Technical Observations

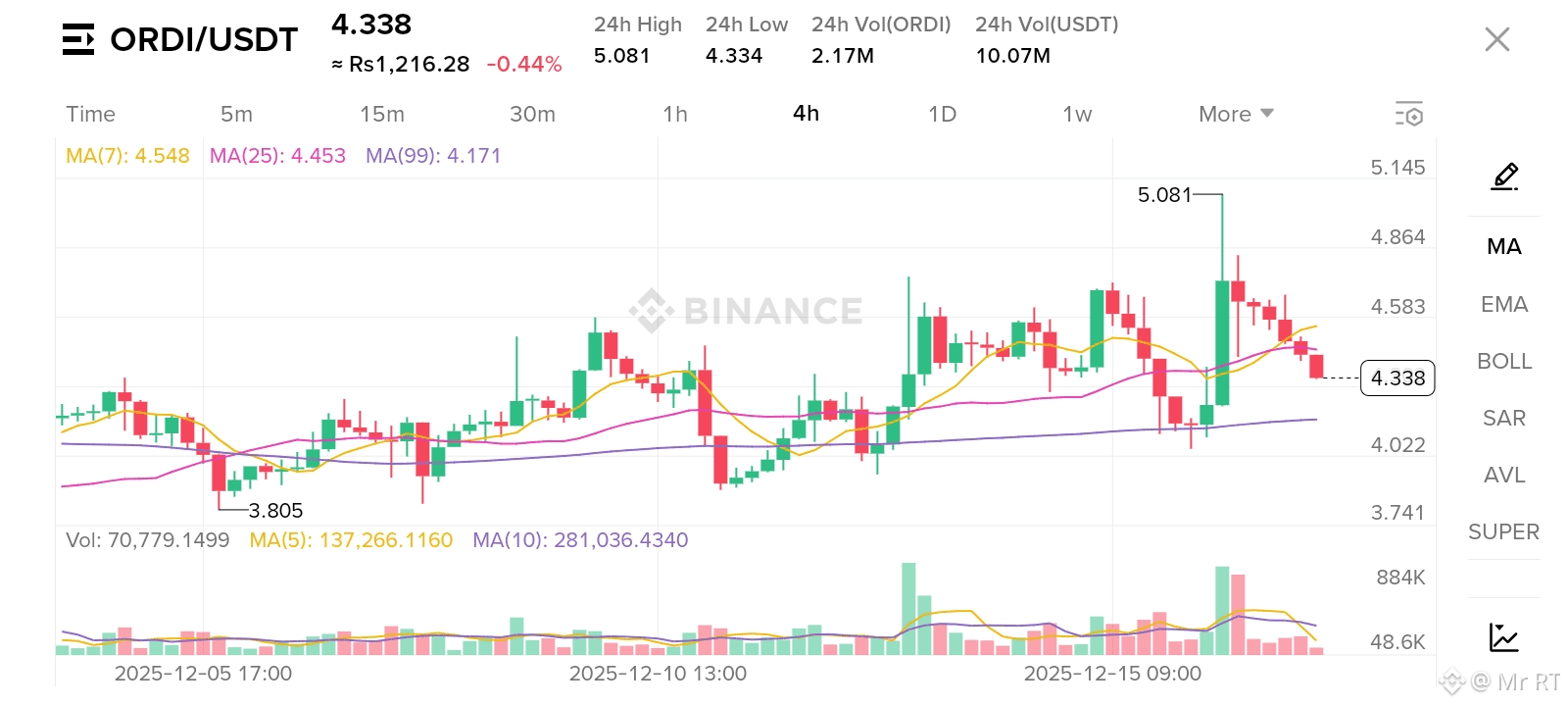

* Price Action: $ORDI is currently trading at $4.338. The chart displays a significant rejection from a recent local high of $5.081. After that peak, the price entered a cooling-off phase, losing roughly 14% of its value in the short term.

* Moving Averages (4h Chart):

* MA(7) - Yellow: Currently at $4.548. The price has slipped below this short-term line, signaling immediate bearish pressure.

* MA(25) - Pink: Sitting at $4.453. This level acted as support earlier but has now been breached to the downside.

* MA(99) - Purple: Located at $4.171. This is the critical "dynamic floor." As long as ORDI remains above this long-term average, the macro structure remains neutral-to-bullish.

* Momentum Indicators:

* RSI (Relative Strength Index): Currently in a neutral-low zone. This suggests that while selling pressure is dominant, the asset is approaching an oversold state where a relief bounce could occur.

* Volume: There was a notable volume spike on the surge to $5.08, but volume has decreased during the current retracement, indicating that the pullback may be a consolidation rather than a total trend reversal.

Market Context (December 2025)

ORDI continues to act as a high-beta proxy for Bitcoin (BTC) sentiment. Current market fear (Fear & Greed Index at 21) is putting pressure on high-volatility assets like ORDI. Additionally, recent policy shifts on exchanges like Binance have reduced leverage capacity for ORDI, contributing to the current "risk-off" environment.

Prediction: The Next Move

Scenario A: Bullish Bounce (55% Probability)

If the price can stabilize above the $4.17 - $4.20 support zone (confluence of MA99 and recent daily lows), a technical "relief rally" is expected.

* Target: A successful bounce would retest $4.55 (MA7) and potentially aim back for the $4.80 range by the end of the week.

Scenario B: Bearish Breakdown (45% Probability)

If ORDI fails to hold the MA99 at $4.17, it could trigger further liquidations of long positions.

* Target: A break below this level would likely lead to a test of the psychological support at $3.80 (the December 5 local bottom).

Summary of Key Levels

| Level Type | Price Point | Significance |

|---|---|---|

| Major Resistance | $5.081 | The "local ceiling" that must be broken to resume the bull run. |

| Immediate Resistance | $4.548 | Short-term hurdle (MA7) that currently caps upward moves. |

| Critical Support | $4.171 | The most important "make or break" level on the 4h chart. |

| Macro Floor | $3.75 - $3.80 | The ultimate support zone for the current month.

#USNonFarmPayrollReport #WriteToEarnUpgrade #BinanceBlockchainWeek