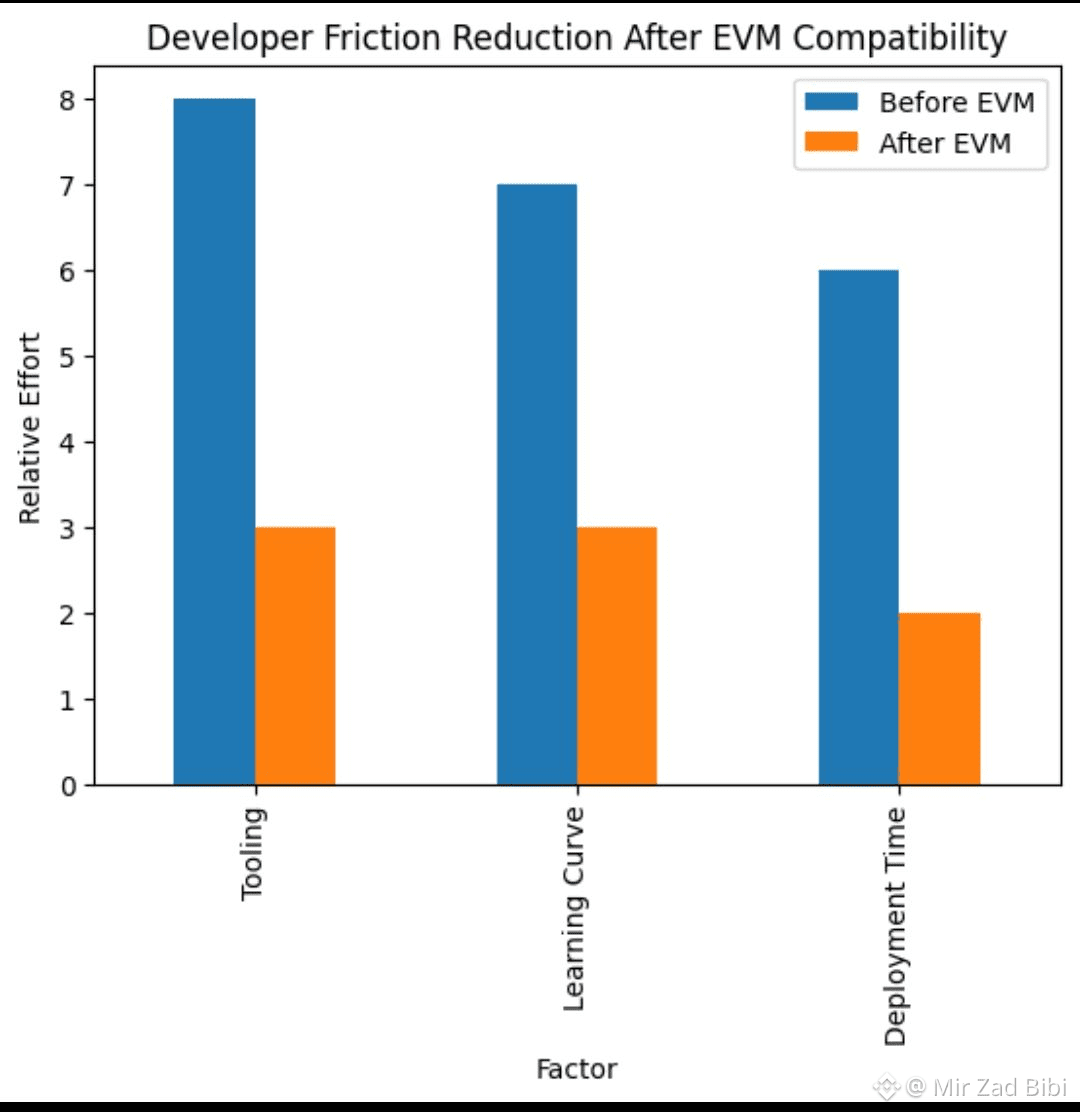

In January 2026, Dusk introduced its EVM-compatible execution layer, enabling developers to deploy Solidity smart contracts while settling on Dusk’s privacy-preserving infrastructure.

This removes a major barrier to entry. Teams can now reuse existing Ethereum tooling, wallets, and developer workflows, while gaining access to confidential settlement and compliance-friendly primitives.

For builders in RWA, compliant DeFi, or institutional infrastructure, this significantly reduces integration friction.

Real-World Assets Are the Real Target Market

Dusk is clearly optimizing for tokenized financial instruments rather than speculative DeFi alone. The network supports:

Confidential ownership records

Private transfers with provable validity

Programmable compliance logic

Institutional-grade settlement finality

These capabilities are directly aligned with the next phase of onchain adoption, where trillions in traditional assets are expected to move onto blockchains.

Market Attention Is Returning

Following the EVM rollout and protocol upgrades, Dusk has re-entered market discussions as traders and builders reassess its positioning. Rather than chasing general-purpose narratives, the project is doubling down on a specific and growing niche: regulated onchain finance.

Momentum now depends less on announcements and more on visible adoption — contracts deployed, assets issued, and institutions integrating.

What Matters Next

The next phase for Dusk is execution-driven:

Mainnet EVM activity and developer traction

First production-grade RWA issuances

Integrations with custodians and regulated platforms

Proof that privacy and compliance can coexist at scale

If these pieces come together, Dusk moves from infrastructure candidate to industry standard.

Forward Outlook

As tokenization accelerates, blockchains that cannot support confidentiality will be structurally limited. Dusk is betting that the future of finance onchain is not fully transparent, but selectively private and verifiable.

If that thesis proves correct, Dusk’s architecture positions it at the center of the next institutional wave — where privacy is not a feature, but a requirement.