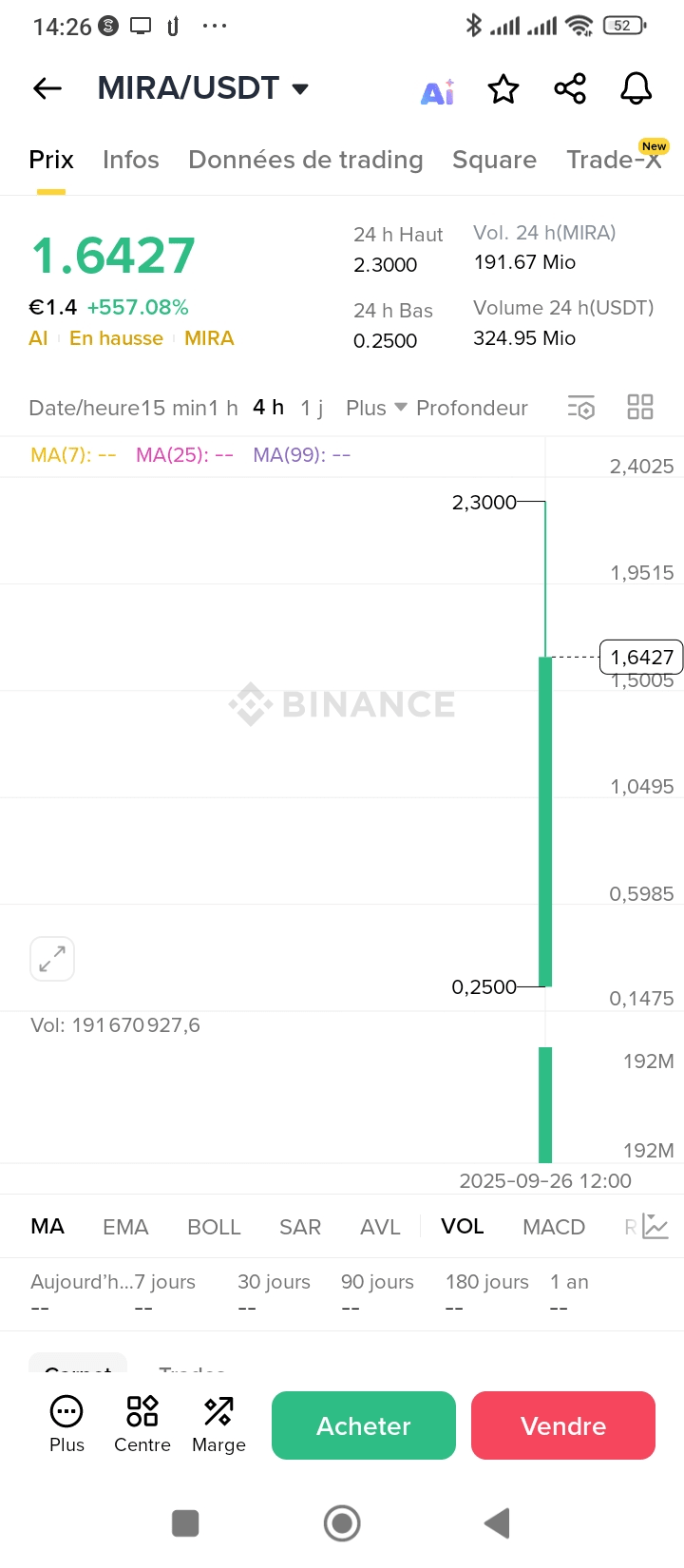

Spot market information for MIRA

Summary

MIRA, a recently listed token, shows an initial price increase but faces significant challenges in terms of liquidity. Let's take a closer look.

1. Initial price movement: MIRA, a recently listed token, experienced a price increase of over 15% in the first hour following its launch, despite a technically zero trading volume.

2. Tokenomics and liquidity: The token currently has a zero circulating supply, which makes its market capitalization theoretical and raises serious concerns about liquidity and price reliability.

3. Project scope: The project aims to be present on multiple blockchains, including the Ethereum, Cardano, and BNB Chain ecosystems.

Positive

1. New listing: MIRA started trading on a platform today, which often attracts initial interest from investors and generates high price volatility for new tokens.

2. Initial price spike: The price of the token jumped from 1.583 to 1.8256 in just one hour after its launch, representing an increase of 15.32%.

3. Multiblockchain ecosystem: Chains of War is developing on the Ethereum, Cardano, and BNB Chain ecosystems, which could expand its user base and utility within different blockchain communities.

Risks

1. Zero circulating supply: No MIRA tokens are currently in public circulation, making its reported market capitalization purely theoretical and rendering any real trading on the market impossible at this stage.

2. Lack of liquidity: Technical data shows zero trading volume during the first hours after launch, indicating extreme illiquidity and a risk of unstable price movements as soon as the tokens become available.

3. Unreliable price data: There are significant discrepancies between the "last known price" of the token and its initial listing prices, combined with a circulating supply of zero, suggesting that the current data does not reflect a real market.$MIRA