💣 Nvidia: sanctions? what sanctions!

Revenue +56% to $46.7 billion. The USA allowed selling chips to China… but with a 'tribute' of 15% from sales. IT giants are playing politics, and the market is applauding.

😱 Ethereum under pressure

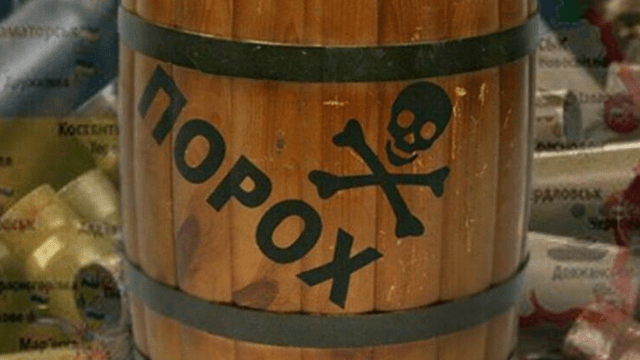

In line to exit — nearly $5 billion ETH. Waiting for a record 18 days. Imagine if even a part goes on sale after +72% in three months. Price pressure could become a ticking time bomb.

🏦 VanEck: Ethereum = Wall Street

“All banks will have to work with ETH or lose out.” Stablecoins are already at $280 billion. It seems there is only one winner in this race.

🐋 Investment consultants have absorbed the market

$18.3 billion in crypto-ETF. Of this, $17 billion is in Bitcoin and $1.3 billion in Ethereum. Hedge funds are nervously watching from the sidelines. If consultants keep pouring in — a pump will be inevitable.

🔓 September — the month of blood?

Tokens worth $4.5 billion are hitting the market. Cliff unlocks could crash prices — a sharp spike in supply against greedy buyers.

⚡️ What does this mean?

We are on the brink: on one side is a giant institutional appetite, on the other is pressure from staking and unlocks. This autumn the market will either shoot up or drown in liquidations.

🚀 “Want to catch a sharp surge? Keep your coins under control in 🤖AIHermes 3.0