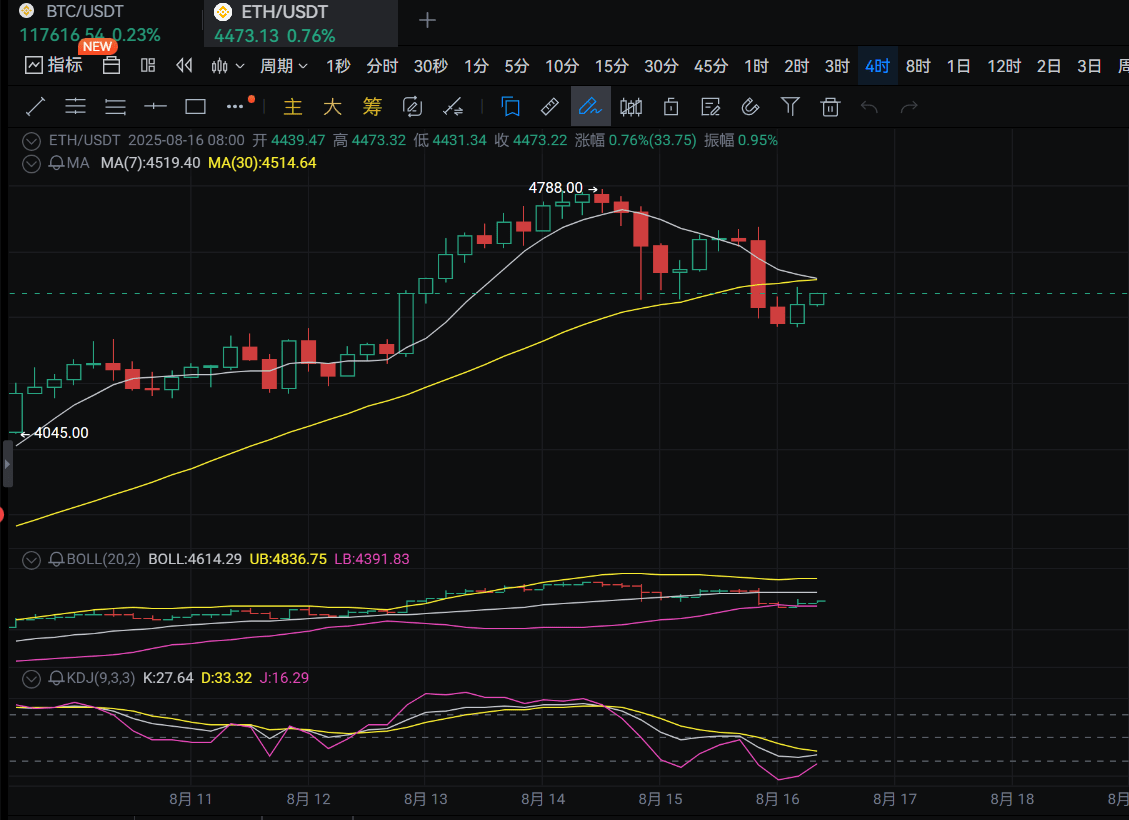

I. Key Data Overview

1. Current Price: 4614.46 USDT (+1.49%)

2. Moving Average System:

MA7 (short-term): 4651.35 (yellow line)

MA30 (mid-term): 4460.39 (blue line)

MA7 > MA30, short-term trend still leans bullish, but the price has fallen below MA7 support.

3. Bollinger Bands:

Middle track: 4568.55

Upper track: 4900.43 (strong resistance)

Lower track: 4236.67 (key support)

Price is close to the middle track; if it falls below, it may test the lower track.

4. KDJ Indicator:

K value (47.82) crosses below D value (59.55), J value (24.36) enters the oversold zone

Death cross signal, short-term retracement pressure is significant.

II. Trend Prediction

1. Short-term (within today):

Bearish signal:

KDJ death cross and J value oversold, indicating exhaustion of bullish momentum.

Price retraced from the high of 4788, failing to break through the upper Bollinger Band, forming a local double top pattern.

If it breaks below the Bollinger middle track (4568), it may accelerate the retracement to 4450-4500 (MA30 support area).

Potential reversal points:

If the price stabilizes above 4600 and re-breaks MA7 (4651), it may continue to oscillate upward, targeting 4750.

2. Mid-term (next 24-48 hours):

Key observation MA30: If MA30 (4460) continues to rise and the price does not fall below, then the mid-term upward channel is not broken.

Risk warning: If the volume breaks below 4450, the trend may turn bearish, target 4236 (Bollinger lower track).

III. Operational Strategy Recommendations

Aggressive bulls: Lightly test long positions near 4600, stop loss at 4560, target 4700. Need to confirm with KDJ golden cross.

Conservatives: Wait for stabilization signals in the 4450-4500 area (such as long lower shadow + KDJ oversold rebound) before positioning.

Bearish opportunity: If it breaks below 4568 and KDJ has not recovered, can short to 4480, stop loss at 4620.

IV. Technical Indicator Resonance Analysis

Contradiction: MA bullish arrangement (trend upward) vs. KDJ death cross (short-term oversold)

The probability of oscillating retracement is relatively high, but it has not formed a trend reversal.

Volume-price coordination: need to pay attention to the direction of increased trading volume (breakthrough/breakdown of key levels is more credible).

V. Conclusion

Today's ETH/USDT main trend forecast is (oscillating bearish):

Asia-Europe session may test support at 4568-4600, US session focuses on rebound momentum.

Key watershed: 4568 (middle track) and 4651 (MA7), breaking either side will determine the short-term direction.

If you have any questions or need more guidance, feel free to reach out to me anytime, I will provide you with detailed analysis!#ETH