The world is entering one of the most uncertain economic periods in modern history.

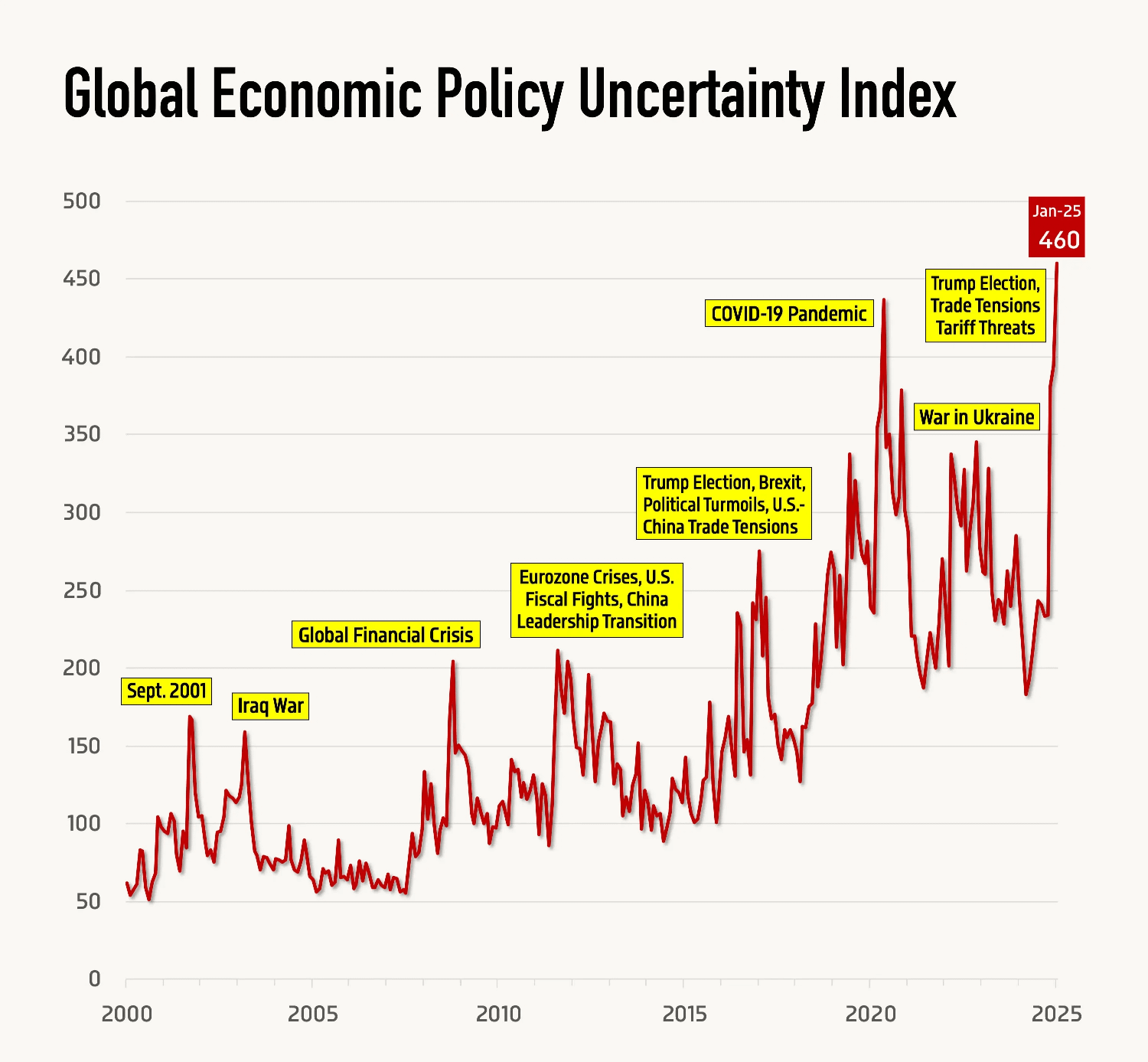

According to the Global Economic Policy Uncertainty (EPU) Index, policy-related uncertainty has surged to extreme levels, reaching 460 in January 2025, the highest reading in the chart’s history. For context, this is significantly above previous crisis peaks, including the Global Financial Crisis and the COVID-19 pandemic.

