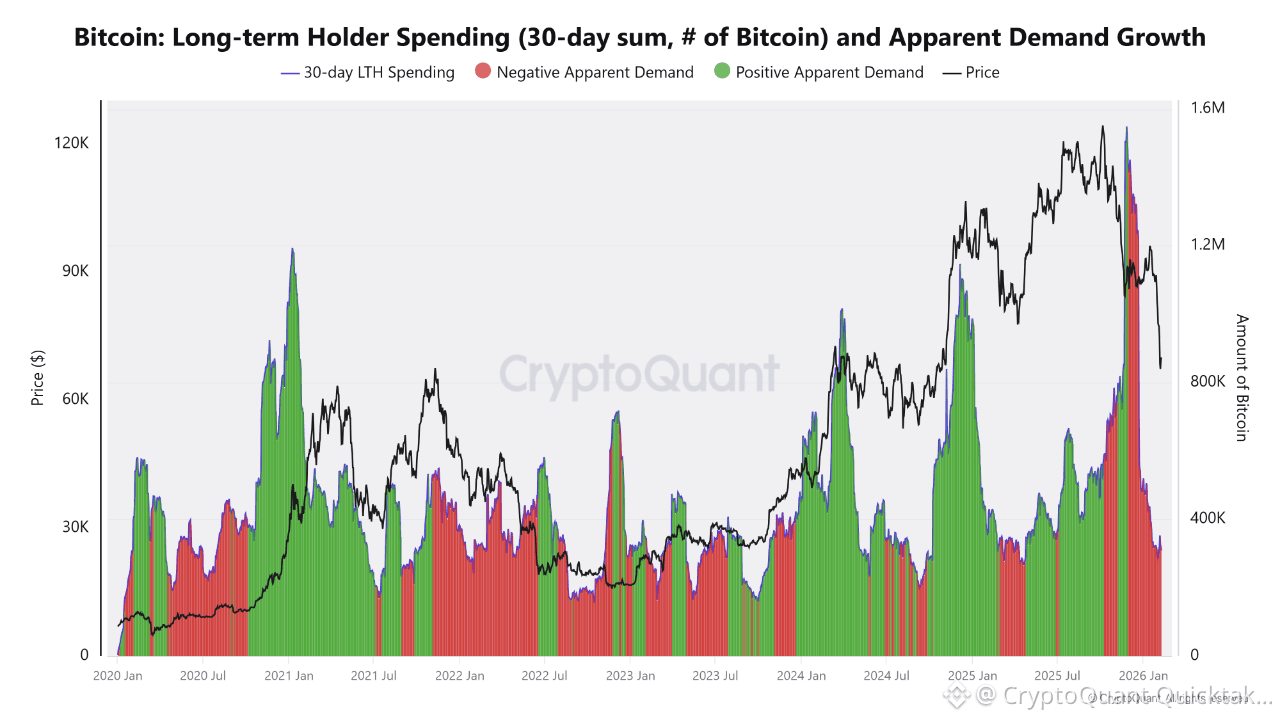

On-chain data is beginning to reflect a structural shift as Long-Term Holder (LTH) spending accelerates sharply. The 30-day cumulative outflow from this cohort has climbed toward cycle highs, a pattern historically associated with late-stage bullish environments. Rather than accumulating, seasoned investors appear to be distributing into market strength, transferring supply to newer participants as price trades near elevated levels.

What makes the current setup more nuanced is the simultaneous deterioration in Apparent Demand Growth. Despite the increase in coins being spent, fresh capital inflows are not expanding at the same pace. Demand has slipped into negative territory, signaling that the market’s ability to absorb distributed supply is weakening. Similar divergences in prior cycles often marked transition phases where bullish momentum slowed before either consolidation or correction unfolded.

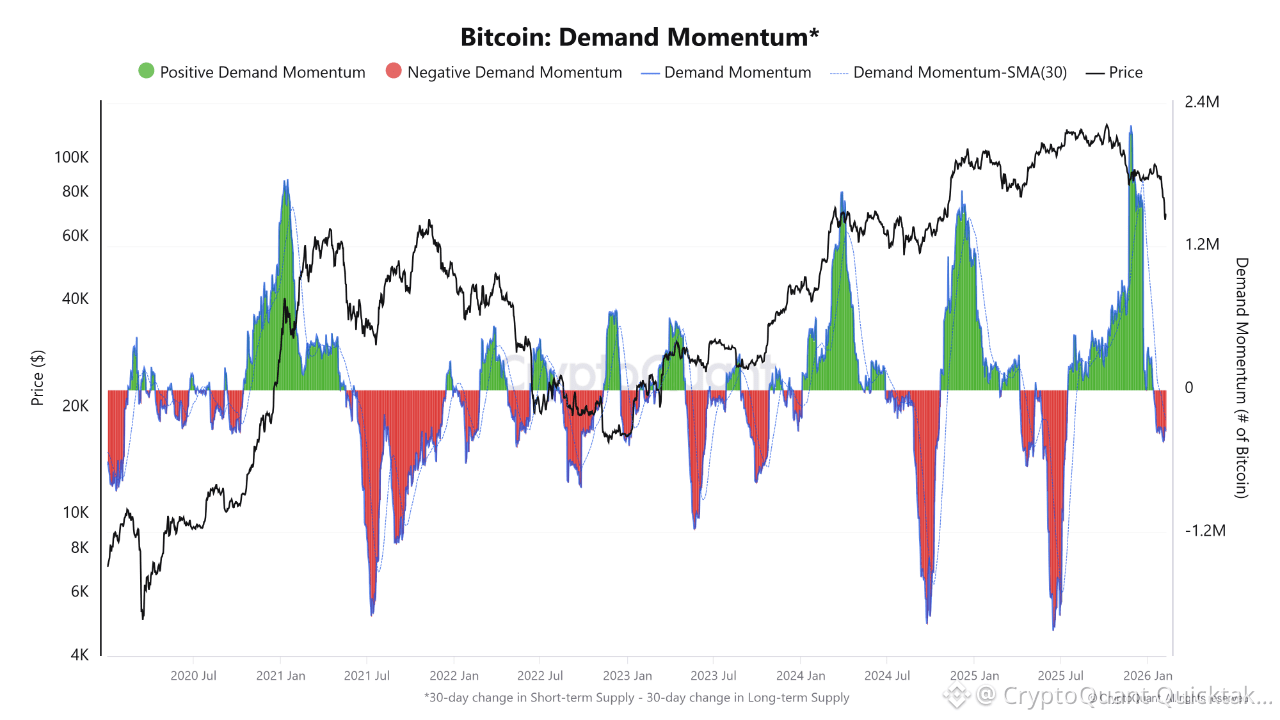

Demand Momentum further reinforces this cooling dynamic. After multiple strong positive expansions throughout the 2024–2025 rally, momentum has now rolled over decisively. This shift reflects softening spot absorption and a slowdown in marginal buyer aggression key forces that previously sustained upside continuation.

From a macro on-chain lens, the market is not yet signaling a confirmed cycle top, but conditions are clearly evolving. Elevated LTH spending paired with weakening demand momentum points to redistribution rather than fresh accumulation. For bullish structure to remain intact, demand metrics must stabilize and re-expand to absorb ongoing supply.

Until that occurs, Bitcoin is likely to face heightened volatility, with distribution pressure acting as a near-term headwind while the market searches for its next equilibrium.

Written by CryptoZeno