The message is clear: global stability is fragile.

And markets, especially crypto, are paying attention.

A History of Shockwaves

The chart tells a powerful story.

Since 2000, spikes in the Global Economic Policy Uncertainty Index have aligned with major geopolitical and financial disruptions:

September 2001 attacks

Iraq War

Global Financial Crisis (2008)

Eurozone debt crisis

Brexit & U.S.–China trade tensions

COVID-19 pandemic

War in Ukraine

Election cycles and tariff threats

Each of these events triggered fear, policy shifts, and market volatility.

But what stands out today is not just another spike; it’s the magnitude and persistence of uncertainty. Unlike short-term shock events, recent readings suggest prolonged instability.

January 2025: A Historic High

The index hitting 460 in January 2025 marks a structural shift rather than a temporary panic.

This surge reflects a combination of:

Intensifying geopolitical tensions

Election-related policy uncertainty

Trade friction and tariff rhetoric

Ongoing war-driven economic disruptions

Fragile global supply chains

Markets thrive on predictability. When policy direction becomes unclear, capital hesitates.

Why This Matters for Financial Markets

Historically, high policy uncertainty leads to:

Lower business investment

Delayed capital allocation decisions

Increased market volatility

Flight to perceived safe-haven assets

During the 2008 crisis and the 2020 pandemic, traditional assets experienced violent swings. Central banks responded with liquidity injections.

Today’s environment is different. Inflation pressures, debt levels, and geopolitical fragmentation limit how aggressively policymakers can react.

That constraint increases risk.

The Crypto Angle: Risk Asset or Safe Haven?

Crypto’s role during periods of uncertainty is evolving.

In earlier years, Bitcoin behaved largely as a high-beta risk asset, falling alongside equities during global stress.

But the structural backdrop is changing.

When:

Trust in monetary policy weakens

Sovereign debt rises

Currency debasement fears grow

Investors begin reassessing alternative stores of value.

Bitcoin was born during the 2008 financial crisis — a direct response to systemic instability. In a world where policy uncertainty is reaching record levels, that origin story becomes relevant again.

Volatility Is the New Normal

The chart shows that spikes in uncertainty are becoming more frequent and more intense over time.

What does that mean?

Markets may no longer experience clean, multi-year stability cycles. Instead, we could see:

Faster rotations between risk-on and risk-off

Sharp liquidity shifts

Shorter macro cycles

Heightened geopolitical sensitivity

For crypto traders, this means:

Volatility is not an anomaly, it’s structural.

A Structural Transition in the Global System

The steady upward trend in the uncertainty index suggests something deeper than isolated crises.

We are likely witnessing:

A transition from globalization to fragmentation

Multipolar economic power dynamics

Persistent trade conflicts

Political polarization in major economies

This is not just a cycle, it may be a systemic reset.

And systemic resets historically create both risk and opportunity.

What Investors Should Watch

If the uncertainty index remains elevated, expect:

Continued volatility in equities and bonds

Increased demand for non-sovereign assets

Heightened importance of liquidity conditions

Faster reaction to geopolitical headlines

For crypto specifically, monitoring macro uncertainty alongside ETF flows, liquidity data, and central bank positioning will be critical.

Final Thoughts

The Global Economic Policy Uncertainty Index reaching 460 is more than a statistic — it’s a warning sign.

The world is navigating overlapping crises: political, economic, and geopolitical.

In such an environment, capital seeks clarity.

And when clarity is scarce, markets move sharply.

The coming years may not be defined by steady growth, but by adaptation to persistent uncertainty.

For investors, that means preparation, discipline, and understanding the macro forces shaping the next move.

Because when uncertainty becomes the norm, strategy matters more than ever.